21 February 2025: Industrial metals demand is being boosted by rapid growth in sales of electric vehicles, including pure EVs and hybrids. Aluminium, copper and tin are clear winners, as governments and car manufacturers persuade consumers to move away from traditional internal combustion cars. Nickel saw an early strong demand boost from EVs, but the story is now becoming more nuanced, as LFP batteries gain market share at the expense of NMC and NCA. Consumers will help to determine where we go next, but electric cars and battery metals demand looks set to grow strongly in the years ahead, despite the threat of US tariffs.

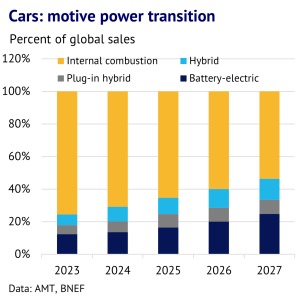

EV sales are surging, as world moves away from fossil fuels. There is no doubt that global passenger car sales are undergoing a tectonic shift, with many governments tightening emission standards and encouraging sales of electric vehicles (EVs). Global EV sales were up 25% in 2024, as traditional cars fell out of favour. According to forecasts from BNEF, sales of internal combustion (IC) cars will fall from 75% of the global total in 2023 to just 54% by 2027. The flip side of this is that sales of cleaner vehicles are surging, including pure EVs, hybrids and plug-in hybrids. However, this green transition is proving to be very complicated, with no clear winners yet in terms of type of motive power. Consumers are often looking for low prices and convenience, while many of the early growth in EVs was led by high-powered vehicles, such as the Tesla Model Y, which were expensive. One of the underlying challenges has been to boost driving ranges, while keeping down battery costs. Also, governments and manufacturers have had to quickly move to ensure that plenty of charging stations are available to support this transition.

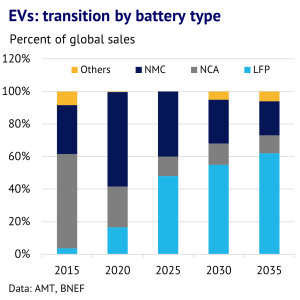

Battery technologies are shifting away from nickel. The second part of the shift from IC to EV is around the battery engineering itself. While nearly all the EV batteries today are based on lithium, there is a bewildering array of different lithium technologies being used in the real world and tested in the lab for potential future use. BNEF lists eighteen different technologies that are currently in commercial use or were used recently. We group these together into three broad categories: nickel-manganese-cobalt (NMC), nickel-cobalt-aluminium (NCA) and lithium-iron-phosphate (LFP). Lithium batteries using significant amounts of nickel and cobalt (i.e. MNC and NCA) dominated the early EV days and in 2015, they took 88% of the market, relative to LFP at just 4%. However, nickel and cobalt are expensive materials and are often sourced from unpredictable parts of the world, making life difficult for manufacturers.

Asian market favours LFP over nickel-based technologies. By 2020, LFP technology was starting to make significant inroads and its market share reached 17%. These batteries were typically cheap, with a limited range, but were popular with many consumers in Asia. Also, the materials used were mostly abundant, meaning that as battery production started to ramp-up, there was plenty of scope for the supply chain to adapt. LFP technology was widely used in China at the time, with other countries still reliant on other batteries.

Recent years have seen a dramatic surge in the use of LFP to 48% of global sales this year. The early limited capabilities of LFP cars now seem to have been largely overcome and manufacturers are boasting of ranges reaching 1,000km on a single charge. Nickel-based batteries are being squeezed, falling back to an expected 52% this year. BNEF is forecasting that by 2030, LFP will account for 55% of the market, with nickel-based batteries down at 40%.

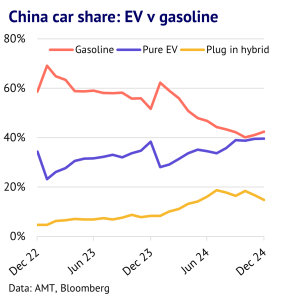

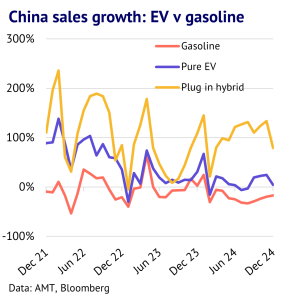

China starts to dominate global EV market. Chinese manufacturers are now dominating the EV market, after overtaking Europe back in 2016. China accounts for 59% of global sales, with Europe a distant second at 23% and the US at 11%. Furthermore, there is not much sign of a slowdown in China. EV sales grew by 29% in 2024 and were still up 30% y/y in January 2025, helped by government incentives. It is worth noting that some of this growth has been driven by increased exports (the country is the largest auto exporter in the world), which is likely to be a difficult market if the US lifts tariffs, but the structural dynamics supporting higher EV sales look very supportive for now.

Base metals demand being boosted by EV boom, but nickel facing headwinds. From a base metals perspective, the simple message is that demand is being lifted by increased sales of EVs, but the technology shift away from nickel is creating areas of demand strength and weakness. For, copper, IC cars typically contain around 20kg, whereas EVs contain around 60-80kg in the battery and wiring. For aluminium, European IC cars had 169kg per unit in 2022, while EVs should contain 300kg by 2026, according to the European Aluminium Association. For tin, IC cars have around 3kg, while EVs have around 4-8kg. The transition for nickel is more uncertain, as LFP batteries contain no nickel, while the early EVs often contained more than 150kg of nickel.

The picture for zinc looks close to neutral, with some extra galvanising required to support the roll-out of charging networks, but less required for automotive body panels made of steel. Finally, lead demand looks to be under threat, as the starter motor used with IC engines may be replaced with 12V lithium batteries. Overall, aluminium, copper and tin look set to be big winners from the rise of EVs, but the transition is quickly evolving, as consumer preferences clash with government attempts to bring down emissions.