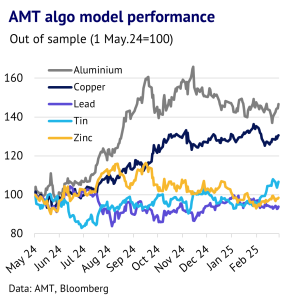

14 March 2025: Our algorithmic trading models continue to produce excellent results, with our model for aluminium jumping by 47% in the first ten months of out-of-sample trading and copper up 31%. Our other models have been disappointing though, with previous outperforming models for tin and zinc struggling to grow in markets that have been characterised by choppy, sideways price moves. The average growth for our five models has been 15%. Looking ahead, we suspect that markets will start to trend more decisively, but diversification across different models should offer significant benefits in terms of risk-adjusted returns.

We introduced our algorithmic swing trading models in July 2024. Back in July 2024, we explained about our new research on algorithmic trading models for base metals. These models were based on a swing trading approach, using the best performing momentum strategy in the thirteen-year period to 30 April 2024. The research can be found by clicking on the following link: AMT Insight – Base metals: Algo Signals and Momentum Modelling (24 July 2024).

Briefly to recap, our back testing found that mean reverting (MR) strategies worked well for aluminium, copper, lead and zinc, while trend following (TR) strategies worked best for nickel and tin. We also noted that the strongest performing models were for tin and zinc, although the models for aluminium, copper and lead also appeared to add alpha, with returns ranging from 11% to 27% per year (excluding any trading costs or the impact of slippage). The model for nickel has also been running, but the market distortions that took place in 2022 (when the market soared and then was briefly suspended) mean that it is likely to be a less reliable tool, at least from a statistical point of view. The average annual CAGR return in back testing was 18% across the base metals complex. We have now been running these models for over ten months since we set them up (i.e. with out of sample data), which has helped to confirm that they provide useful trading signals.

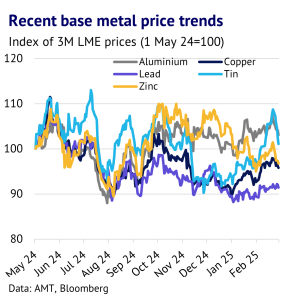

Base metal markets have been volatile, but relatively trendless. In our first chart, we show how LME three-month prices have behaved in the period from 1 May 2024 to 28 February 2025. Prices are indexed to show their relative performance. Overall, the base metals complex has seen some large swings, but over the ten-month period, prices have mostly ended up close to where they started. Lead has been the most significant outlier, with a meaningful downward trend of 9%. By contrast, aluminium and tin have been rather trendless, with a change of 1% and 3%, respectively. Copper and zinc have been somewhere in the middle, with a drop of around 4%.

Bullish and bearish factors have been broadly offsetting each other. Markets are currently being buffeted by fear that a global trade war will drive up inflation and cause an economic slump. However, China and Europe appear to have a brighter future, as governments in both these places have stepped up deficit spending in recent weeks to lift economic growth and, in Europe, to beef up defence spending.

AMT algo models have performed well, with an average return of 15%. In our next chart we show the performance of our algo models during the past 10 months. The unweighted average return in 10 months was 15.3% (ignoring trading costs and slippage), which is very close to the 18% annual return that we found with our back testing. What has been interesting though is that the models for aluminium and copper, which were the weaker performers in back testing, have surged ahead, with returns of 46.7% and 30.6%, respectively. Meanwhile, the stronger performers in back testing, tin and zinc, have struggled. We do not think that this is surprising.

Sideways market movements have worked well for some models. As we noted above, the base metals complex has been mostly characterised by sideways trading in the past ten months. This has been a perfect environment for our MR models for aluminium and copper. Meanwhile, the lead model has underperformed because the market has been mostly trending, bad news for our MR model. Tin is the only model that has a TR strategy, which means that it has performed poorly, with the market moving sideways.

Zinc model has been slow to react and has underperformed. Zinc is a bit more difficult to explain. In theory it might have expected to have performed as well as copper, as the range and end point were similar over the past ten months in percentage terms. However, the MR model for zinc is based on a different setup and reacts relatively slowly. The trading signal for zinc changes on average every 18 days, whereas for copper it is every 11 days. This has been a disadvantage in a market which has been changing direction relatively quickly. Macroeconomic uncertainty has created extra volatility, which is hampering this model for the time being.

Too early to say whether models are generating alpha, but our diversified model has been far better than we expected. Overall, as we have noted in previous research notes, diversification across different models seems like a wise strategy, particularly since the model performance for the individual base metals are uncorrelated. At this point we cannot say that a certain model is necessarily effective at generating alpha, because we need to see how the models perform in different market environments. However, our expectation is that the tin and zinc models will start to outperform once more if the base metals start to trend strongly, either lower (due to a global recession) or higher (encouraged by a strong economic upswing in China and Europe). When the dust settles around US tariffs, financial markets should have better visibility on the likely direction of the global economic cycle and the behaviour of base metals will adjust accordingly.