11 January 2024: The LME three-month aluminium price is up 6% in the past month, making it the best performing base metal during this period. Market fundamentals are supportive, with SHFE prices trading at a premium to the LME and the raw material market tightening, due to problems with bauxite supply in China and Guinea. However, also important is the steady build in Russia’s share of LME inventory, with tighter sanctions reducing the pool of willing buyers, discouraging traders from holding/transporting metal and making short speculation increasingly risky. Given this backdrop, prices are likely to trend higher this year.

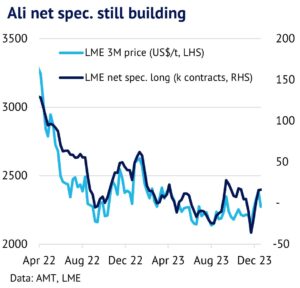

Aluminium prices hit nine-month high, as supply shocks spread. The three-month LME aluminium price was range-bound for most of last year between US$2,100-US$2,300/t, before surging to a nine-month high around US$2,400/t in the final week of the year and then pulling back in early 2024. Fundamentals looked lacklustre for most of 2023, which encouraged speculators to push down prices, but this bearish view was challenged in December, as a series of supply shocks spread through the market.

Visible inventory levels are getting very low, particularly when Russia is excluded. The market was surprised by new UK sanctions imposed in mid-December on British citizens and companies, which outlawed buying, importing and selling Russian base metals, including aluminium. Shortly afterwards, the EU tightened its own sanctions on Russia, including a ban on imports of Russian aluminium wire/wirerod.

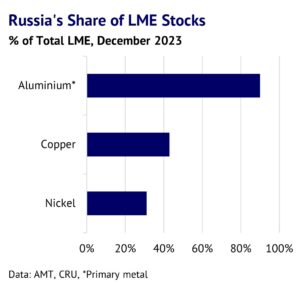

At first glance, LME stocks look relatively comfortable at 561kt (data for 11 January). However, 90% of this is now Russian metal (based on the most recent December breakdown) and so allowing for this alters the picture dramatically, as many traders want to avoid it, as the sanction regime gets stricter. Furthermore, inventory levels in China are also very low. According to CRU calculations, these fell to their lowest level since January 2017 by late-December.

Speculative positions build and there is still scope for further growth. Our most recent LME COTR analysis shows that short-covering was seen in aluminium for four weeks in a row, lifting LME net speculative positions by 52k contracts in the period ending 5 January 2024 – see chart. This shows a significant shift in sentiment from early December. Furthermore, there is still scope for this to keep building, with aluminium positioning currently low at 21% of the recent historical range. Our latest COTR analysis can be found on our website – www.amt.co.uk/insights.

Alumina and bauxite markets are getting tighter. Recent years have generally seen a glut in the raw materials market for primary aluminium (including bauxite and alumina), but this dynamic seems to be shifting as well and both markets tightened in the second half of 2023 and into the early part of this year.

One structural problem for Chinese alumina refineries is that local (diasporic) bauxite quality is very poor, which has resulted in a heavy reliance on Guinea as a supplier. Unfortunately, an explosion in mid-December at a key port in the African country caused power supply problems and this quickly fed through into panic about potential shortages of bauxite. According to CRU, China imported 91 million tonnes (Mt) of bauxite from Guinea in the first eleven months of 2023 – equivalent to around 23Mt of primary aluminium or a massive 60% of the country’s output. Chinese bauxite production was also hit in late 2023 by government inspections and closures. Given this backdrop, it was not surprising to see bauxite prices being pushed sharply higher, building on the rally seen through most of 2023.

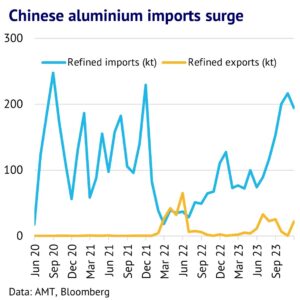

Chinese imports of primary metal are still ramping up, with SHFE at a premium in early January. China is also becoming increasingly reliant on imports of primary aluminium, despite good growth in domestic smelter output. Imports reached 194 thousand tonnes (kt) in November 2023, up from 74kt in May 2023. This has come as a surprise to many in the industry, given that domestic smelter output grew by 3% in the same period – according to IAI figures. Moreover, the SHFE premium over the equivalent LME price trended higher in the period from late December to early January, suggesting that import demand will remain buoyant into the early part of this year. The SHFE February contract was at a premium of US$50/t on 27 December and this increased to US$134/t by 10 January 2024. While there might be a lot of negative sentiment expressed about the Chinese economy, so far at least, the more bullish dynamic of rapid growth in aluminium’s end-use markets appears to be dominating. This supports the idea of upside risks for the aluminium market in the year ahead.