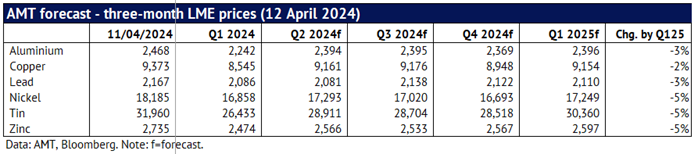

12 April 2024: After a weak start to 2024, base metal prices jumped in March and early April, mainly driven by speculative forces. There are three reasons to believe that prices look overextended. First, net speculative positions look very high for copper and tin and rallies in nickel and zinc look difficult to justify given the current state of fundamentals. Second, weekly seasonality analysis shows that base metal prices normally peak around week nine of the year and then typically head lower in the remainder of the year. Third, deep contangos on the LME highlight a lack of interest from consumers, with cash prices well below three-month prices. Our updated price forecasts show that we expect all the base metals to head lower in the year ahead, with falls of 2-5% by Q1 2025. Copper is expected to outperform the other base metals given its superior fundamentals.

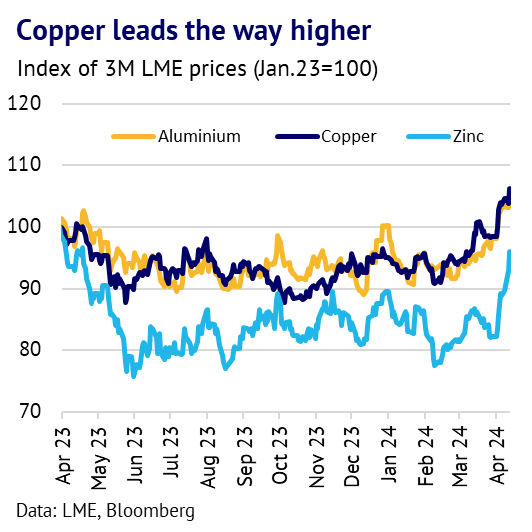

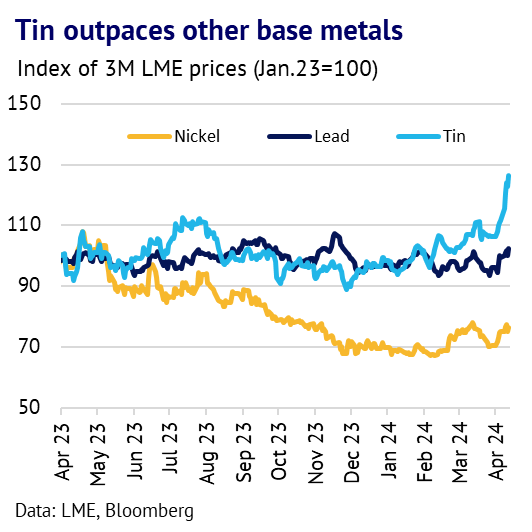

Prices rally sharply, but air starts to look thin. In recent weeks base metal prices have soared, as markets moved quickly from worrying about OECD inflation and debt problems in China, to focussing on more bullish drivers such as supply challenges and the green energy transition. There are also clear signs of excess liquidity in the financial system, with gold prices soaring to record highs in April and Bitcoin prices going supernova. LME three-month copper prices are now up 12% since the start of this year, while tin has soared by 28% (data to 12 April). Aluminium and zinc prices also rallied sharply in early April, despite little change in fundamentals. Even nickel has seen a 9% rally, despite being badly oversupplied.

Back in mid-January we were bullish on the whole base metals complex, but we now believe that prices are starting to overextend. We predict that prices will trend lower in the year ahead, as we show in our forecast table on the next page of this report. Our forecast takes into account, seasonality, fundamentals and market sentiment and whether markets are correctly pricing in all these factors.

There are three reasons to believe that prices will retreat in the medium-term. First, for copper and tin, net speculative positions are getting close to their five-year highs, warning that the scope for further growth is getting limited. Our most recent LME COTR data showed that copper positions reached 74% in the week ending 5 April, while tin reached 87%. Click this link to see our latest report on this– LME COTR analysis. We define 0% as the lowest level for speculation in the past 5 years, and 100% as the highest level. The chances of prices mean-reverting increases close to these extremes.

Second, across the base metals, seasonality trends suggest a pullback in the weeks ahead. For copper, for example, our weekly seasonality analysis based on the past 14 years finds that prices normally peak in week nine in the year and then fall back over the summer. We are now in week fifteen. For aluminium, the peak is normally between week 9 and 14. While the peak for demand normally comes later in the year (around the middle of the second quarter), prices are forward looking and normally turn down earlier in the year.

Third, most of the base metals are in a steep contango on the LME from cash-to-three months, with cash well below the three-month price. The annualised spread ranges from 7.6% for aluminium to 3.8% for nickel and copper stands at 5.5% (data at 12 April). This highlights that the recent rally has been largely driven by speculative forces. By contrast, consumers, on the whole, are happy to run down stocks and hope for lower prices further down the road.

In China, for example, wirerod plants reduced utilisation rates in late March (ie they cut copper demand), as copper prices were seen as too high. Tightness in fundamentals normally results in a backwardation (cash price above the three-month price), as consumers pay a premium for immediate delivery because they are concerned about future shortages.

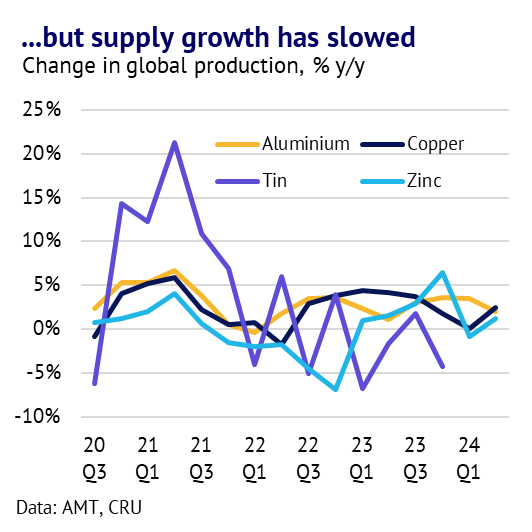

While there is a tendency for base metal investors to buy the whole complex through commodity indices such as BCOM and GSCI, we expect weak fundamentals in markets like nickel to reassert themselves in the year ahead. The market’s supply glut can only be ignored in the short-term and higher prices will potentially encourage restarts of mothballed capacity. Zinc has better fundamentals, but it is heavily exposed to problems in the Chinese construction/property market and the impact of the green energy transition is potentially negative for demand, as many electric vehicles are switching away from galvanised steel to aluminium body sheet. The recent rally in tin prices highlights that speculative forces are widespread, as it is not included in these indices.

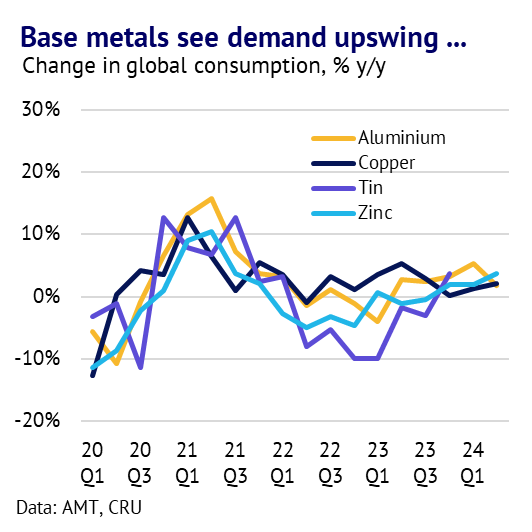

Global economic outlook should remain supportive, amid lower US rates and Chinese government stimulus. In terms of the year ahead, the US economic outlook looks strong and interest rates will probably come down this year, helping to support base metals demand. Recent data though has increased the chance of a market shock, with CPI inflation remaining persistent into March and the US labour market generating more jobs in March (303k) than in February (270k). If US rates start to rise once more, financial markets are likely to correct, bring down base metals at the same time.

Meanwhile, the Chinese economy has accelerated recently and problems in the property market have not spilled over into a debt crisis, even though Fitch downgraded the country’s sovereign debt in April. This caused little reaction, showing that financial markets are focussed on other economic drivers for the time being, such as US inflation/interest rates. It also helped that official PMI figures showed that China’s economy has accelerated, helped by recent government stimulus measures. The manufacturing PMI moved up to 50.8 in March from 49.1 in Feb. Similarly, the non-manufacturing PMI rose to 53 in March up from 51.4 in February. Both beat consensus forecasts by a notable margin.