8 November 2024: Risk appetite has been fickle in the run up to the US election and Chinese stimulus measures have been disappointing. Given this, base metal prices have mostly moved sideways in the past six months, creating an ideal environment for mean reverting algorithmic trading models. Our models for aluminium, copper and zinc have all performed well in this environment. By contrast, our models for lead and tin have performed poorly. Overall, our average performance across the six base metal models was 12%, significantly outperforming our expected performance from back testing. This is based on the period from 1 May 2024 to 31 October 2024.

We introduced our algorithmic swing trading models in July. A few months ago, we explained about our new research on algorithmic trading models for base metals. These models were based on a swing trading approach, using the best performing momentum strategy in the thirteen-year period to 30 April 2024. The research can be found by clicking on the following link: AMT Insight – Base metals: Algo Signals and Momentum Modelling (24 July 2024).

Briefly to recap, our back testing found that mean reverting strategies worked well for aluminium, copper, lead and zinc, while trending following strategies worked best for nickel and tin. We also noted that the strongest performing models were for tin and zinc, although the models for aluminium, copper and lead also appeared to add alpha, with returns ranging from 11% to 27% per year (excluding any trading costs or the impact of slippage). The model for nickel has also been running, but the market distortions that took place in 2022 (when the market soared and then was briefly suspended) mean that it is likely to be a less reliable tool, at least from a statistical point of view. The average annual CAGR return was 18% across the base metals complex. We have now been running these models for over six months (i.e. with out of sample data), which has given us extra insight into their value during real market conditions.

Base metal markets have been volatile, but relatively trendless. In our first chart, we show how LME three-month prices have behaved in the period from 1 May 2024 to 31 October 2024. Prices are indexed to show their relative performance. Overall, the base metals complex has seen some large swings, but over the six-month period, prices have not moved significantly. Lead has been the most significant outlier, with a meaningful downward trend of 9%. By contrast, aluminium and tin have been trendless, with a change of around 1%, while copper is somewhere in the middle, with a 4% drop. Bullish and bearish factors have broadly offset each other. Markets had been nervous ahead of an approaching US election and while China has been tackling hidden debt and boosting its stimulus measures, this had not fed through into more bullish sentiment.

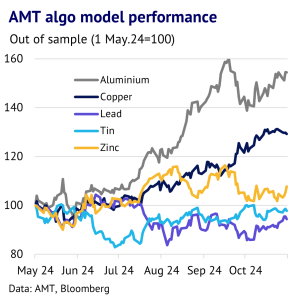

AMT algo models have mostly performed well, with out-of-sample performance better than expected from back testing. In our next chart shown above, we show how our models have generated returns and losses during the same six-month period. The model for aluminium has performed exceptionally well, with an increase of 36%. This reflects market conditions during the period – choppy and sideways – which aligns nicely with our algo model set up. Copper and zinc have a different model set up, but have also performed well, with increases of 22% and 7%, respectively.

In terms of the worst performers, lead is also a mean-reverting model and has therefore done poorly, as prices have mostly trended lower. It lost 4% in six months. Finally, tin was another weak performer, losing 2%. This is not surprising as the model does well when the market is strongly trending. Clearly market conditions have not been favourable, although the losses have been modest. As we explained in our original research piece, tin has a win: loss ratio of 36:64 i.e. it often generates small losses, but winning trades are often large and should offset losses if the market starts to trend decisively.

While the unweighted average return of our models in back testing was 18% per year, the actual return in the past six months was 12% i.e. the models are outperforming their historical performance by a significant margin. What has also been notable is the wide range of outcomes for the different models (i.e. their lack of correlation), suggesting that a diversified algo model across the six base metals might be attractive to improve risk-adjusted returns and limit potential drawdowns and volatility.

Looking ahead, market behaviour is likely to change once more. Looking ahead, we will continue to monitor our models and keep clients updated. With the US election now out of the way, markets have started to price-in higher future inflation, which tends to boost commodities, as they are a potential hedge. Furthermore, Chinese stimulus should start to be felt more strongly in 2025. Most likely this will alter market behaviour again in the months ahead, impacting our algo models in different ways. Potentially this might usher in a period where correlations between different base metals increases once more and mean reverting markets get replaced by trending markets. Only time will tell.