14th July 2023: LME base metal prices showed mixed trends in H1 2023. While tin prices jumped, the rest of the complex retreated. Headwinds are coming from poor sentiment in China and weakness in global construction and manufacturing markets. However, markets like copper, nickel and tin saw a demand boost from the green energy transition. The first half of this year saw demand growth outpacing supply for tin, but the rest of the base metals showed a negative demand gap, highlighting weak fundamentals. Looking ahead, we expect copper and tin to outperform the rest of the complex. We expect lead and zinc to be weak and prices to trend lower. Aluminium and nickel prices are also expected to fall, but the downside is limited.

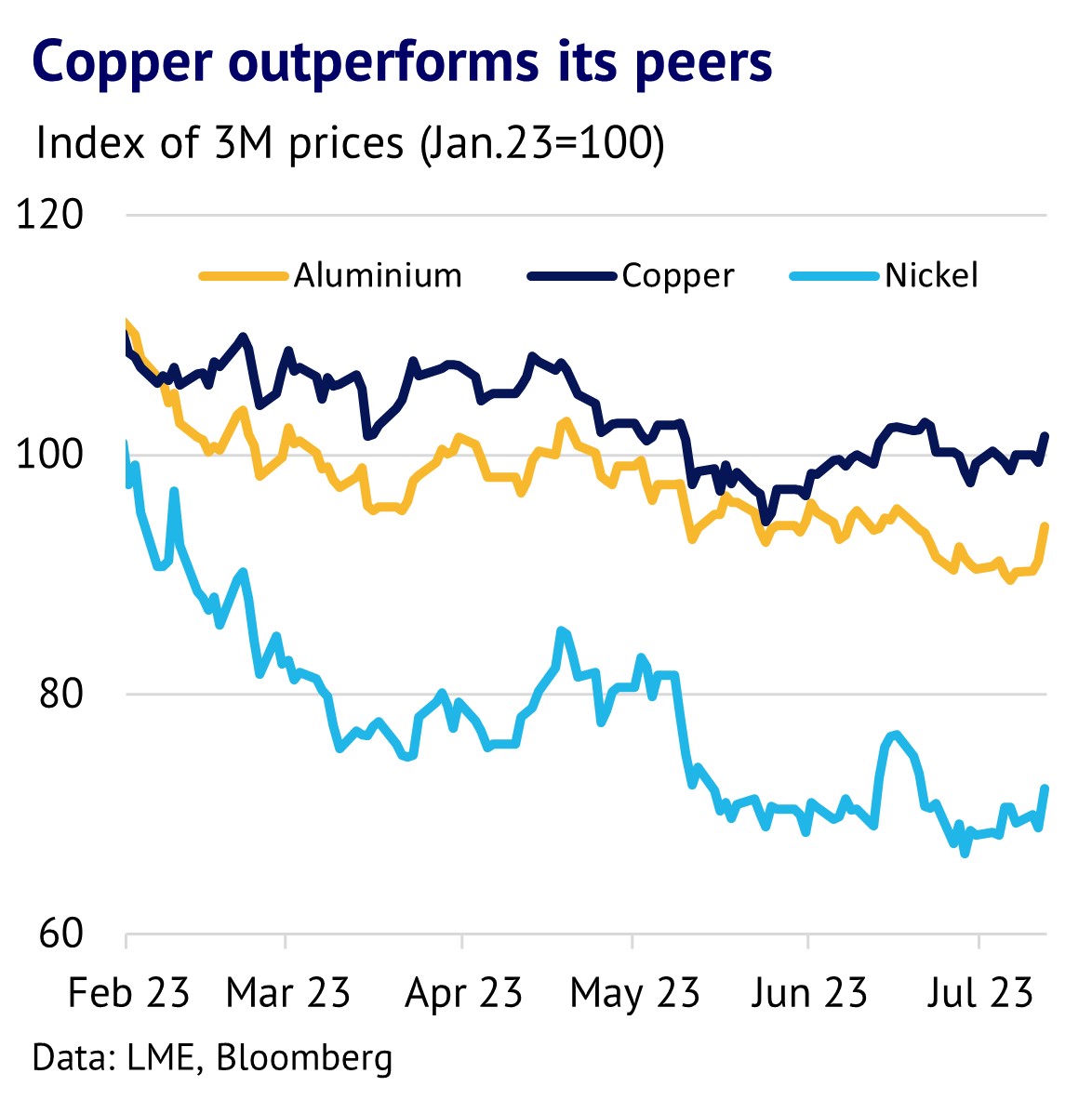

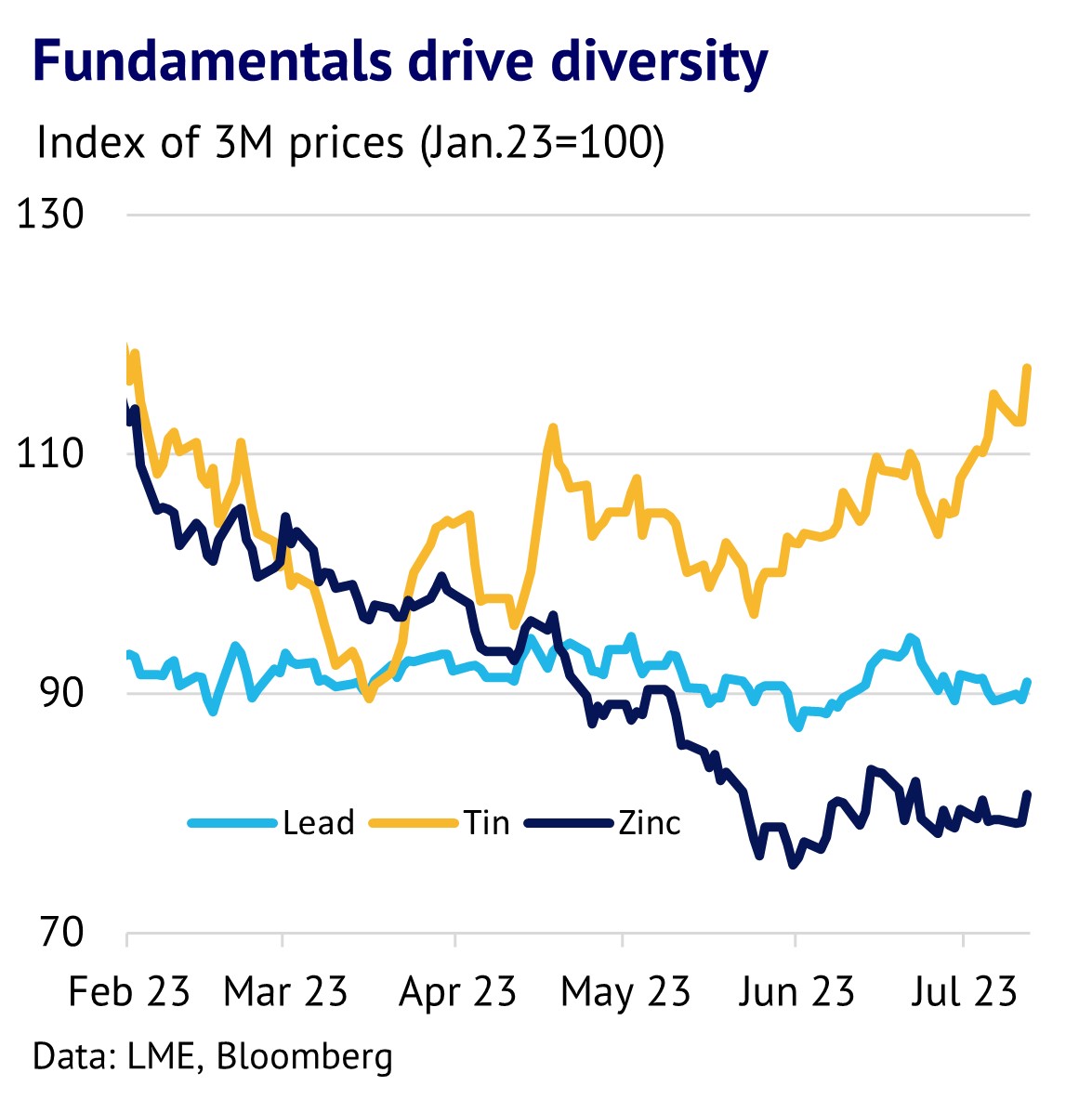

Base metals see mixed price trends in H1 2023. The first part of this year saw significant divergence across the base metals complex, reflecting differences in fundamental drivers. In the first six months of this year, LME three-month nickel prices led the way lower with a 32% drop, with zinc not too far behind with a 20% fall. Aluminium and lead held up slightly better, but still fell 10% and 8% respectively. Copper was down 1%. Tin was a notable exception and prices jumped by 8%, with fears about a supply crunch due to a crackdown on mining in Myanmar. During this period US equity markets rallied by 16%, showing that while commodities often follow global risk appetite, in this case there is clearly something else behind the general base metals weakness.

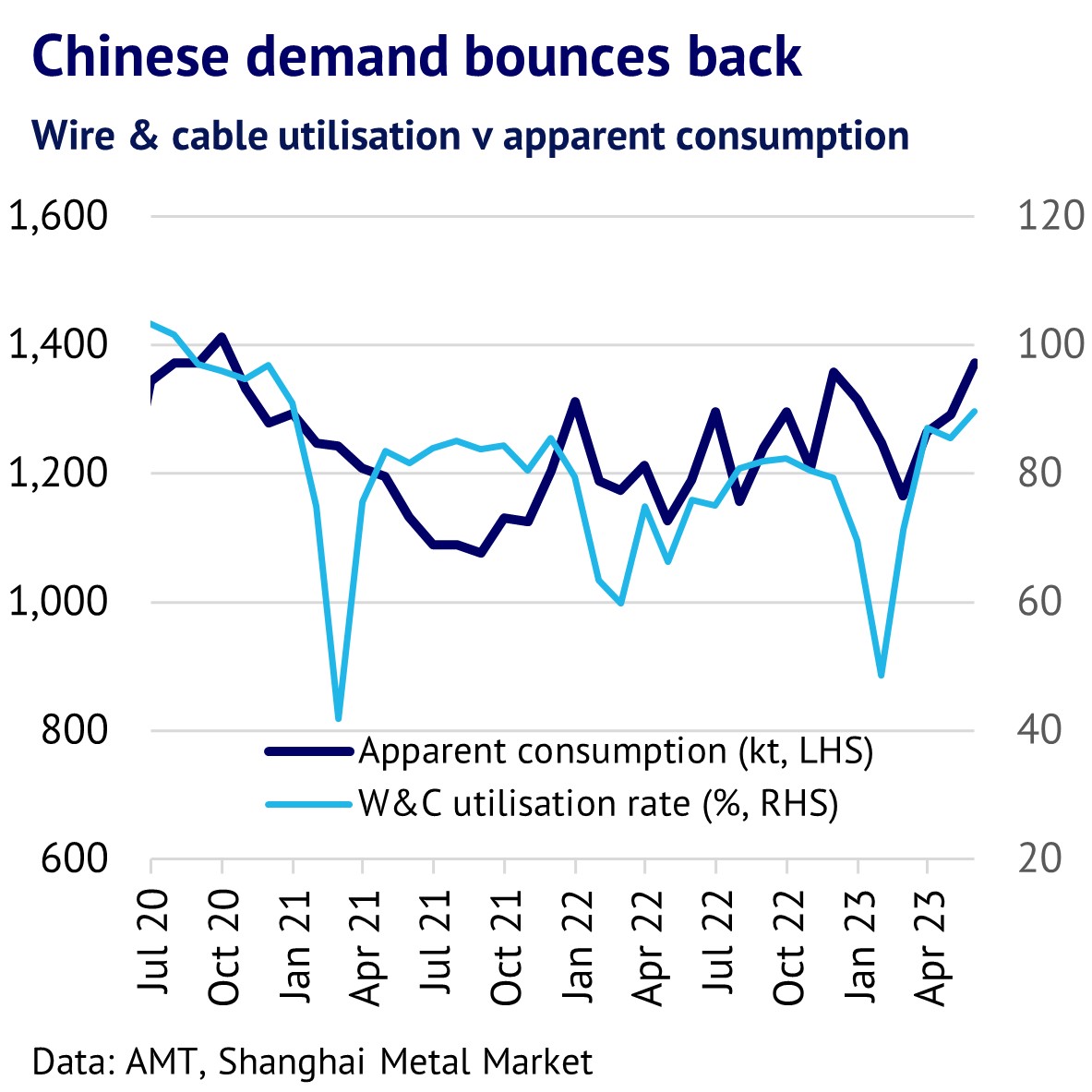

Chinese demand has inflated, then sagged, as stimulus measures hit a wall of negative sentiment. One of the biggest challenges for base metal bulls is that sentiment around China is very depressed and the local stock market rose by a modest 4% in H1 2023. Economic activity bounced back in March and April, as the country emerged from recent lockdowns, but the strongest phase of growth now seems to have passed. The consultancy firm CRU is currently predicting that Chinese GDP will grow by a decent 5.3% this year, but the majority of this growth is coming from the service sector, while the key sectors for base metals – construction and manufacturing – remain depressed. This can be seen in the most recent official PMI figures. The services PMI for June was 53.2, whereas manufacturing was 49 (below 50 indicates falling growth).

Green energy transition does not lift all boats. One key differentiator is that the green energy transition is having a very different impact on base metals demand. For copper, demand is getting a significant boost from electric vehicle (EV) batteries and the more comprehensive grid needed to support solar and wind power and fast vehicle-charging. CRU figures show that global copper consumption was up 3% y/y in H1, helped by 5% growth in China. Aluminium and tin are also benefiting from the greater use of electricity for transport, with aluminium retaining its monopoly in overhead power lines, while significant amounts of tin are being used in solders and solar panels.

Nickel demand is also being lifted by EV batteries, but there is a looming threat from the move towards lithium-iron-phosphate technologies, which contain no nickel. For lead we believe that the impact will be negative. Nearly all EVs have maintained a lead-acid battery, but there is plenty of scope for downsizing to save weight and the optics of having a toxic metal in an environmentally-friendly EV look difficult to justify. For zinc there is some slight benefit from the green energy transition, but the overall impact is small.

Base metals supply is trending up, but tin is under threat. Base metals supply is also showing very diverse trends. CRU figures show that global nickel production was up a robust 18% y/y in H1, with copper up 5% y/y, while lead and zinc grew by 2% and 1% respectively. IAI figures for aluminium indicate 2% y/y growth in the first five months. Tin, by marked contrast, fell by 3% y/y in H1, with a large drop in the world ex-China.

Base supply-demand trends mostly bearish. However, it is also important to consider the above supply growth in the context of global demand and how these trends might continue into year-end. Copper and nickel showed the greatest increase in demand in H1 2023, with an increase of 3% and 8% y/y respectively, according to CRU. Aluminium saw the worst performance, with a 2% fall. The other base metals saw little change in demand.

One way to think about supply-demand fundamentals is to look at the demand gap – i.e., how far ahead in percentage terms is demand growth relative to supply. On this basis, tin looks most bullish, with supply at -3% relative to stable demand, giving a demand gap of 3%. However, the other base metals are all showing negative demand gaps, which is bearish, as supply growth has been outpacing demand growth. Most bearish is nickel at -10%, followed by aluminium at -4%. Copper, lead and zinc showed small negative demand gaps of 1-2%.

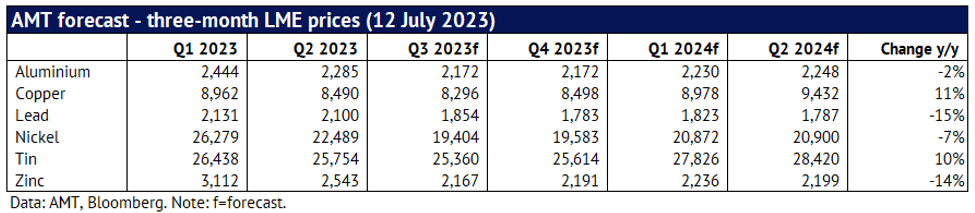

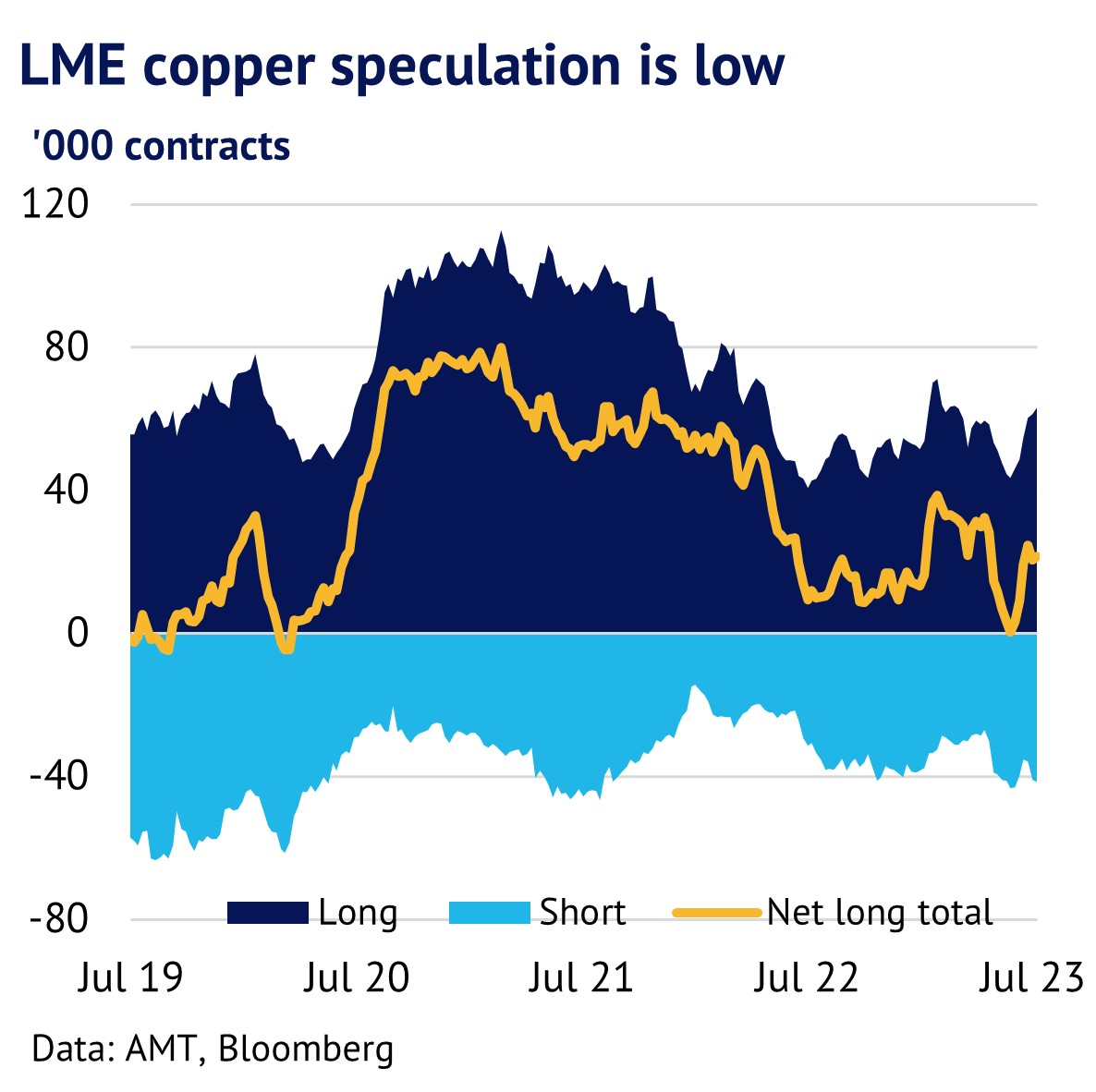

Copper and tin to outperform in year ahead; lead and zinc to tumble. In the table below we show our latest price forecasts for the base metals sector. Comparing Q2 2024 with Q2 2023, we expect to see copper outperform the rest of the complex with an 11% increase, closely followed by tin at 10%. Lead and zinc are predicted to be the worst performers, with falls of 15% and 14% respectively. Nickel is also expected to be weak with a 7% drop. Aluminium should be little changed by Q2 2024. When producing these forecasts we take account of fundamental drivers, seasonal factors and where we assess prices to be relative to fundamentals. We also consider where speculative positions are relative to historical levels (on a one-year-view positions are expected to mean revert).

For example, while we believe that tin is in a very strong fundamental position, prices have already moved up quickly to take account of this, which limits the upside for prices. In terms of zinc, prices have already fallen sharply this year, but we see more downside, given the problems in construction markets, the limited boost from the green energy transition and the scope for rapid supply growth, as new mines come through in Russia and Europe. Finally, copper prices should be lifted by the green energy transition and greater investor interest, as the world pulls out of its current weak patch. Overall, the base metals sector is expected to show significant divergence, with speculators likely to focus on base metals with green credentials.