21st October 2022: Base metal prices have fallen sharply this year, as Russia’s invasion of Ukraine sent shockwaves through financial markets. While demand growth has slowed across the complex, inventory levels remain surprisingly low, helped by supply side challenges. We believe that investor positioning has already discounted most of the bad news. In the year ahead, we expect price trends to be mixed. We expect copper, lead and zinc to outperform other markets. LME speculative positions in copper are currently trending up, suggesting that the floor may be close.

Base metals are knocked back by USD strength and fears about recession. This year has proved to be a difficult one for the base metal markets, with Russia’s invasion of Ukraine in February sending financial markets into freefall. Inflation spiked and economic growth slowed across the world in response to reduced confidence and rising interest rates in the OECD countries. In mid-October, the USD was up 18% compared to the start of this year, while the S&P500 equity index was down 25%. With fears about a global recession rising, most of the base metals also fell. Aluminium dropped 19%, while copper and zinc fell by 22% and 17% respectively. Lead dropped by 11% and tin retreated by 49%. Nickel was a notable exception and rose by 6%.

Threat of Russian ban is keeping markets on edge. This year has seen numerous attempts to damage the Russian economy and sanctions were imposed on individuals in the metals industry, with a limited impact on companies. The energy market was also rocked by a sharp drop in Russian gas shipments to Europe. Moreover, OECD companies have been self-sanctioning and avoiding Russian metal for ethical reasons. All of this helped to drive up energy prices and resulted in both supply cuts and softer demand for the base metals.

LME and US announce consultations. Amid all this uncertainty, the LME announced in October that it would be launching an industry consultation to consider banning Russian deliveries. Shortly afterwards the US government weighed in with its own statement that it wants to ban Russian aluminium, with the implication that other metals might also be impacted. These announcements caused sharp spikes in aluminium prices, as they have the potential to disrupt the supply-demand balance. Moreover, it could be a game-changer for the cash-and-carry trade, where traders rely on physical metal to close out short paper positions. Russia accounts for 6% of world aluminium production, but we suspect it is more important for this trade.

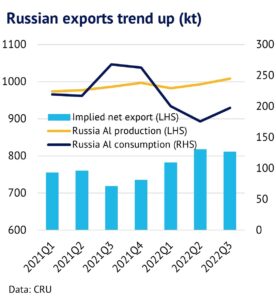

Sanctions mean that more Russian metal is available. Certainly, more Russia aluminium has been exported this year, as domestic demand has sunk under the weight of international sanctions. The vehicle market was particularly hard hit, with sales tumbling by 61% in the first eight months of the year. According to CRU figures, Russian aluminium consumption fell by 17% in the same period, while production rose by 1%. Net exports rose by 7% as a result, as we show in our chart below.

An oversupply in Russia has spilled over into the global market. Looking ahead, the opportunities for selling Russian metal appear to be getting more limited, but there is scope for trade flows to be diverted, which could act as a safety valve. We discuss this in more detail in our research piece – Russian Aluminium: the door is closing.

In terms of copper, there has been a similar trend towards greater exports. Russian copper consumption fell by 7% in the first nine months of this year, while production rose by 6%, leaving more metal searching for international buyers. However, Russia is a smaller part of the refined copper market, with a 4% global market share. Also, countries like Chile dominate the supply of copper concentrate, which is an important part of the supply chain. For copper, we are closely tracking spot treatment charges and traffic congestion in China, as these are key indicators. More detail can be found in our recent research piece – Copper falls: setback or existential crisis?

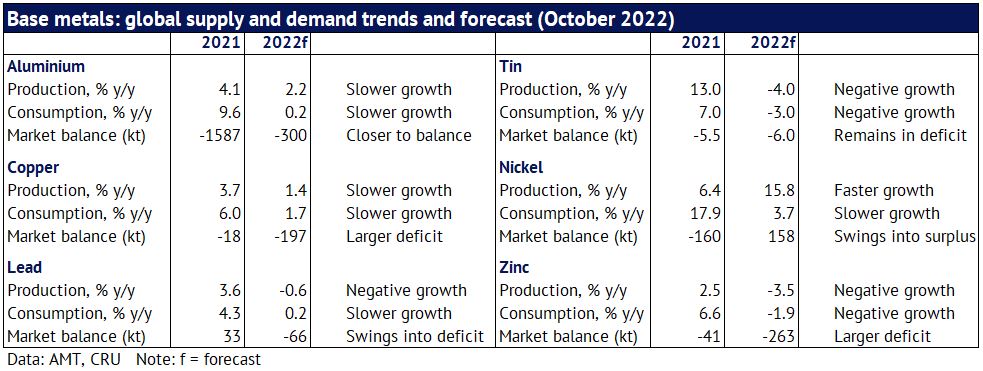

Copper, lead and zinc balances are looking tight. While there has been a lot of gloom about the outlook, some base metal balances are looking surprisingly firm, partly because of the Russian impact on supply. While demand growth has slowed across the whole complex, production has also been curtailed due to very high electricity prices in Europe and other supply challenges in places like Chile and Peru.

The biggest turnaround this year is likely to be seen in the zinc market, which is expected to move from a small deficit of 41k in 2021 to large 263kt deficit in 2022, according to CRU forecasts. Similarly, lead is expected to switch from surplus in 2021, to deficit this year. In terms of copper, both supply and demand are seeing slower growth, but the market is still predicted to be in deficit this year. Furthermore, copper demand growth has been accelerating in recent months, as the impact of the green energy transition has started to outweigh other more bearish factors.

Aluminium and nickel fundamentals are softening. Other markets where the fundamental drivers are looking more bearish are aluminium and nickel. Aluminium is moving quickly back towards balance. Global demand growth has slowed from 9.6% last year to just 0.2% this year. Also, Chinese production has accelerated recently and looks set to increase by around 6% in Q4, considerably faster than the 2% growth predicted for domestic consumption in the same period. This bodes badly for fundamentals in the year ahead, if these dynamics persist.

Finally, nickel has swung into a large surplus due to a ramp-up in production, while demand growth has dropped sharply. Strong supply growth is taking place in Indonesia to meet extra demand from the electric vehicle battery market. CRU is predicting global production growth of 15.8%, compared to consumption growth of 3.7%.

LME stocks have fallen sharply. While LME prices are reflecting recession fears, LME inventory levels are not. Indeed, there has been a sharp drop in reported inventory so far this year across the major base metals. Aluminium is down 49%, with copper, lead, nickel and zinc down 7%, 45%, 47% and 74% respectively (18 October). Weak fundamentals and rising interest rates should have combined to encourage more metal onto exchanges, but this has not happened.

Moreover, the tight market balances noted above for copper, lead and zinc are reflected in very low inventory levels. In terms of days of consumption, LME stocks are just 1.1, 0.9 and 1.3 days respectively. Aluminium inventories are also low at 2.5 days.

By contrast, weak fundamentals for nickel are showing in more comfortable levels of LME inventory at 7 days. Across the base metals, consumers are currently not too concerned about low levels of LME inventory, because of recession fears, but if demand starts to improve there is a very limited cushion of spare metal to cope with any future shortages.

There is also a widespread belief in the market that significant amounts of metal are being stored outside official exchanges, particularly for aluminium. If this is the case, LME inventory trends and levels are not an accurate reflection of current fundamentals. With copper, lead, tin and zinc all in backwardation in mid-October, there is now a financial incentive to lend surplus metal, which will clarify where we stand in terms of fundamentals and how tightly any surplus metal is held.

Base metals are closely following macroeconomic drivers. The base metals have also been tracking global risk appetite higher and lower this year, showing that investor flows remain powerful drivers. Any upward surprises for inflation have been reflected in a stronger USD and lower equity and base metal markets. For copper, the 52-week rolling correlation between copper and the S&P500 reached 41% in mid-October. This is one reason why the base metals look disconnected from fundamentals. The corollary is that once US interest rates reach a peak – probably in early 2023 – then base metal prices will start to be boosted by USD weakness, even if base metal fundamentals look lacklustre.

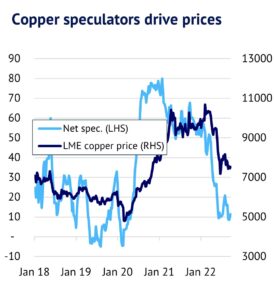

Speculative positions may have reached a floor. Given the backdrop of falling global PMIs, investors have been cutting long positions across the base metals complex. Net speculative positions in aluminium fell to -5k contracts in late September, the first time these have turned negative since February 2020. In copper, net longs have been cut from a recent high of 66k contracts back in October 2021 to just 9k contracts in early October. However, there seems to be limited scope for speculative positions to fall further, if recent history is a guide. If we compare current net speculative positions with their historical range, aluminium’s glass is currently just 13% full, compared to 19% for copper, 5% for nickel and 29% for zinc. Tin’s speculative positioning is already close to a record low at net short of 553 contracts.

Copper investors tend to lead the recovery and green shoots are emerging. We show in our chart how copper prices and speculative positions are closely linked. There is also some indication that speculators lead both the upswing and the downswing. For example, investors turned from net short to net long in March 2020 and these then reached a peak well before copper prices. It is still early days, but net speculative positions for copper turned higher in the first half of October, potentially flagging up the start of a new uptrend.

Base metal prices look set to diverge. Looking to the year ahead, we expect to see mixed trends for the base metals. Copper should benefit from tight fundamentals and lead and zinc look set to remain buoyant, due to challenges on the supply side. Nickel is predicted to remain weak, although we do not see much downside for prices, given that they are already low in a historical context. Aluminium is a very difficult market to predict. LME inventory is still low, but inflows of Russian metal threaten to dampen sentiment for the short-term and global demand looks soft in Q4 2022. However, if Russian metal is banned, prices will probably jump, as cash-and-carry traders rush to cover short paper positions. Also, LME aluminium speculative positions are already very low and there seems to be scope for these to be rebuilt, if the global economy can pull out of its recent slump. Ultimately if the USD can find a floor soon and China emerges from its Covid shackles, then bullishness should return to the base metals complex. In the year ahead we expect upside risks to dominate, given where we are in the economic cycle.