28th September 2022: Copper prices fell in the past month, as inflation seems to be running out of control in the US and recession fears are elevated. Copper is closely tracking economic variables, showing that the headwinds from a strong US currency are significant. Fundamentals are looking supportive though and Chinese demand looks set to accelerate in the months ahead. We expect prices to grind lower in the short-term, but upside risks should dominate in the year ahead.

Copper Depressed by strong USD

Prices drop on inflation concerns. Three-month LME copper prices have fallen back in recent weeks in response to a slowing world economy and persistent inflation in the OECD countries. The price is currently $7,431/tonne, down 9% m/m (26 September), although the cash-to-3M spread remains in a backwardation of $89/tonne.

While copper fundamentals look supportive the market has struggled to gain any bullish traction, as recession fears are elevated. The latest US inflation data showed a shock acceleration in core CPI to 6.3% in August, showing that the US Fed is struggling to rein in price pressures, amid tightness in labour and commodity markets.

As we show in our chart, copper is closely following broader financial market conditions, rather than fundamentals. The 52-week rolling correlation between copper and the US equity market (as measured by the S&P500 Index) reached 50% in June, its highest level since February 2021 and the link between copper and the US dollar (DXY) is also elevated compared to recent history, with a strong negative correlation.

Bearish backdrop from global economy. Looking at global PMIs there is plenty of ammunition for bears. The global composite PMI fell from 53.5 in June to 49.3 in August. This is the first time it has fallen below 50 since the Covid crisis of early 2020. A figure below 50 suggests contracting economic activity.

Small green shoots appear in China. However, we are starting to see early signs that economic activity in China is turning a corner, which would be a significant bullish signal for copper. The latest economic data for August showed an improvement. Industrial production, for example, rose by 4.2% y/y in August, up from 3.8% in the previous month. Retail sales also accelerated to 5.4% growth from 2.7% in July.

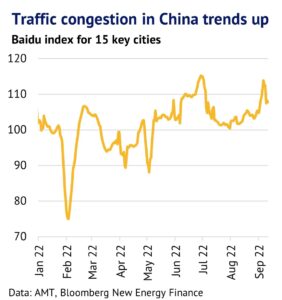

High frequency data is turning up. The Chinese government is also pressing on the economic accelerator to offset the headwinds coming from Covid-related lockdowns. Evidence that a slow upswing in taking hold comes from the latest traffic congestion data compiled by Bloomberg New Energy Finance. The data shows that in 15 key cities congestion had increased by 8% by 14 September, compared to the start of August. Increased mobility suggests that the economy is getting back to normal after a very weak second quarter. Furthermore, property companies are being urged to restart stalled construction projects, with giant firm Evergrande restarting 668 out of 706 of its homebuyer projects this month.

Copper demand is being boosted by energy transition. According to CRU, copper demand has held up well in recent months, despite the challenges of dealing with high and volatile energy prices and a moribund property market in China. The consultancy firm estimates that Chinese demand grew by 5% in Q3 and is predicting an acceleration to 9% growth in Q4. Government investment in the country is helping to boost sectors such as the national grid, solar power, infrastructure and other sectors related to the green energy transition. Utilisation rates at wirerod mills have risen from 62% in early August to 66% in mid-September.

Visible inventory levels are low. Meanwhile, spare levels of copper inventory remain low, which could prove to be a challenge for consumers if demand starts to turn around as expected. Exchange on-warrant inventory levels (LME and SHFE) currently stand at just 159 thousand tonnes (kt), which is equivalent to just 2.4 days of global consumption. Bonded warehouse stocks are China are also down by 61% in the past six weeks.

We also hear, anecdotally, that Covid lockdowns and power shortages have only had a mild impact on Chinese copper demand in recent weeks, while supply has been more severely reduced. This is not that surprising because demand tends to be more evenly spread across small fabricators, whereas supply is concentrated at larger plants, leaving it more vulnerable to Covid outbreaks and local problems with power.

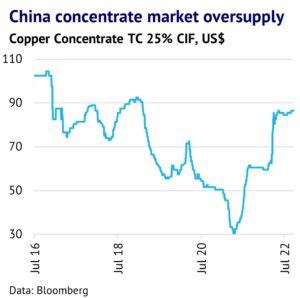

Supply side pressure is easing, as miners ramp up. While copper demand looks set to accelerate, the supply side of the industry has also been ramping up, which is easing concerns about potential shortages. Looking at the latest spot treatment charge (TC) data (cif Asia Pacific), there has been a steady uptrend from $68/t in mid-July to $78 on 23 September, according to Fastmarkets data. This shows that concentrate supply has been outpacing demand and is a bearish signal. TC are now at their highest level since mid-May.

Mine production is back on a growth path. Global copper mine production is now expanding, which is helping to allay concerns about potential shortages. According to Bloomberg analysts, growth will be around 450kt this year or 2%. This year will see expansions taking place at several major mines including Kamoa (up 204kt), Quellaveco (up 120kt), Escondida (up 116kt) and Grasberg (up 106kt), with Russia’s Norilsk also due to increase by 103kt.

Traditional mining areas are falling behind. While the general trend in copper has been up, traditional mining areas in Latin America have struggled this year. In Chile, for example, latest data shows that mine production fell by 7% in the first seven months of this year. Problems have included accidents, falling ore grades, water shortages and a lack of investment. Similarly in Peru, copper output fell by 7% y/y in July. Both countries have seen political problems this year and a number of strikes and disputes with workers and local residents.

Price search for a solid floor. Copper has struggled to find a solid floor in recent weeks, with significant headwinds coming from a downturn in the world economy and a rapid ramp-up in US interest rates. In the short-term we expect prices to grind lower until a clear recovery starts to come through in China.

Nevertheless, we feel that upside risks should dominate in the year ahead. Chinese economic data is likely to recover from its soft patch in Q2 and even Europe is likely to prove resilient, as the region finds ways to cope with challenges in the energy market. While copper supply is starting to trend higher, this will be needed to cope with higher demand and an industry adapting to extra pressure from the green energy transition.