Why is copper rebounding?

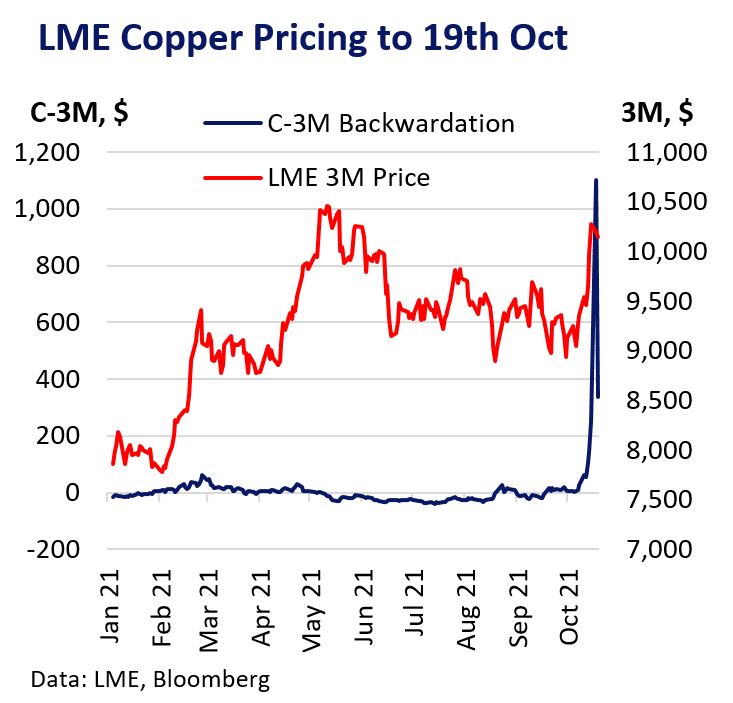

Escalating physical market tightness has jolted the copper price into life after several months of directionless trading. Declining copper exchange inventories and heightened inflation concerns prompted by the global energy crisis have acted as a catalyst for historically extreme LME spread tightness and a resurgence in 3M prices to within a touching distance of the all-time high of $10,747.5 from early May.

[spreaker type=player resource=”episode_id=47094790″ width=”100%” height=”200px” theme=”light” playlist=”false” playlist-continuous=”false” chapters-image=”true” episode-image-position=”right” hide-logo=”false” hide-likes=”false” hide-comments=”false” hide-sharing=”false” hide-download=”true”]

Attention Switches to Physical Tightness

Investor attention has shifted away from copper demand macro-risks such as stimulus tapering and a China property market slowdown. Growing signs of acute physical market tightness are now in the spotlight.

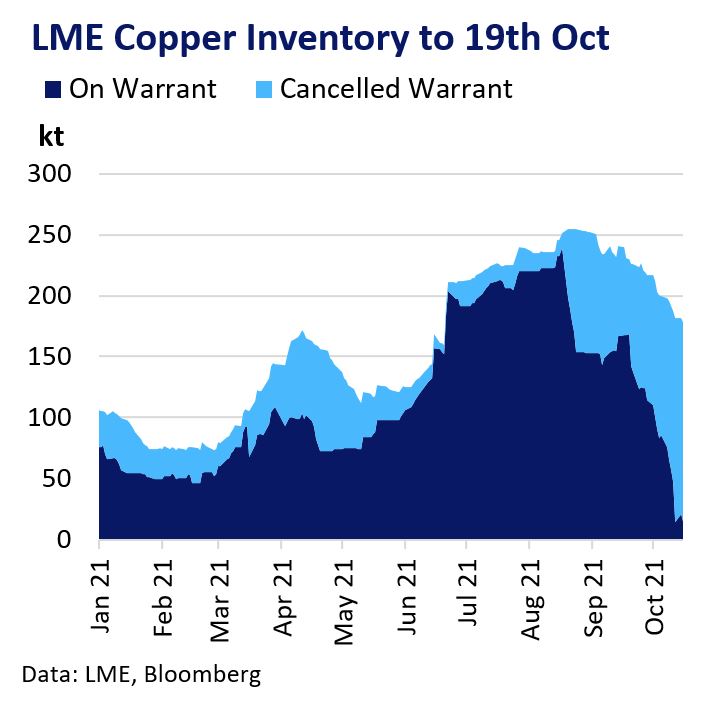

The most striking development is the recent collapse in available LME copper warrants to as low as 14,150 t as reported on 15th October, the lowest since 1974. The decline came amid a spate of sizeable LME stock cancellations in which Bloomberg reported Trafigura played a key role.

SHFE copper inventories are below 50 kt, their lowest level since 2009. Demand from China amid an open import arbitrage has contributed to the pressure on LME inventories.

This coincides with growing concern about inflationary pressures and disruption to base metals supply from the developing energy crisis in China and Europe.

LME Copper Market Goes Wild

Copper prices have jumped notably, with the cash price hitting a record high of $11,299.5. However, the reaction of LME nearby copper spreads was the most dramatic. The Tom-Next spread backwardation hit a high of $175 on 15th October while Cash-3M copper settled at $1103.5 on Monday 18th, the tightest since the 1970s.

The tightness was concentrated on the Oct-Nov spread as shorts scrambled to cover and roll short positions. Forward spreads tightened in sympathy, with the curve in backwardation out to 2025.

The LME responded to the extraordinary market conditions late on Tuesday by imposing a backwardation limit on the Tom-Next spread of 0.5% of the prior day’s cash price, along with other measures designed to minimise market disorder.

The extreme nearby backwardation has moderated after the initial bout of panic-driven activity and following the LME’s intervention.

Market Outlook

The ICSG expects a 328 kt global copper market surplus in 2022 after a broadly balanced 2021. The Group forecasts strong supply growth against a modest rise in demand.

Although Evergrande’ s debt crisis financial contagion fears have eased, a China property sector slowdown is likely to weigh on China’s growth next year.

There is strong optimism about long-term copper demand prospects from the green transition, particularly electric vehicles and power grid investment. However, there is a lack of consensus as to whether this will ramp up fast enough to offset China growth pressures and fading monetary and fiscal stimulus support globally.

The global energy crisis may be supporting copper as investors look to hedge against rising inflation risks. However, it is not clear that power rationing has hit copper supply particularly hard thus far. CRU reports that China’s semi-fabricators have faced more disruption than copper producers have.

Conclusions

Pressure on global inventories, particularly LME available stocks, remains the primary short-term driver of higher copper prices and significantly tighter spreads. Inflationary pressures from the energy crisis have also provided underlying support.

The medium-term outlook for the market is less clear amid macro-risks to growth in 2022. However, there is broad consensus on the strong longer-term demand prospects from decarbonisation.