The week has begun largely as anticipated, with a clear pickup in enquiries around the merits of investing in hard assets. For most, that still means precious and industrial metals, though it is likely to broaden to include hydrocarbon molecules as well.

Something shifted at Davos. That moment appears to have dissolved the remaining resistance among passive investors. “Alternatives” and “ESG” are no longer sufficiently descriptive terms for what remains, in most portfolios, an altogether too small allocation to real assets. Further reinforcement of this shift in sentiment came with President Trump’s latest comments signalling comfort with a weaker dollar. Intentional or otherwise, the market has taken this as validation of debasement concerns. That, in turn, strengthens the case for capital to seek assets offering a degree of currency neutrality, either through their ability to transact across multiple currencies or via internationally diversified revenue streams.

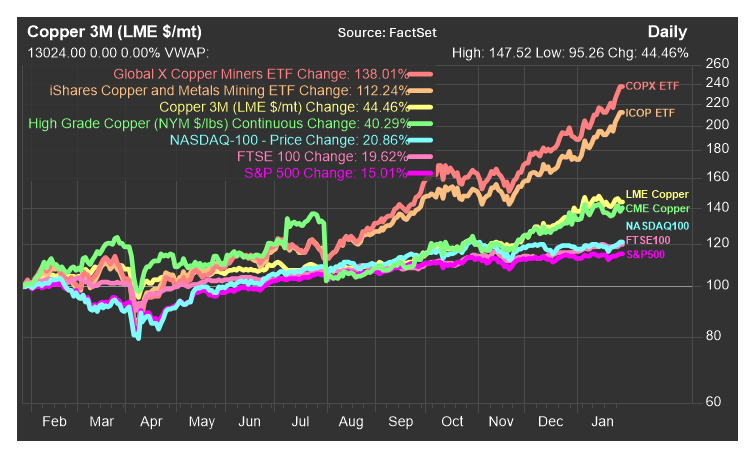

This shift is also evident in relative performance. Copper itself has performed well, but the more striking feature has been the outsized response in copper-exposed equities and mining vehicles relative to broader equity indices.

The divergence between copper miners, metals ETFs and general market benchmarks suggests capital is not merely expressing a view on near-term price, but is seeking operational and asset-backed exposure to scarcity themes, leverage to real assets, and revenue streams that sit outside a single domestic currency framework.

Gold, copper, aluminium. We will come back to silver shortly, noting that a “moment” in silver can now reasonably be defined as two big figures per ounce.

Some are framing the current price action as late cycle, arguing that a new phase of price discovery is nearing exhaustion, to be followed by a more balanced auction and stable rotation between time-frame participants. But it is worth asking what cycle we are actually referring to.

This rally is not born of a stressed supply and demand backdrop. It is emerging from a relatively benign current cycle. The sharpening willingness of politicians, policymakers and central bankers to lean into concerns that fall outside the scope of their tenures in office represents a genuine departure from historical behaviour. Problems are usually deferred to the back of the curve, not paid for in advance.

This tells us something quite interesting. These people do not ordinarily think in those terms. The implication is that the electorate, the group that will determine the next election or selection, is itself becoming more forward-looking.

The risks now being priced are therefore not narrowly financial. They align with more fundamental human concerns, those captured in the hierarchy of needs. The kinds of challenges more commonly associated with late-night charity appeals on television are no longer abstract or distant. They are moving closer to home, not tomorrow, but soon enough to matter today.

Returning to silver, it is not that it is un-investable, rather that it is not tradable for the time being. If silver is on an inextricable journey toward a new price paradigm, one in which it ultimately stabilises at a higher clearing level, then entry timing becomes a secondary consideration. An extremely long-term attitude can be taken, with position sizing and patience doing far more of the work than tactical precision.

Important Disclaimer –

This article is intended for general information purposes only and reflects the market environment at the time of writing. It does not constitute investment advice, a personal recommendation, or an offer to engage in any trading activity. The content does not take into account individual objectives or circumstances and should not be relied upon as the basis for any investment decision. Past performance is not a reliable indicator of future results.

Content may have been created by persons who have, have previously had, or may in the future have personal interests in securities or other financial products referred to therein. All conflicts and potential conflicts relating to our business are managed in accordance with our conflicts of interest policy. For more information, please refer to our Summary of Conflicts of Interest Policy.

For more information and important risk disclosures, please see our Derivative Product Trading Notes and Privacy Policy. AMT Futures Limited is authorised and regulated by the Financial Conduct Authority.