What has caused the global shipping disruption?

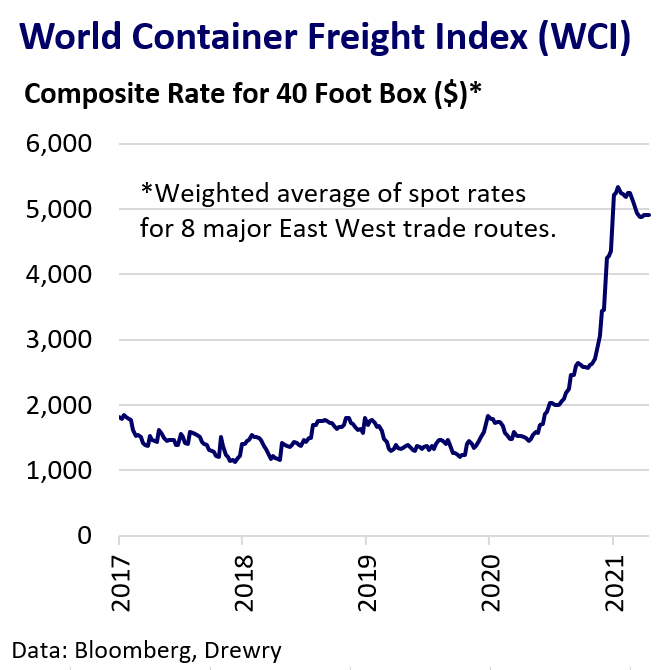

Since the onset of the pandemic, an acute shortage of global container freight capacity has seen shipping costs and delays surge to unprecedented levels. Causing this was an unexpected surge in demand for consumer goods, stranded containers from asymmetry in trade flows, and port delays. Disruption has impacted base metal markets by exacerbating tight supply of concentrate, driving regional physical premiums to extremes, and precipitating a likely longer-term shift from a “just-in-time” to “just-in-case” approach to inventory management in global supply chains.

Pandemic Drives Shipping Disruption

Lockdown measures imposed on global populations as a result of the pandemic and fiscal stimulus measures triggered a sharp shift in spending behaviour. Demand surged for manufactured goods such as imported consumer electronics, medical goods. Businesses also looked to build buffer inventories. The global shipping industry was unprepared for the surge in demand, particularly for containerised freight, where costs and shipping times have risen significantly. The significant asymmetrical flows of physical goods to western economies led to severe shortages of empty containers where they were needed. Overloaded ports added to shipping congestion and delays, made worse by the fallout from the recent Suez Canal blockage in March.

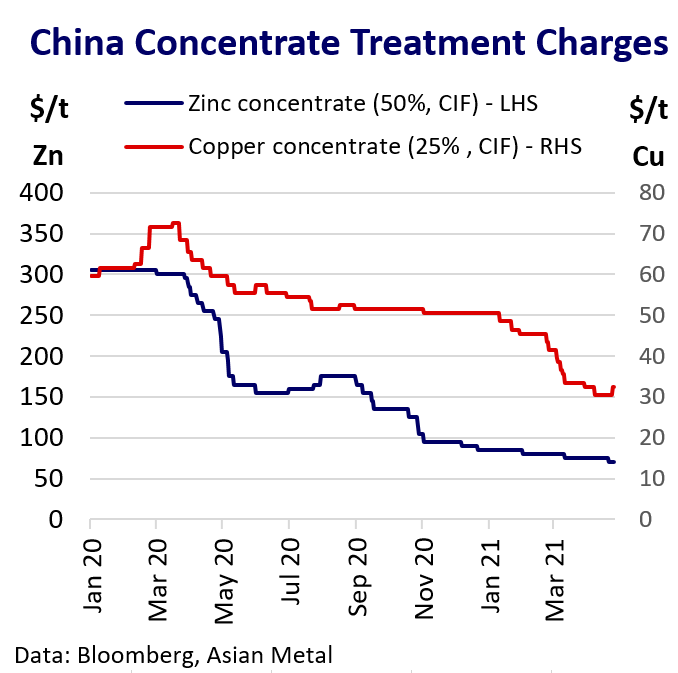

Suppressing Treatment Charges

Pandemic-related disruptions to mine supply in 2020 resulted in much tighter availability of ore and concentrates. Along with recovering metal demand this drove down smelter treatment charges; notably for copper and zinc. Shipping disruption has added to fears about when recovering mine supply can provide relief to smelter shortages. This has reinforced stockpiling behaviour in 2021 and helped keep treatment charges under pressure.

Metal Price Impact

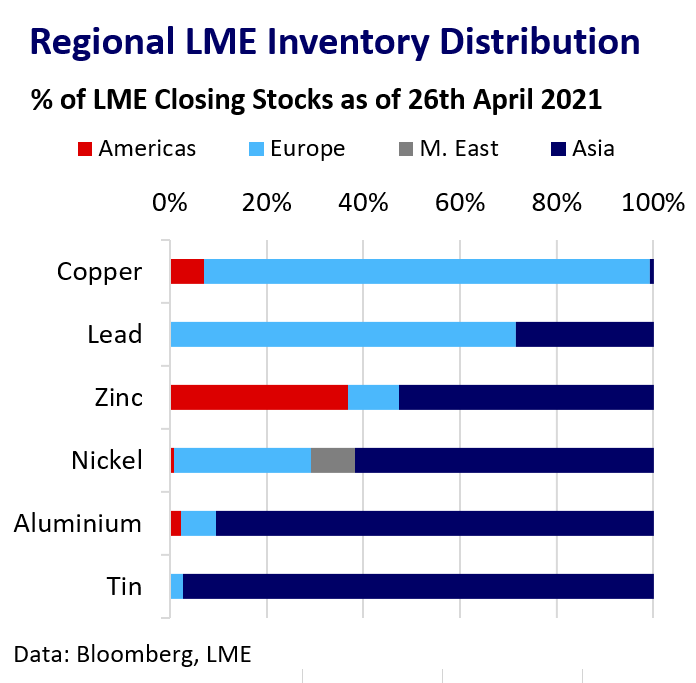

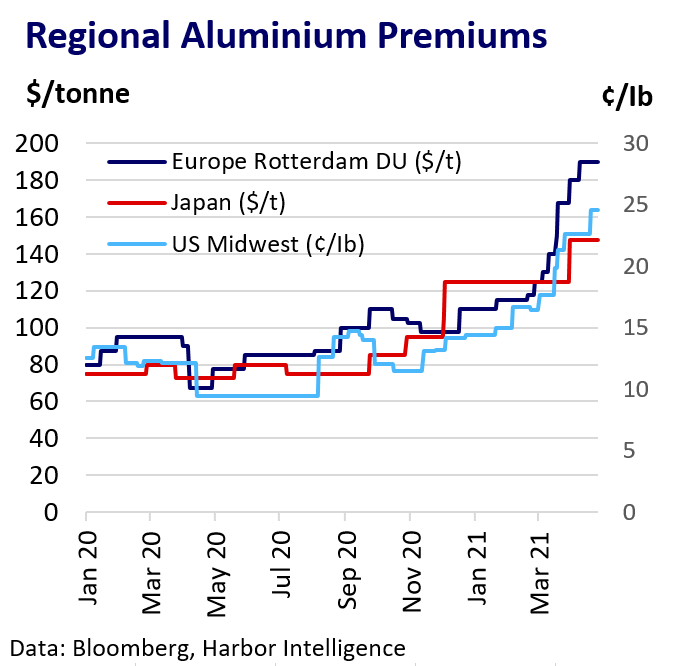

Implied cost inflation and raw material shortages from global shipping disruption have also arguably played an indirect role in supporting underlying price sentiment across base metals, exacerbating the narrative of disrupted supply that may struggle to keep pace with demand. However, the impact on physical metal markets is clearest in surging regional premiums. Regional supply tightness is clearest for big metal importing regions such as Europe and North America, where demand has rebounded strongly fuelled by stimulus and vaccine optimism. Metal premiums are strongest where local inventory availability is limited and there is greater reliance on importing metal at higher costs.

When Will Disruption Ease?

Shipping industry analysts such as Sea-Intelligence see the container shortage worsening in May and early June as a result of the Suez Canal blockage fallout. Global demand for shipping will likely continue to grow over the summer as key economies recover from lockdowns. Therefore analysts do not expect globally shipping disruption to ease substantially until at least the second half of 2021. This will likely remain supportive to regional metal premiums, particularly in North America and Europe.

Long-Term Implications

Shipping disruption has exposed vulnerabilities in the resilience of “just-in-time” supply chains. Businesses may look to hold greater inventory “just-in-case” in the future, broadly supportive for metal demand prospects. There is a risk that inflation stoked by global supply-chain disruption could push central banks to tighten monetary policy sooner, which would be negative for metals demand and dollar prices. For now, central banks see supply-chain disruption as a temporary inflation driver and are maintaining an accommodative policy stance despite the clear short-term inflationary pressures.