Why has the shipping crisis worsened?

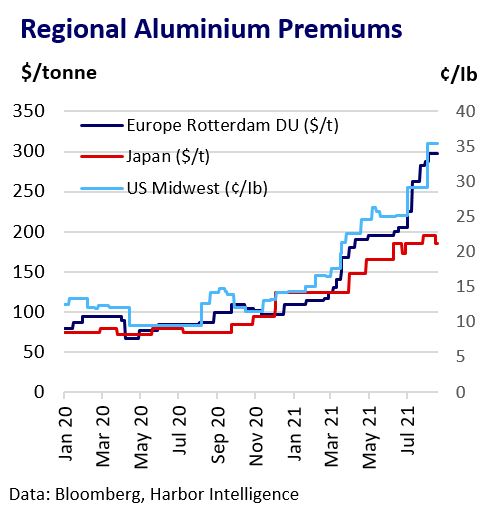

The continuing global shipping crisis has widened dislocations between regional physical metal markets. Soaring physical premiums in the US and Europe and severe imbalances in global metal inventory distribution reflect the growing difficulty in shipping metal to where it is most needed. Shipping difficulties could worsen after recent port disruptions in China, adding to congestion at key ports globally. This could support regional premiums, but indirectly weigh on metal prices by threatening the broader global economic recovery.

Shipping Crisis Background

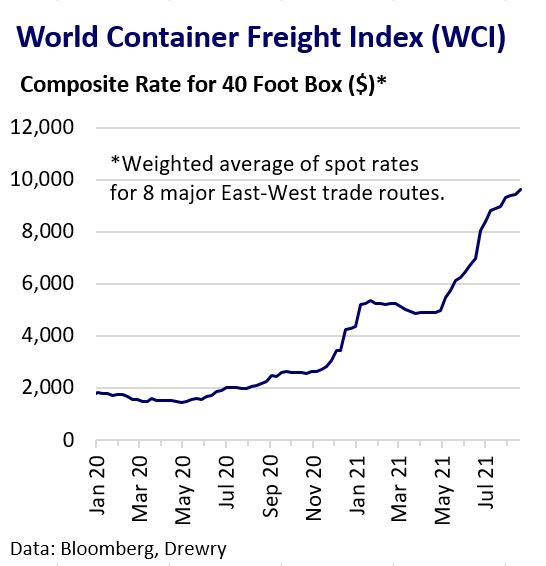

Global freight rates have surged since late-2020, rising up to fivefold on major east-to-west container trade routes. Strong, stimulus-fuelled, industrial production growth has fuelled a corresponding surge in global trade volumes. The US and Europe have been the main engines of demand growth in 2021 as China’s rebound has slowed. Demand for shipping has met numerous capacity issues. The blockage of the Suez Canal early this year was followed by broader port congestion across Asia as covid cases in the region soared. Yantian port in Shenzhen, China, was closed temporarily from May following a Covid outbreak. The part-closure of Ningbo port in China represents the latest blow to the industry. The disruption extends beyond nautical shipping; soaring US trucking rates are another symptom of a global logistics system that is severely stretched.

Ningbo Closure Adds to Woes

The detection of a Covid case led authorities to close a major terminal at the port of Ningbo on 11 August, the world’s 3rd busiest port. The Meishan terminal usually deals with 25% of the port’s cargo. Ningbo port is a major conduit for the export of electronics, textiles, and manufactured goods and imports of electronics and raw materials, such as nickel ore. The port is operating at 90% of July levels and may not return to normal capacity for weeks. Other regional ports such as Shanghai and Hong Kong are already feeling the strain of redirected cargos. Other major global ports foresee a major knock-on impact.

Metal Market Disruption

The impact on metal markets from shipping disruption is three-fold. Firstly, shipping of metal-precursor materials like ore, concentrate, and scrap faces ongoing delays and difficulties. Peru is currently having issues shipping to Asia, with delays commonly exceeding two months. With miners absorbing high shipping costs this has kept China’s smelter treatment charges under pressure, notably for zinc. Secondly, shipping difficulties have inhibited trade in refined metals and the ability to smooth out regional market imbalances. This dynamic has pushed a number of US and European base metal premiums to multi-year highs. The lead market is a good example of this dynamic, with a supply glut and growing SHFE inventories contrasting LME stock drawdowns amid scarce US and European supply. Thirdly, the disruption to trade is affecting the flow of goods and semi-finished products, which risks weighing on global industrial activity and broader economic growth.

Outlook

Industry experts suggest ongoing shipping chaos could extend well into 2022. While trade volumes moderated in Q2, recent port disruption and stronger demand ahead of the US and European Christmas holiday season could maintain upward pressure on rates and shipping times. This should support US and European premiums by keeping replacement costs high. Concentrate shipment disruption may help cap smelter treatment charges in China. However, ongoing shipping disruption perpetuates the narrative of a sluggish and uneven global recovery from the pandemic. Covid-restrictions on ports risk extended trade frictions that could undermine the broader global economic recovery, much like restrictions on other industries. This could ultimately weigh on metals consumption and prices.