Unprecedented Spread Tightness Across LME Metals

Base metal prices have proved largely resilient to emerging risks to economic growth. This is amid persisting signs of acute physical tightness across the complex. Abnormally backwardated forward curves, sustained pressure on LME inventories, and elevated physical premiums are the clearest indicators.

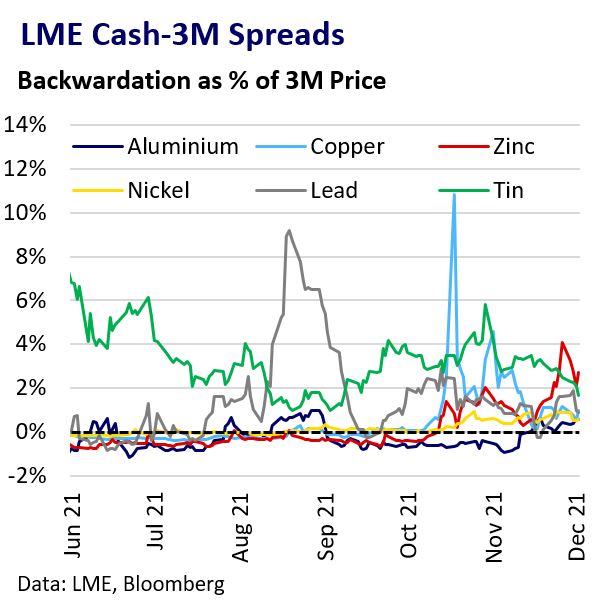

Backwardations Everywhere

Notable tightness has developed across nearby LME spreads for all the base metals. From mid-November, Cash-3M was in backwardation across the whole complex for the first time since May 2007. Forward LME spreads also tightened aggressively over the course of the year.

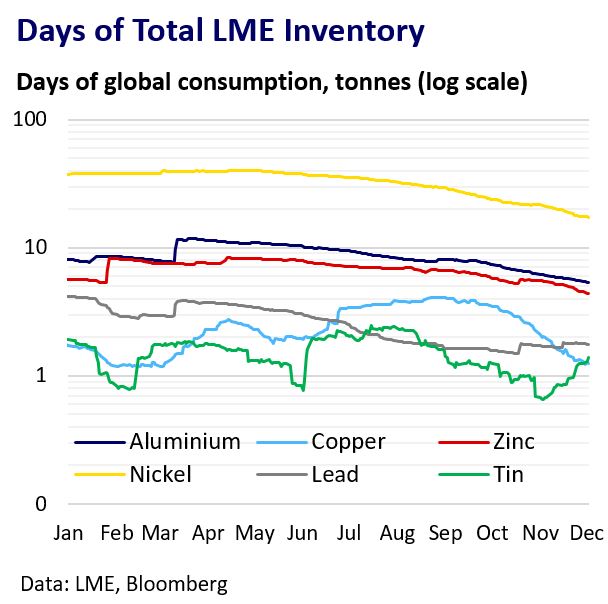

Inventory and Shipping Pressures Are Key

Acute pressure on LME inventories is the clearest reason for pronounced nearby backwardations. Total LME warehouse stocks for each of the base metals are either near critical lows or in consistent decline.

Shipping disruption continues to frustrate efforts to deliver metal to regions with acute shortages. This includes Europe and US, which continue to see strong consumption despite automotive sector slowdowns. High physical premiums in these regions have offset the cost of hedging in a backwardation. This has helped sustain borrowing interest from inventory holders.

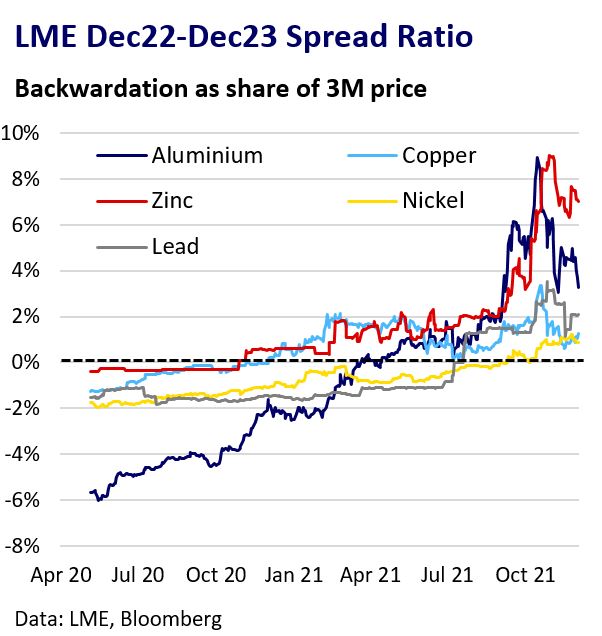

Divergence in Long-Term Hedging Demand

As base metal prices have rallied higher, producers have keenly sold long-term forward contracts to lock in higher prices. Consumers have been less willing to hedge long-term at higher prices, particularly amid supply-chain woes and emerging threats to sustained demand growth. These factors are driving backwardations and volatility in forward spreads.

These spreads remain highly sensitive to 3-month price moves. However, they could ease substantially if participation from underhedged consumers rises as supply-chain uncertainty wanes.

Spreads Illiquid Amid Risk-Aversion

Copper, tin and lead have each seen backwardations spike to recent historical extremes during 2021. This demonstrated new vulnerability to extreme backwardation spikes has dulled lending appetite among non-physical participants. This has exacerbated market tightness, illiquidity and price volatility across the forward curve.

Conclusions

In this current metal supply- and inventory-constrained environment, indicators of physical market tightness will remain a critical source of price support across base metals. This should help offset price pressures from emerging risks to economic growth. These include high inflation, stimulus policy withdrawal, Covid-19 variants, energy availability and China’s property market slowdown.