Russian Aluminium – The Door Is Closing

6th October 2022: Aluminium prices have rallied as the market starts to worry about low LME stocks and the potential impact of an LME ban on Russian metal. While there is scope for trade flows to be diverted, this will take time and significant short-term disruption is likely. We believe that prices are close to a floor and are likely to trend higher in the year ahead.

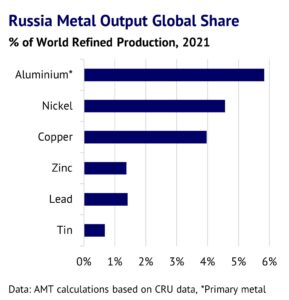

Russia Metal Output Global Share

Aluminium prices pick-up, as US economic data gets worse. The past month has seen a tentative rally in the base metal markets, as the USD has weakened on hopes that US interest rates may be close to peaking. While ISM survey data for US manufacturing showed a sharp slowdown in September, hopes for an early peak in interest rates are driving all financial markets higher. The three-month aluminium price has outperformed copper and is currently up 5% m/m at $2,377/tonne (5 October).

Russian metal may be banned from the LME system. Sentiment in aluminium is also being boosted by other factors. Firstly, the LME confirmed in late September that it might ban Russian metal from being delivered to its warehouses, although a long period of consultation would be required before that. Nevertheless, this announcement caused a sharp spike in aluminium prices, as it has the potential to disrupt the cash-and-carry trade, where traders rely on physical metal to close out short paper positions. The market was previously unconcerned that LME stocks were close to record lows, around 266kt (6 October), given rumours of plenty of metal sitting outside the official reporting system. However, any ban in this context has the potential to be a game-changer. Russia accounts for 6% of world supply, but we suspect it is more important in the shadow inventory story.

Russian Aluminium Market

Sanctions mean that more Russian metal is available. Certainly, more Russia aluminium has become available this year, as domestic demand has sunk under the weight of international sanctions. The vehicle market was particularly hard hit, with sales tumbling by 61% in the first eight months of the year. According to CRU figures, Russian aluminium consumption fell by 17% in the same period, while production rose by 1%. Net exports rose by 7% as a result. An oversupply in Russia has spilled over into a better supplied global market.

Some potential for trade diversion. Looking ahead, the opportunities for selling Russian metal appear to be getting more limited, but there is scope for trade flows to be diverted, which could act as a safety valve. Trade data shows that historically Turkey was the single largest importer from Russia. According to CRU, the bulk of this metal is converted into semis, which are then sold into Europe. China has also become an increasingly important buyer, with imports from Russia rising from just 5kt (thousand tonnes) in 2015 to 380kt in 2021. Finally, there is scope for shipments from the Middle East to be redirected from Asia to Europe. China imported 244kt from the Middle East last year, which could potentially be replaced with Russian metal, releasing more for Europe. Nevertheless, any additional restrictions on Russia will cause significant short-term disruption.

Upside risks for net speculative positions. For now, investors are still bearish, but sentiment can change quickly. Investors remain worried about the slowing macroeconomic backdrop and have been cutting long positions in aluminium, as a result. Net speculative positions fell to -3.5k contracts at the end of September, close to its lowest level since February 2020. However, there seems to be limited scope for this to fall further, given that these have not fallen below -23k contracts since the data started being reported in January 2018. Indeed, if we compare current net speculative positions with their historical range, aluminium’s glass is currently just 8% full, compared to 17% for copper and 26% for zinc.

Global context will help to drive price direction. Ultimately key macroeconomic trends will determine how aluminium prices react, if any ban takes place. The world economy is currently slowing, but the aluminium market is in deficit and LME inventory is very low. Moreover, we continue to see green shoots emerging in the Chinese property market, which suggests physical tightness may re-emerge soon. As a result, we believe that aluminium prices are close to a floor and should trend higher in the year ahead.