12th December 2022: Tin prices have rallied in recent weeks, as LME speculators have gone from net short to net long. Like other base metals, tin is being boosted by hopes that the Chinese economy will see a strong bounce back, after severe Covid-related lockdowns in November. However, current fundamentals look weak and exchange stocks are trending up, amid weak demand conditions. While the market is likely to trend higher in the year ahead, current headwinds look very strong and we look for short-term weakness.

Tin prices are on a roller-coaster ride, reflecting the war in Europe and an uncertain outlook. This year has seen wild swings in the tin market as speculative forces have clashed with softer global fundamentals. Three-month LME tin prices have surged in the past month to USD24,400/tonne, up 24% m/m, although they are still down 37% so far this year. While there has been a general recovery in the base metals complex, tin is starting to outperform, as the USD has weakened and financial markets have started to look eagerly ahead to 2023.

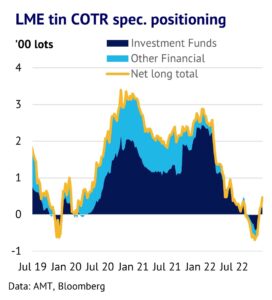

Speculative positions start to build on hopes that China will bounce back. The hope is that economic growth in China will accelerate soon, as it lifts Covid-related lockdown measures and the country starts to benefit from a mass of policy changes and stimulus measures, which have been taken to underpin the property market. Moreover, US interest rates are expected to peak in early 2023. This hope has already been reflected in a steady build in LME speculative positions in tin. A net short position of 691 on 21 October switched to net long of 470 by 2 December. There is also significant scope for this to keep rising in the weeks ahead. Comparing the current position with the historical range (starting in January 2018) the glass is still just 28% full.

Supply side risks are significant and unquantifiable. In the months ahead there is also a significant threat to tin supplies from Indonesia and this helps to justify a bullish stance heading into year-end. The government is trying to restrict refined tin exports and capture more of the value-chain by consuming more tin domestically. A ban on exports has been floated as a possible solution, but this seems unlikely to happen because tin is consumed in a wide range of applications and industries and the metal is a small element in the context of global manufacturing costs. According to WBMS figures, Indonesia produced 72kt of refined tin in 2021, but consumed just 1.2kt and imports of tin solder were 11kt. The country produces 19% of world supply.

Weak fundamentals set to challenge the bullish narrative. While speculators are looking for green shoots to emerge soon, tin’s fundamentals today look soft, and look set to get worse as we head into the northern hemisphere winter. This is likely to strongly challenge the current bullish narrative. One of the most visible signs of market softness comes from exchange inventory levels (LME and SHFE). These have risen by 23% in the past month (8 December) and are now at a 4-month high. Higher interest rates will have encouraged some inflows, but supply-demand conditions are not as tight as they were, according to industry sources.

We expect demand to have a bumpy ride. Tin demand started the year strongly, but then slowed as economic headwinds started to build due to the war in Europe. CRU estimates that demand growth was 7% in Q1, but then turned negative in Q3 with a 4.6% y/y drop. Furthermore, we are expecting a weak end to this year and a rocky start to 2023. One of the main problem areas will likely be China, which accounts for around half of global demand. High frequency data for daily passenger movements by metro and weekly property sales show that economic activity slowed sharply in the second half of November, and it will take a while for the country to emerge from lockdowns. A particular challenge is that it is not clear how the government can quickly lift lockdown measures without crippling the healthcare system. We discussed this challenge in our recent research piece – China: don’t believe the hype (25 November).

Prices to be volatile, but upside risks should dominate. While we expect tin prices to trend lower in the months ahead on Chinese demand weakness, we do not see much downside. One reason is that the cost floor for tin producers is not too far away and has been boosted by inflation, and particularly higher energy prices. Industry sources estimate that average production costs for the top 10 producers are up by more than 20% in recent years. Also, the prospect of decent supply growth seems low, given where prices are today. Also, price volatility has made project financing even more challenging. On the other side of the equation, demand is set to benefit from significant tailwinds coming from the green energy transition, in particular electric vehicles and solar PV. Higher tin prices are likely to be needed over the medium term to encourage investment to flow into the mining sector. Recent volatility is likely to fuel future volatility, with history likely to repeat itself.