19 December 2024: LME tin prices have outperformed the rest of the base metals complex so far this year and upside risks are now building for 2025. In terms of global demand, this appears to have grown strongly in H2 2024, helped by a boom in computers/electronics, electric vehicles and solar PV. Furthermore, on the supply side, the Chinese market looks very tight and the country has switched back to being a net importer recently, due to an ongoing lack of raw materials. Finally, while Indonesian exports have trended up and there are rumours of an imminent restart of mining in Myanmar, significant challenges remain. Overall, tin’s fundamentals look tight in the year ahead and with LME speculative positions currently low, there is plenty of scope for a rebuild.

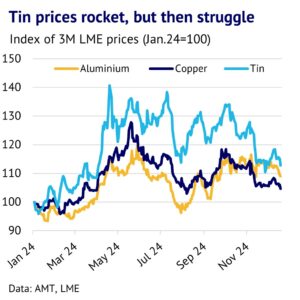

Tin prices fall, as speculators pullback. The LME three-month tin price is up 12% so far in 2024 (data to 19 December), making it the best performing base metal. This rally came despite the headwind of a strong US$, with DXY up 6% in the same period. However, a surge in tin prices in March/April was followed by a steady retreat from mid-July, creating doubt about the bullish narrative that had previously gripped the market.

Speculative positions have also pulled back from overbought levels. LME net speculation peaked at 100% of the rolling five-year historical range in the week ending 12 July 2024, but then fell to just 31% (data to 13 December), suggesting that a withdrawal by investors played a key role in undermining the price rally. However, the scope for further selling from here is much more limited and any supply shocks could see a rapid rebuild.

Demand upswing in H2 2024 to help keep global market tight. Global tin demand is growing rapidly and this also suggests that downside risks for prices are limited. CRU figures indicate growth of 8.7% y/y and 4.3% y/y in Q3 2024 and Q4 2024, respectively. Strength in electronics and electrical products is boosting demand in both China and the rest of the world, with the boom in electric vehicles and solar PV obvious areas of robust growth. Furthermore, extra stimulus measures in China are finally starting to have some impact on the property market, and house prices are stabilising, albeit at low levels.

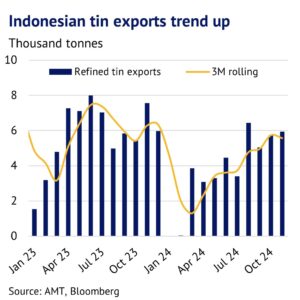

Indonesian exports recover into November, but December looks weaker. On the supply side of the industry, the pressure has eased a little, with CRU estimating global production growth of 0.1% y/y in Q4 2024. In January 2024, Indonesian refined tin exports had plunged to just 0.4t, as traders were not able to get export licences, ahead of the Indonesian election. This compared to average monthly exports of 6.2kt in the previous two years. Since then, there has been a steady build and exports reached 5.9kt in November 2024, as mining restrictions were eased. Overall though, exports are still down from their recent peak – see chart – and provisional estimates (based on exchange volumes to 16 December) suggest that this month will see a fresh 13% m/m fall. Indonesia is the world’s second-largest producer of refined tin (after China), with a global market share of 19%.

Myanmar turmoil is supposed to ease, although uncertainty remains very high. The latest rumours suggest that Myanmar’s Wa State will resume production soon at its key Man Maw mine, boosting concentrate shipments to Chinese smelters. It is worth remembering though that the country is in the middle of civil war and the political situation is very unstable, after a coup in 2021, meaning that the risk of another significant delay is high. Mining was originally suspended back in August 2023, to minimize environmental damage from artisanal workers and move towards a more organised, professional approach to extraction. The Wa suspension was supposed to be short-lived, but has now dragged on for over a year. Wa State previously supplied one-third of China’s concentrate requirements, with smelters there normally producing 48% of global refined tin.

Lack of concentrate supply sees China flip from exports back to imports. For now though, the China market looks tight and smelters are struggling to keep up with domestic demand growth. The country managed to source some extra concentrate from other parts of the world after the halt in Myanmar, but according to figures from Reuters, tin concentrate imports were down by one-third in the first nine months of 2024. Some smelters in China boosted scrap processing to try to maintain output, amid a tight raw material market. The jump in tin prices in March/April 2024 resulted in a temporary surplus, with the country being a net exporter of refined tin for a few months, but this proved unsustainable and net imports returned by August, rising to 1.5kt by October.

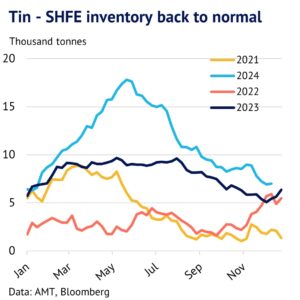

Market tightness in China flagged up by falling inventory and price signals. There are other indicators of tightness. For example, SHFE inventory fell by more than 50% in H2 2024, which supports this idea. Furthermore, the latest data from SMM shows that spot treatment charges fell steady in H2 2024, showing that global miners are not keeping up with Chinese smelter demand further downstream. In summary, tin prices are likely to remain volatile in the year ahead, but we currently forecast that three-month LME prices will rally to US$32,072/t by Q4 2025, as upside risks should dominate.