20 March 2025: LME tin prices have significantly outperformed the rest of the base metals complex so far this year, helped by decent demand conditions and increasing tightness in the concentrate market. The latest challenge for smelters is a worsening conflict in the DRC, which has resulted in Alphamin halting mining, due to the advance of the M23 rebel group. More bearish is that Myanmar is planning to restart mining soon and Indonesia is exporting more than last year. China has also returned to being a net exporter of refined tin at the start of this year. Overall, we expect tin prices to remain high and volatile, but the trend should be upwards into year-end, as fundamentals are likely to remain tight.

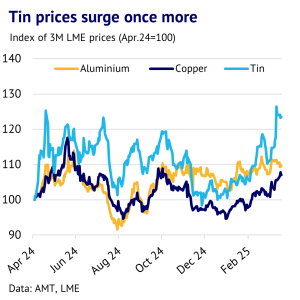

Tin prices outperform the base metals complex. The LME three-month tin price is up 22% so far in 2025 (data to 19 March), making it easily the best performing base metal. A weaker US$ drove this rally, with DXY down 5% in the same period, but tight fundamentals and strong speculative inflows played a key role. According to our COTR analysis, LME net speculation is back to the top of the rolling five-year historical range (week ending 14 March 2025). Furthermore, fresh longs are still coming into the market, which is potentially flagging higher prices in the short-term.

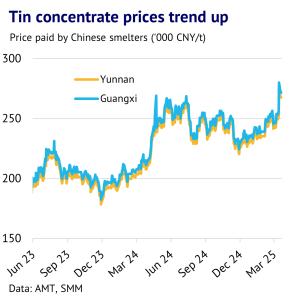

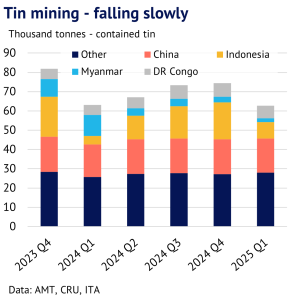

Supply risks are very high as war spreads in the DRC. One of the challenges for tin smelters is that the raw materials market is still very tight – treatment charges are falling and concentrate prices are trending up. Also, the chance of an immediate improvement looks low. Recent weeks have seen the military conflict worsening in the DRC, adding to previous problems with other key mining countries. M23 rebels, who are allegedly supported by Rwanda, have been taking control of key cities in the Congo, escalating a conflict that started back in 2022. This forced Alphamin Resources to suspend production at its Bisie tin mine in North Kivu this month. While there have been some attempts to create a peace deal, the rebels have been reluctant to engage, which suggests that the conflict may rumble on for some time. The ITA is currently pencilling in a three month halt at Alphamin. The company produces around 70% of mine output in the country and the DRC produced 10% of the global total last year.

Myanmar plans to restart mining soon, but ramp up will take a while. At least there is now slightly more clarity on Myanmar. In late February, the Wa State mining authority said it plans to resume production at its key Man Maw mine soon, boosting concentrate shipments to Chinese smelters. According to the ITA, it will take at least 2-3 months to get workers back and ramp back up towards full capacity. Also, it is worth remembering that the country is in the middle of a civil war, after a coup in 2021, meaning that the risk of further delay is high. Mining was originally suspended back in August 2023, to minimize environmental damage from artisanal workers and to move towards a more organised, professional approach to extraction. The Wa suspension was supposed to be short-lived, but has now dragged on for over 18 months. Wa State previously supplied one-third of China’s concentrate requirements, with smelters in the country normally producing 48% of global refined tin.

Indonesian exports are on an upward track. One part of the world where there has been a definite improvement in supply already has been Indonesia. In January 2024, Indonesian refined tin exports plunged to just 0.4t, as traders were not able to get export licences, ahead of the Indonesian election. This compared to average monthly exports of 6.2kt in the previous two years. This year there has been a steady build and exports reached an estimated 4.8kt in February 2025 (based on exchange volumes) and figures for early March suggest another high figure, around 4kt. Exports could therefore be around 10kt in Q1 2025, up from just 4kt in Q1 2024. Indonesia is the world’s second-largest producer of refined tin (after China), with a global market share of 19%.

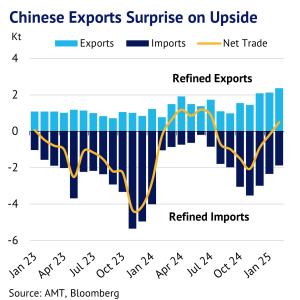

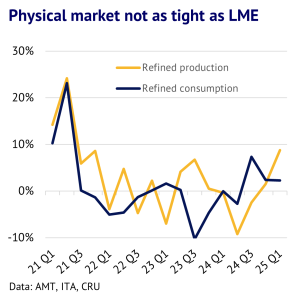

China also looks softer, as net exports return. There are also some bearish dynamics developing within China, as the country has flipped back into being a net exporter of refined tin. As we show in our chart, net imports peaked at 1.2kt in June last year, but net exports returned in February this year at 0.5kt. In theory the country has been struggling due to a lack of concentrate imports. However, production appears to be outpacing consumption for the time being. One reason for this is that China has lifted the amount of secondary tin in its mix. There are also some industry traders speculating that shipments of Myanmar concentrate may still be getting into the country, despite the official mining ban.

Tin demand is expected to grow more than supply this year. Global tin demand is expected to grow reasonably well this year, helped by strength in electronics and electrical products in both China and the rest of the world. The boom in electric vehicles and solar PV continues despite the US boosting import tariffs. Furthermore, extra stimulus measures in China are finally starting to have some impact on the property market, and weekly data for house sales are showing a moderate upturn relative to 2024. However, the biggest problem in China is that the overhang of unsold inventory is still massive, at around 5 years of sales. This means that housing starts (more important for tin demand) are still very depressed.

In conclusion, the ITA is expecting global tin demand to increase by 1.7% this year, slightly faster than the 1.2% increase expected for global supply. This looks like a moderately bullish environment for the physical market, but speculators have come into the market in anticipation of this. The outlook is clearly very dependent on what happens with the DRC and Myanmar, where conflict is creating a volatile, unpredictable environment. Overall, we expect three-month LME prices to remain high and volatile in the months ahead, but the trend should be upwards into year-end, with an average of US$36,610/t predicted in Q4 2025.