9 February 2024: LME tin prices have outperformed the rest of the base metals complex in the past month, with fundamentals starting to tighten. Demand is improving, helped by an upswing in the global technology cycle. Even in China, electrical/electronic products are benefitting from government stimulus focussed on tin-related sectors, with limited exposure to the troubled property market. Meanwhile, supply is being challenged in both China and Indonesia, which together produce 67% of the global refined metal total. We expect prices to be volatile, but trend higher in the year ahead, reaching US$27,730/t by Q1 2025.

Tin rallies, despite negative sentiment about China. LME three-month tin prices increased by 5% m/m (data to 8 February), making it the best performing base metal during this period. We believe that this reflects tin’s heavy exposure to the green energy transition and technology sector, but also supply threats from several key countries. Fundamentals are likely to tighten in the year ahead, which will help prices to push higher by Q1 2025.

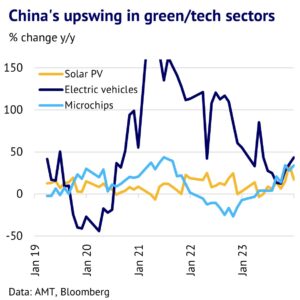

Demand boosted by upswing in green energy and semiconductors. While the Chinese economy is currently suffering from a lack of confidence, the government is pumping money into sectors which it sees as important from a strategic perspective. This includes green sources of energy (particularly solar and wind power) and electric vehicles. This means that tin is in a unique position among the base metals of having limited direct exposure to the property market in China, but high exposure to fast growing technology-related sectors. Solar PV is particularly important for tin, in addition to solders used in electronics and electrical devices. We show in our chart that China finished 2023 on a robust footing, which bodes well for the immediate demand outlook. Output of microchips increased by 34% y/y in December, while electric vehicles grew 44% y/y and solar PV grew 17% y/y. The global picture is also improving, with the semiconductor sector swinging from a sharp downturn in 2023 into recovery in late 2023 and early 2024. In December 2023, global sales increased by 12% y/y, its fastest growth rate since June 2022.

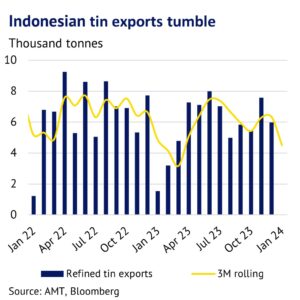

Indonesian exports tumble in January. On the supply side, tin also looks challenged. In January, Indonesian refined tin exports plunged to just 0.4t, a 99% y/y drop. The main problem is that traders have not been able to get licences to export metal ahead of the Indonesian election on 14 February. The government has been looking closely at mining in the country and has been pressurising companies to build smelters and move further downstream. This has worked for copper and nickel, but looks impractical for tin because it is used in small amounts in many industries, who do not want to relocate to the country.

Tin is however being impacted by a plan to change from a 1-year export licence system to a 3-year one. This change is problematic and is expected to delay the issuing of export licences this year, which is creating significant uncertainty for the industry. We expect exports to resume soon, but the exact timing is still unclear. Indonesia is the world’s second-largest producer of refined tin, with a global share of 19%.

Myanmar turmoil is impacting Chinese supply, adding to global risks. Furthermore, Myanmar’s Wa State still has a mining ban in place, which is restricting concentrate shipments to Chinese smelters. Mining was originally suspended back in August 2023, to minimize environmental damage from artisanal workers and move towards a more organised, professional approach to extraction. The Wa suspension was supposed to be short-lived, but there is no sign yet of an imminent restart. Stockpiled material has been leaving Myanmar, although traders report that this is now close to exhaustion and shipments cannot continue without mining. Wa State previously supplied one-third of China’s concentrate requirements, with smelters there normally producing 48% of global refined tin.

Shortages meant that Chinese imports of tin reached a substantial 10.3kt in the last two months of 2023. At the start of this year, SHFE tin prices remain at a premium to the LME of more than US$500/t, which points to further strong imports. Tightness is also flagged up by falling spot treatment charges for delivery to Yunnan, China in January/early February.

Exchange inventory levels are comfortable, which should provide a safety valve. In terms of the market balance, the first quarter is likely to see the market switch into deficit (production normally falls in Q1 for seasonal reasons, while demand is normally steadier). However, exchange stocks are up 1.2kt so far this year (data to 8 February), which points to supply outpacing demand (or a willingness for traders to lend metal to the market). Total exchange stocks are now 14 days of global consumption, which is high compared to recent history. Given this backdrop, speculators have started to reduce net positions on the LME by liquidating long positions. The challenge for tin bears is that a large part of the supply chain is still under threat due to a fragile political backdrop and technology demand is recovering. This is likely to add to market volatility in the months ahead, as supply struggles to keep up with demand.