What is the Outlook for Nickel Prices?

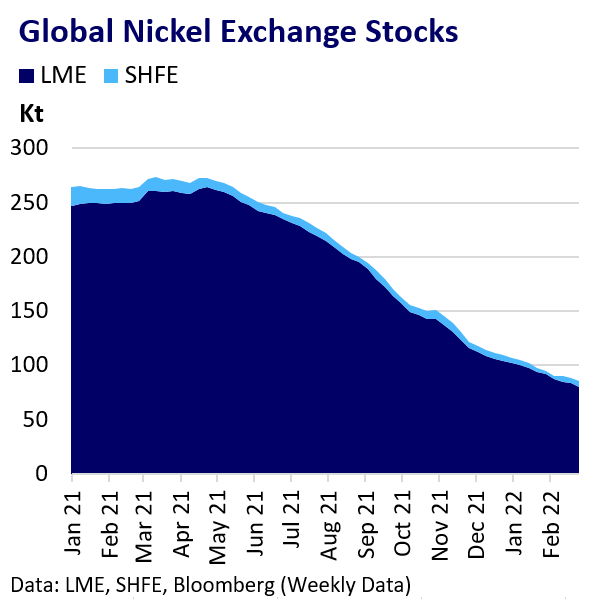

Nickel prices have had a roaring start to 2022. An extended drawdown of visible inventories reflects acute global physical market tightness, particularly for Class 1 refined nickel. The market is struggling to satisfy demand from the burgeoning electric vehicle battery sector and improving expectations for stainless steel demand growth in China. Acute supply risks due to Russia’s invasion of Ukraine have supercharged nickel’s ferocious rally.

Price Recap

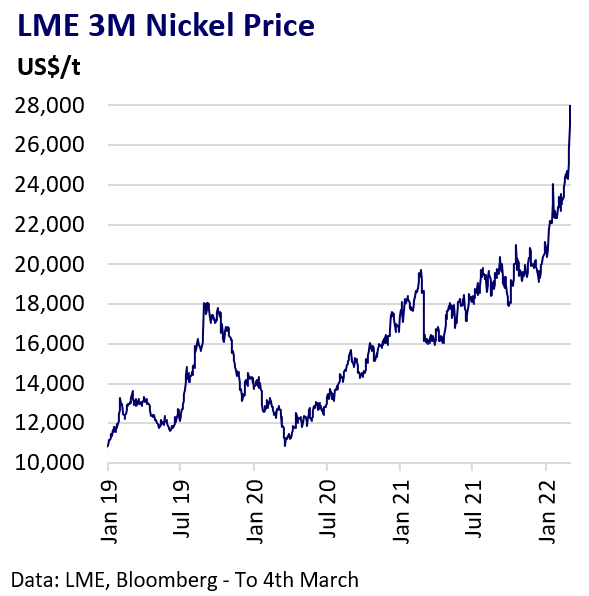

LME nickel prices have risen ~40% so far this year to an 11-year high beyond $29,000. Supply risks from the war in Ukraine drove the most recent surge. The market is up by over 160% from lows at the onset of the Covid-19 pandemic.

Physical premiums have soared globally, particularly for nickel briquettes, amid growing demand from the battery industry and supply risks.

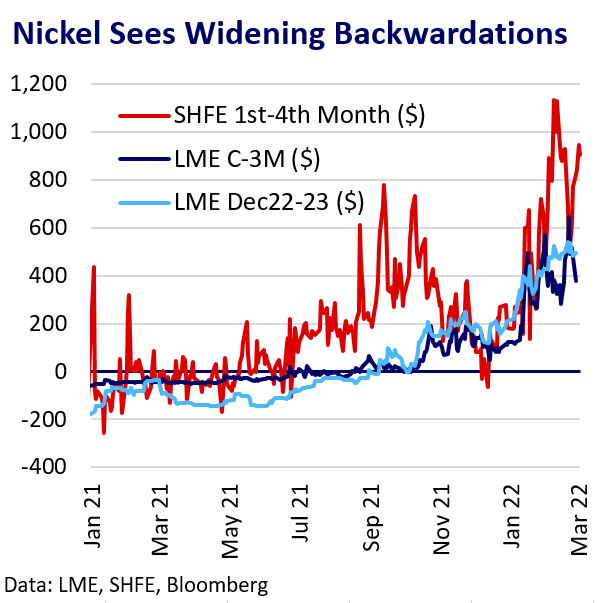

Both SHFE and LME nickel markets show backwardations at multi-year extremes. Spreads on both exchanges continue to tighten as LME inventories dwindle and SHFE stocks stay broadly depleted.

Demand Drivers

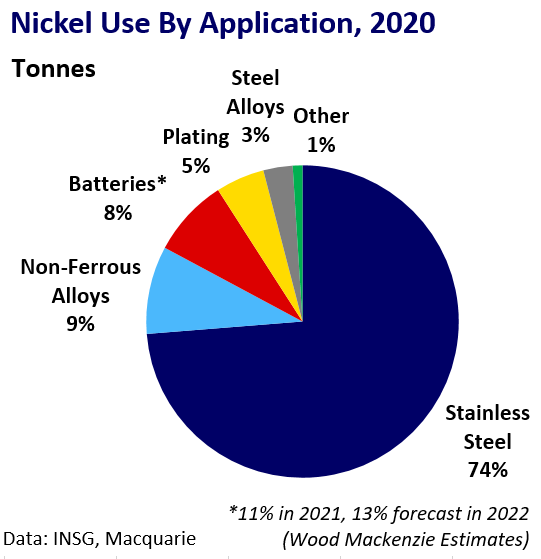

Nickel consumption rose ~16% in 2021 (INSG). The stainless steel sector still dominates global nickel use, representing over 70% of direct consumption. Nornickel estimates global 300-series stainless steel output rose 9% y/y in 2021, driven by China and Indonesia.

China stainless steel demand waned in H2 2021 due to the domestic property sector slowdown. However, vows of greater policy support for China’s economy in 2022 has reinvigorated stainless steel demand prospects.

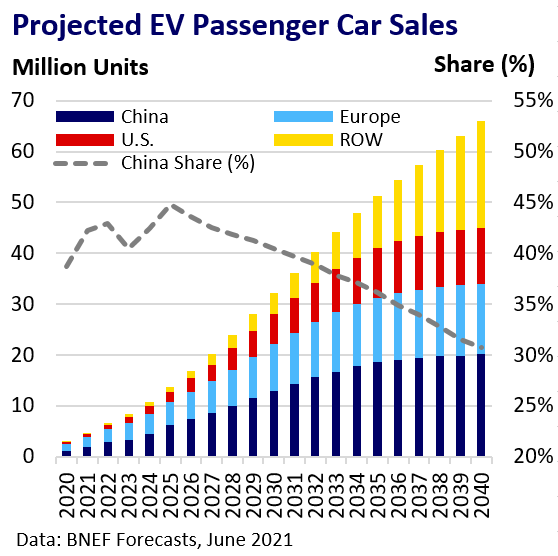

Double-digit growth in consumption by the flourishing EV battery sector underpins long-term nickel demand optimism. Battery makers and car producers are already scrambling to secure offtake agreements as the EV transition accelerates.

Wood Mackenzie estimates batteries represented 11% of global nickel demand in 2021 and forecast this will rise to 13% this year. We expect weaker, but robust overall nickel demand growth in 2022.

Supply Pressures

Production growth failed to match rising consumption in 2021. While Indonesian NPI capacity continued to rise strongly, supply disruptions predominantly hit Class-1 nickel supply including operations in Russia and Canada. Strong NPI output growth in Indonesia versus lagging Class-1 nickel supply will remain a key theme in 2022.

Western sanctions on Russia for its invasion of Ukraine have not targeted Russian nickel exports, but broader financial sanctions are likely to disrupt trade. Notably, Russia accounts for ~17% of global Class-1 refined nickel output.

The most likely salvation to refined nickel shortages is the expansion of nickel matte and ferronickel production in Indonesia. This faces technical challenges and may not provide meaningful relief until H2 2022 or beyond.

Resource nationalism is a supply risk. Indonesia has demonstrated a willingness to use disruptive policy to conserve domestic nickel resources and encourage downstream investment.

Market Balance

Industry experts estimated the nickel market deficit at between 100 and 200 kt in 2021. The broad consensus is for a modest surplus of around 50 kt in 2022 with a deficit in H1.

Russian supply risks or stronger stainless steel and battery demand could see this revised lower.

The H2 2022 surplus is also likely be concentrated in the low-grade NPI segment of the market rather than Class-1 nickel, where supply and demand pressures are the greatest.

Financial Drivers

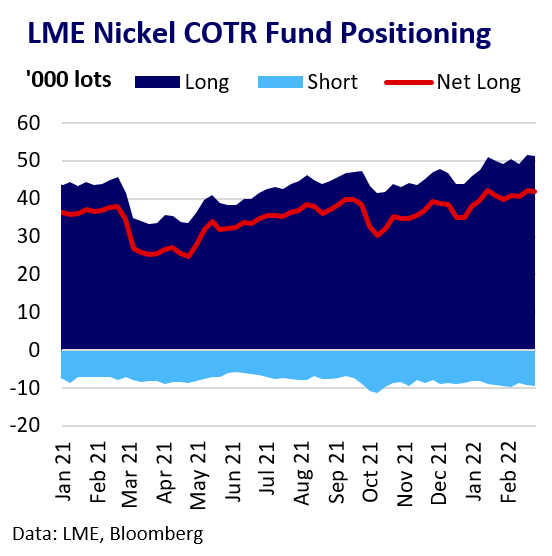

Investors remain highly bullish of nickel. LME COTR data suggest fund long positioning at the largest on record (Since 2019).

Macro-investor demand for metals as a portfolio hedge against rising inflation expectations is also a tailwind. The war in Ukraine will only add to global inflationary pressures as commodity prices surge.

Nickel’s long-term battery demand narrative is also fashionable for investors seeking exposure to the green energy transition. The current rate hike cycle is in its infancy, but as rates rise so will global recession risks.

Outlook

The developing situation in Ukraine will dictate price direction and drive significant volatility in the short term. Even if supply from Russia is undisrupted, all fundamental indicators point to further strength in prices, premiums and spreads in the coming months. 2011’s high of $29,425 is a key target, but the sky is the limit considering growing vulnerability to scarcity pricing.