what does this mean for consumers?

Pressure from society, industrial consumers and governments to cut CO2 emissions from aluminium production is imposing costs on producers. Whether this cost is absorbed by governments or passed on to industrial consumers through higher premiums or underlying aluminium prices is subject to significant policy uncertainty.

Background

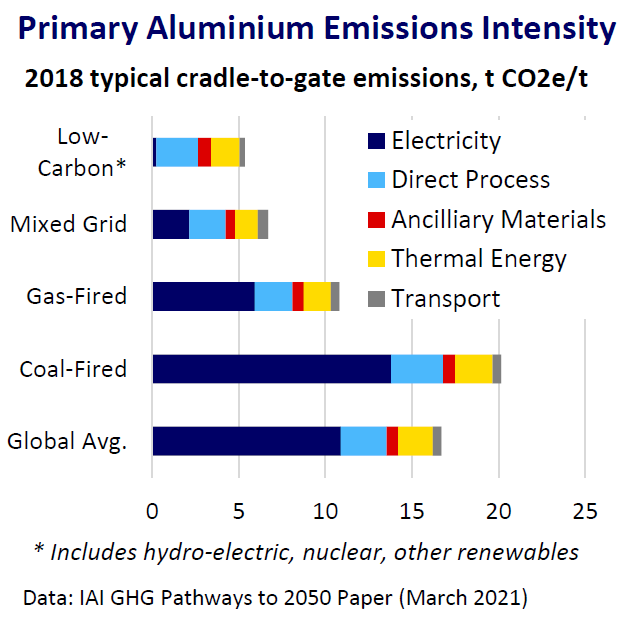

The global aluminium industry emits 1.1 bn tonnes of CO2 annually, ~2% of man-made emissions (WEF). Growing policy pressure from China, Europe and the US since 2020 is a catalyst for a significant industry response to this issue. China has committed to reaching peak emissions by 2030. Europe’s “Green Deal” sees net-zero by 2050 and threatens a carbon border tax. The US is adopting a greener policy direction after the election of Joe Biden. Major aluminium-consuming industries such as the auto sector are also under social pressure to ensure responsible sourcing of metal.

Producer Response

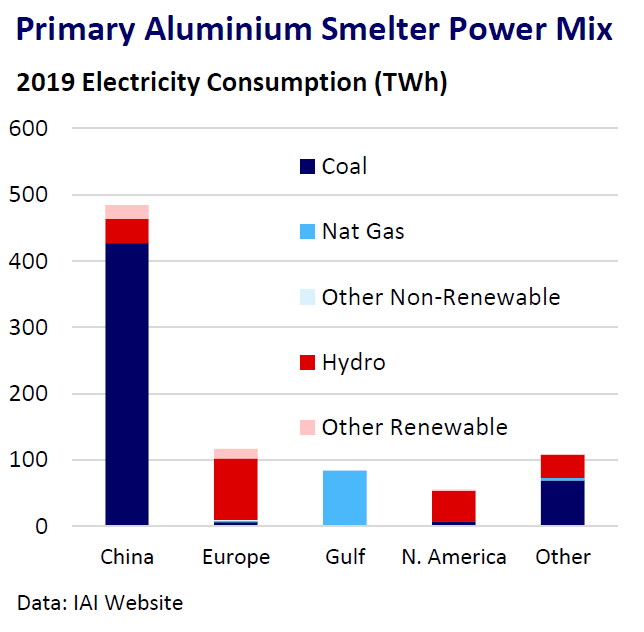

Primary aluminium producers have responded to the demand for low-carbon metal, with a particular focus on more renewable electricity sources for electrolysis, the main source of emissions. China is pushing its industry hard to move away from coal, which lags behind other world regions in transitioning its power mix. However, these global changes represent an additional cost to producers, who are looking to pass this on to consumers.

Challenges

The market for low-carbon aluminium is in its infancy. Producers have struggled to secure upcharges for low-carbon metal and are largely using low-carbon aluminium as a sweetener and marketing tool to grow market share. Low-carbon primary aluminium differentials from pricing providers including Platts, Fastmarkets and Harbor have so far remained near-level, although deals have been reported for low-carbon foundry alloy of up to €50/t. Some industrial consumers argue that they expect their suppliers to provide environmentally sustainable metal and shouldn’t have to pay more for the privilege. A lack of consistency and clarity in determining low-carbon emission thresholds and calculation methodologies is also a barrier to low-carbon market growth; i.e. at what point does the metal become low-carbon?

Policy Uncertainty

There is also huge uncertainty about the tools governments will use to drive change and where in the supply chain these actions will fall hardest. Government policy could target upstream supply-chain through subsidies for producing low-carbon metal, increased costs for high-emission electricity sources and carbon border tariffs. Regulation could also threaten high-emission producers’ license to operate. Such actions could impact the underlying aluminium price, whilst diminishing the need for a specific market incentive in the form of a low-carbon premium.

Conclusion

Unless absorbed by governments through subsidies, the growing requirement on producers to reduce carbon emissions will add to costs which will ultimately be passed on to industrial consumers. The uncertainty is exactly where consumers will pay more. This could be through the growing adoption of low-carbon premiums, as a component of existing premiums for preferred lower-carbon aluminium brands or partially reflected in the underlying exchange-traded price. This will depend on the growth and maturity of the low-carbon market and the net impact of government policy intervention and societal pressure to drive the change desired.