Surging Energy Prices Hit European Zinc Output

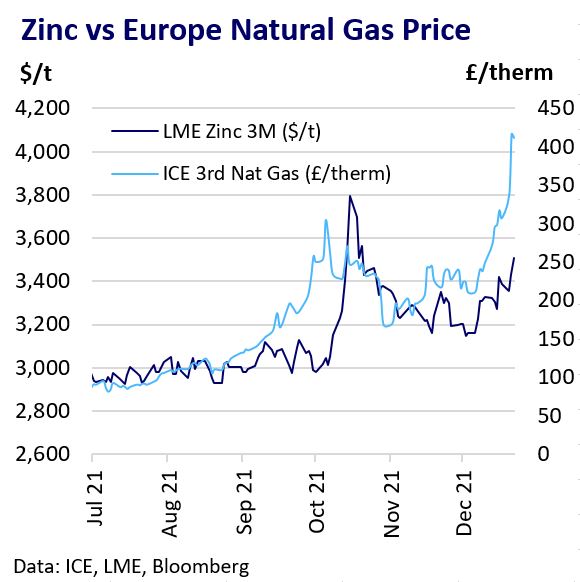

The spiralling cost of energy and emissions allowances in Europe continues to undermine the economics of Europe’s zinc production. Capacity reductions and smelter closures will exacerbate acute zinc supply pressures in Europe, where visible inventory is at critical lows. This should continue to underpin the LME zinc price, spreads and regional physical premiums in Q1 2022. The zinc market will remain highly sensitive to power cost volatility.

European Power Costs Soar Higher

Europe is seeing a combination of strong power demand, constrained supply and depleted natural gas inventories. As a result, European electricity and natural gas prices hit record highs in December.

Colder temperatures and increased home working due to the Omicron variant have buoyed demand for heating.

The supply of power is under pressure; EDF announced outages at two nuclear reactors in France and extended shutdowns at two others.

Geopolitical tensions with Russia over Ukraine also threatens natural gas shipments from Russia to Europe. Germany has delayed the approval of the Nord Stream 2 gas pipeline. Large expected shipments of Russian gas have not materialised and flows through a key route fell to zero early on 21st December.

Other power-related costs are also soaring; the price of EU carbon emission permits hit a record €90.75 (~$103) per tonne in early December, more than doubling since the start of 2021.

Smelters Cut Output on High Costs

Higher energy and emissions costs are hitting Europe’s zinc smelter output. Even if zinc producers are not making a loss, there is an incentive to cut output and sell power hedges back to the market.

On 16th December, Nyrstar said it would put its 172 kt Auby plant in France into care and maintenance from January. The company blamed high power prices and carbon-emission costs. It will keep running its Budel and Balen plants at reduced capacity. In late November, Glencore announced plans to halt its 100 kt Portovesme smelter.

These announcements follow those made in October; Nyrstar said it would cut production from three European smelters by up to 50%. Glencore also said it was mulling curbs at its European operations.

Market Strengthens on Tight Supply

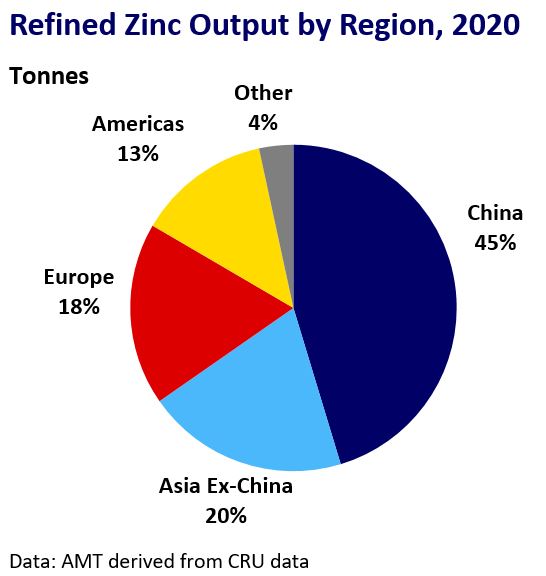

LME zinc prices rose in early December as the latest announced output cuts threaten to exacerbate existing supply scarcity. Europe is both a significant producer and consumer of zinc.

Critically low zinc inventories in Europe mean there is limited capacity to absorb a significant deficit in supply.

There are fears that sustained high power prices could lead to further cuts. However, macro-fears such as Omicron, stalling China growth, and Fed policy have restrained the rally higher.

China Supply Recovering

While Europe’s energy crisis worsens, China’s zinc output surged to a 2021-high of 570 kt in November. Domestic smelters ramped up production as domestic power curbs gradually eased, although anti-pollution measures weighed on output gains.

A less tight Chinese market has created export arbitrage opportunities. This could provide relief to the ex-China market and see deliveries into LME warehouses in Asia. However, 60 kt of LME inflows in early December had no lasting market impact.

It is unlikely China exports will significantly relieve the zinc-starved European market until global shipping disruption eases. This is unlikely to occur to any significant degree over the next few months.

Outlook

In October, the ILZSG projected a 44 kt global market surplus in 2022. The balance may ultimately be tighter than this as European production cuts through the winter months of January and February result in deeper deficits in early 2022.

Citibank analysts see a global zinc market deficit of 170 kt in Q1 2022. Zinc prices should therefore see sustained fundamental support in Q1, although macro-risks remain elevated.

Physical conditions could ease over the remainder of 2022 as power issues subside, shipping disruption eases and zinc production pick up. This scenario could see surpluses re-emerge and prices ease later in the year.