18 June 2024: Base metal prices rallied in the first half of this year, but we believe that the rally is overdone, given the state of fundamentals, where investors are positioned and seasonality charts. Chinese demand was strong in Q1, but weakened into Q2. In many cases this fed through into higher domestic inventory levels or reduced imports/increased exports or both. Extra tariffs on China are also likely to negatively impact demand for base metals in H2 2024. In the third quarter of this year, we expect base metal prices to fall back, although the weakness should be short-lived. We see aluminium and tin being underperformers in Q3, and lead and zinc being outperformers over the next six months. Copper prices are likely to pull back in the months ahead, although the downside should be limited, given supply tightness and broader investor interest in commodities and copper especially.

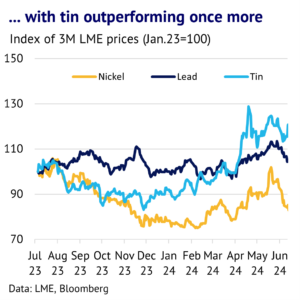

Base metal prices rally in the first half of 2024. The first part of this year saw all the LME base metals rallying, with copper and tin leading the way higher, with increases of 13% and 27%, respectively. The rallies in aluminium, lead, nickel and zinc were modest, at around 5-6% (data to 17 June). Fears about a debt crisis in China faded and sentiment in the OECD countries was boosted by falling CPI inflation and accelerating economic growth. The global composite PMI reached 53.7 in May 2024, up from 51.8 in January, with a significant improvement being seen in both services and manufacturing.

Chinese demand looked solid in Q1 2024, but Q2 looks softer. One surprise this year initially came from China, where base metals demand grew, despite problems in the housing/property market. According to CRU figures, in the first quarter of this year, demand for aluminium in the country grew 6% y/y, while copper and zinc grew 1%, while tin jumped by 10%. April also looked strong with sectors related to the green energy transition booming. Sales of electric vehicles, for example, grew by 34% y/y in May and solar PV sales were up 29% y/y in the same month. However, demand in late May and early June looked notably softer, suggesting the that Chinese demand growth is cooling, as it heads into the summer.

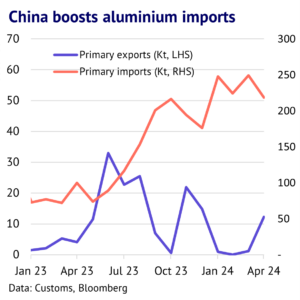

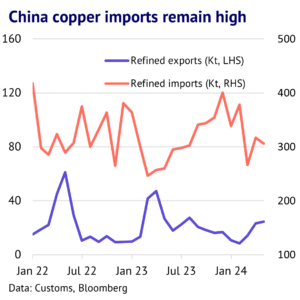

China has been building inventory or exporting more, which suggests that bullish sentiment is overdone. One bearish factor is that while imports by China have continued at a high level (for aluminium, copper and zinc), a lot of metal is being stockpiled and anecdotal evidence is building that demand slowed recently. In the case of tin, China switched from being a net importer for most of the past year, to being a net exporter by March and April. The country has also boosted its exports of refined nickel, in response to rapid growth in domestic output.

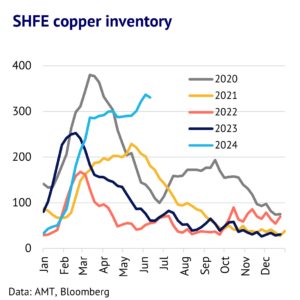

SHFE stocks build, when they should be falling. SHFE stock building of copper has been a very visible sign that the country has too much metal. As we show in our chart, the period from April to June normally sees a falls in inventory for seasonal reasons (with demand normally outpacing supply). However, this year has been unusual, and stocks rose to reach 337kt in early June, up from 76kt a year earlier. This is also consistent with a downturn in demand. According to CRU figures, utilisation rates at copper wirerod plants fell to just 49% at the end of May, as fabricators reacted to high prices, but also lacklustre downstream demand.

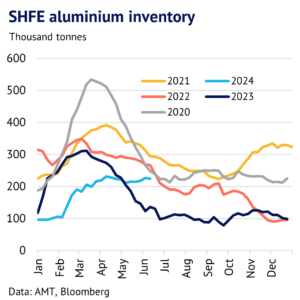

Aluminium demand also looks soft in Q2, although SHFE stocks are still low. Chinese fundamentals for aluminium look rather tighter than for copper (based on SHFE and social inventory trends), although even here Chinese demand is looking below par. While rolling mills have been operating at normal levels in recent weeks, extruders only saw a modest seasonal upturn in April and May, reflecting headwinds in the housing/property market. Over the past 5 years, April saw an average 8% m/m rise in utilisation rates at extrusion plants, but this year they fell by 5% for the month and then rates remained subdued into May. According to CRU, aluminium demand weakness was seen in sectors such as air conditioning, automotive and construction.

Base metals demand hits an early summer lull. We are assuming that Chinese base metals demand is in a temporary lull, partly due to the early Dragon Boat festival, although it seems clear that the boom in demand in Q1 has started to fade. This is disappointing for market bulls, particularly given the backdrop of significant government stimulus measures that were implemented in late 2023 and early 2024.

Higher tariffs will make it more difficult for China to grow. The Chinese economy also received a boost in May from strong exports, reflecting a recovery in global economic activity. However, the export environment looks set to get tougher in the second half of this year, as Europe starts to implement new tariffs on sectors that are important for base metals, such as electric vehicles (EVs) and solar PV. In mid-June, the European Commission said it would impose tariffs of up to 38% on imported Chinese EVs from July. Meanwhile, the US is lifting its EV duties from 25% to 100% and also doubling its tax on solar panels from 25% to 50%.

Investors start to cut speculative positions, but they still look overextended. Looking at LME speculative positions, investors were betting heavily on a rally in prices until mid-May, but since then bullish sentiment has started to fade. Our analysis shows that for copper, net longs rose by 9k contracts in the week ending 17 May, but since then long liquidation has reduced them from 84k to 66k by the week ending 7 June. The problem is that net longs are still at 81% of the five-year rolling high, which suggests plenty of downside should China continue on the bumpy path seen in recent weeks. Our most recent LME COTR analysis is on our website here: AMT LME COTR report. Most of the other base metals have tended to track copper lower, with aluminium also seeing long liquidation in the most recent week.

Base metal prices often peak in late Q1 and early Q2 and then head lower. It is also worth noting that seasonality trends are now looking bearish for most of the base metals (based on trends from the past 14 years). Copper, for example, normally peaks in week nine of the year and then hits a low around week forty of the year. Aluminium normally peaks around week fourteen of the year and then hits a low around week twenty-six of the year. We are currently in week twenty-four of the year, implying continued headwinds from a seasonal perspective.

We expect base metal prices to trend lower heading in Q3, but the weakness should be short-lived. In terms of our price forecast, we consider seasonality, the outlook for fundamentals and market sentiment and also whether we believe that markets are correctly pricing in all these factors. In the short-term we expect base metal prices to decline across the complex, resulting in an average for Q3 being below Q2 in all cases. This reflects lacklustre demand conditions in China. We also assume investors continued to par back bullish positions from current elevated levels.

Aluminium and tin have held up relatively well in the past month, but we expect them to lead the way lower in the months ahead. Lead and zinc are expected to outperform in Q3, with the raw materials market looking tight in both cases. Chinese trade flows are likely to be supportive for these two base metals; some early indication of this comes from the trend in the SHFE arbitrage relative to the LME, which has switched negative to positive by mid-June.

However, we do not expect the weakness in the base metals to last very long. By Q1 2025, we predict that prices will be higher across the complex. Lead and zinc are expected to outperform the rest of the complex, as the Chinese market is likely to remain tighter. Copper and tin are both predicted to rally by early next year. Aluminium prices currently look close to fair-value, although we also see some modest upside by the start of 2025.