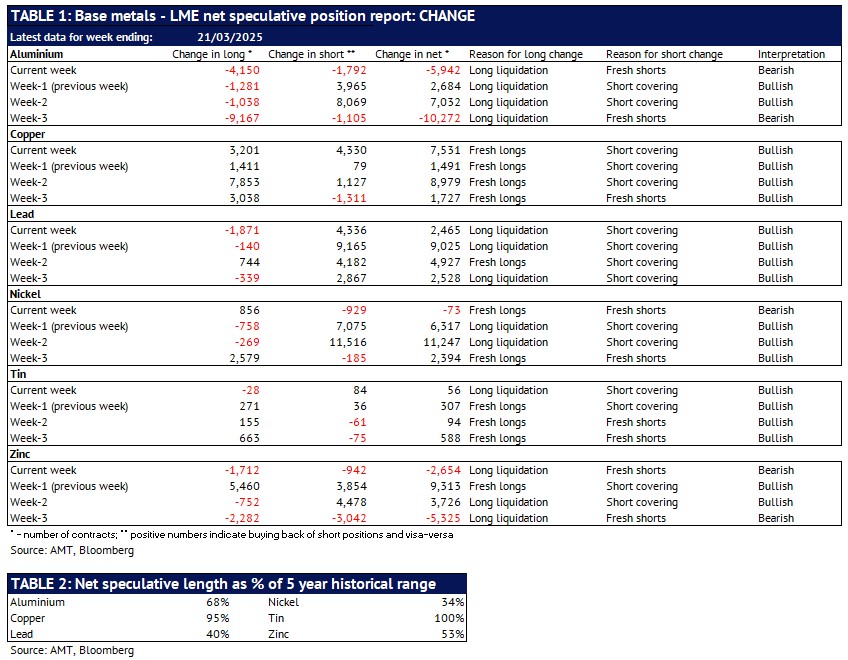

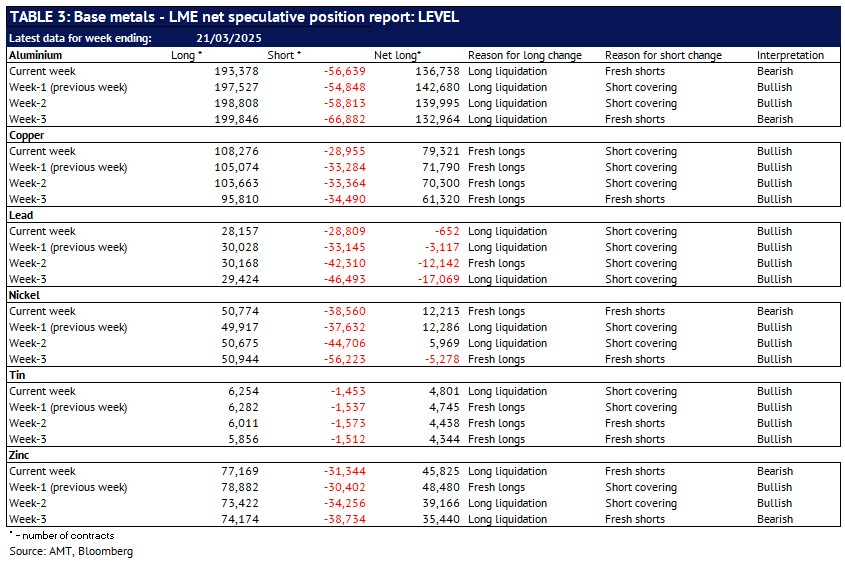

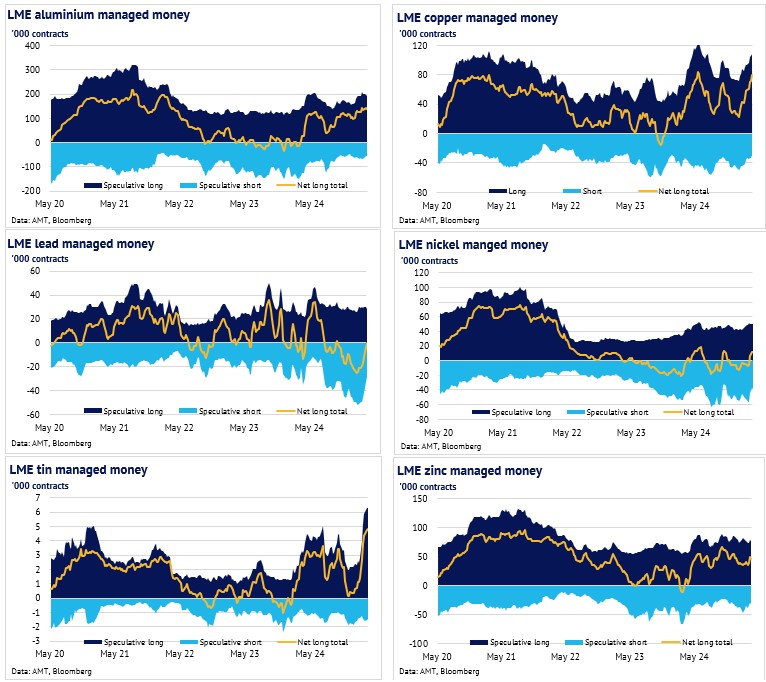

25 March 2025: Data on LME COTR speculative positions (for the week ending 21 March) were released this afternoon. Trends were mixed, with the net position increasing for copper, lead and tin, but falling for aluminium, nickel and zinc.

The data also show that copper and tin looked overbought at more than 95% of the historical five-year range (see Table 2). By contrast, nickel looked slightly oversold, with a position in the bottom 34% of the range, showing limited scope for further speculative selling.

We use the trend in the categories “Investment Funds” and “Other Financial Institutions” combined for this report, because this total has a close correlation with LME price trends. The report is here: https://amt.co.uk/amt-insight-lme-cotr-follow-the-money/.