Base metal prices have rallied in recent weeks and copper prices have jumped, despite the backdrop of weakness in global manufacturing and continued lockdowns in China. Investor sentiment is still depressed compared to recent history, but is tentatively moving higher on hopes that we may be close to a turning point in the economic cycle. Copper’s fundamentals look very tight, with supply disruptions keeping the market in deficit. We still see upside price risks for copper and the base metals in the year ahead.

Base metals rally despite ongoing recession fears. The past month saw a significant rally across the base metals complex, despite significant macroeconomic headwinds. Copper and nickel led the way higher and were up 11% and 16% respectively m/m, while aluminium increased 7% m/m (11 November). Lead, tin and zinc prices were also boosted.

Macroeconomic drivers still look weak. At first glance, this recent rally looks difficult to justify from a macroeconomic perspective. While global equity markets are turning up and the USD is weakening – both supportive factors for industrial metals – there seems to be plenty of reasons for bearish sentiment to persist. For example, the latest figures for the global manufacturing PMI showed a drop to 49.8 in September and 49.4 in October; its lowest level in 28 months.

Moreover, forward looking indicators such as new-orders-to-inventory ratio are at a very low level, consistent with a weak Q4 2022 and Q1 2023. China has also reiterated that it is determined to stick with its zero-Covid policy, which is keeping activity depressed, amid virus outbreaks are taking place in key places such as Beijing, Guangzhou and Guangdong province. This has all encouraged the bears.

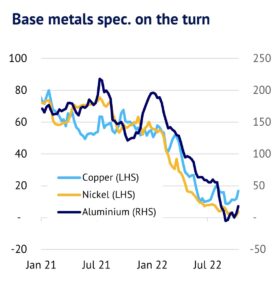

Speculators sense that the floor is close. However, a factor that has changed recently is that investors have slowly started to turn more bullish on copper and the base metals. Looking at LME net speculative positions, aluminium has moved from a net short of 5k contracts in late September, to a net long of 18k contracts in early November. Similarly, copper net longs have built from 9k to 17k in the same period.

Furthermore, there is plenty of potential for further increases in the months ahead. Looking at the historical range for speculative positions, the glass is just 17% full for aluminium and 26% full for copper. Bullishness might seem odd given the macroeconomic backdrop, but it is worth noting that base metal prices normally turn up ahead of the economic cycle, consistent with the idea that it is wise to look ahead in a period of depressed activity. We show this in our chart below.

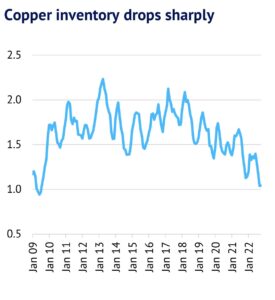

Copper fundamentals look tight and inventory levels are super low. One surprising development is that copper’s fundamentals have remain very tight through the recent economic slowdown, as we highlighted in our recent research piece: Copper Falls – Setback or Existential Crisis (September 28, 2022). Indeed, visible inventory levels have been trending sharply lower through most of this year, which is a worrying sign for consumers, as we expect an economic upturn soon.

According to CRU, global stocks of refined copper (including exchanges, producers and consumers) are down by 25% since February 2022 and at just 1.09Mt they are at their lowest level since July 2009. Rising interest rates and nearby backwardations this year are also likely to have discouraged cash-and-carry financing deals, suggesting that invisible inventory levels will also have fallen.

Copper supply and demand trends look supportive. The latest fundamental data from CRU indicate that both supply and demand are trending up, with growth of 3.5% in Q4 and the market in deficit of 252kt. Moreover, this deficit has increased compared to 211kt in Q4 2021. Demand is being supported by the green energy transition, including more electric vehicles (EV) and the rollout of solar and wind power.

Meanwhile, supply challenges for copper have been very significant this year. In a normal year 5% of potential supply is lost due to disruptions (strikes, social unrest, operational issues and other random factors), but this year has seen an abnormally high level of losses, meaning that around 6% of potential supply has not been delivered (equivalent to 1.5Mt of copper). Chile has suffered particularly badly, with output down 10% y/y in August to a six-month low. Limited supply growth has swung the market from a potential surplus into a deficit.

The other base metals are being boosted by decent demand and high energy prices. While the other base metals are following a slightly different path to copper in terms of fundamentals, there are also reasons to believe that prices will trend higher in the year ahead. Strong growth in the EV sector is helping to lift markets like aluminium and nickel. Also, very high energy prices mean that the cost floor has been raised and the downside for prices is limited. A clear sign of this is that smelters have been closing due to high electricity prices in places like Europe. Demand will also recover soon in China, as the country starts to ease Covid-restrictions.

Base metals to trend higher in year ahead. Overall, for the base metals we still expect upside price risks to dominate in the year ahead. Speculators have moved early in anticipation of an economic upswing in H1 2023 and it remains to be seen whether the recent upward trend in net speculative positions can be maintained. While betting on a recovery might seem optimistic, with Europe currently teetering on the brink of a recession, it is often said that fortune favours the brave.