Why is there a shortage?

In early March nickel prices retreated by ~20% from February highs. The sharp move came after China steel giant and top nickel producer Tsingshan announced plans to produce a precursor to battery-grade nickel from nickel pig iron (NPI). This dampened investor expectations for a future shortage of Class 1 nickel from strong forecast growth in electric vehicle (EV) battery demand. However, meeting the environmental requirements of consumers and alleviating substitution pressures remain key challenges for nickel suppliers in the coming years.

Battery Demand Optimism

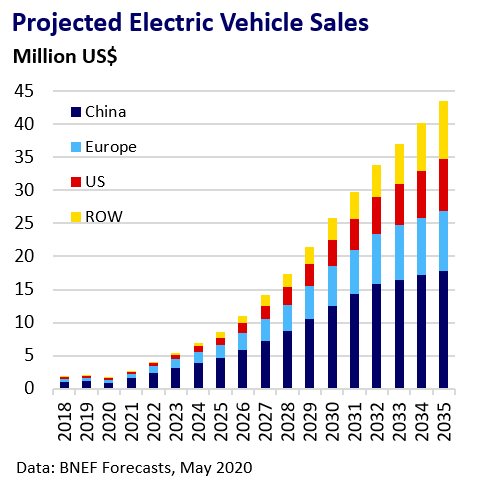

In the wake of Covid-19, policymakers in Europe, China and the US, have more forcefully adopted a decarbonisation agenda, spurred by a desire to stimulate post-pandemic economic recoveries through “green” investment. The EV sector will be a key beneficiary, with governments looking to phase out combustion vehicles and invest in EV infrastructure. CRU estimates nickel consumption could double by 2030 (~2.5 Mt in 2020) due to EV battery demand growth. The market needs additional supply to meet this; Macquarie says battery-grade nickel production will need to grow by 1 Mt over the next decade.

Tsingshan Moves to Fill Supply Gap

Tsingshan, the world’s largest nickel producer, is responding to the expected supply gap. The company announced plans to supply nickel matte from its Indonesian NPI operations to two China battery companies by the end of 2021 and revised output projections by 75 kt to 850 kt in 2022 and by 300 kt to 1.1 Mt in 2023. SMM estimates it will cost at least $14,000 to produce nickel sulphate via Tsingshan’s route, not accounting for the capital cost of required downstream converter plants. An efficient process to produce battery-grade metal from NPI, traditionally used for steelmaking, will limit reliance on a future wave of HPAL nickel projects to meet battery-grade nickel demand and limit any potential bifurcation between more abundant NPI and Class 1 metal.

Tsingshan Faces ESG Hurdles

Sceptics of Tsingshan’s announcement fear that the technology for producing NPI from nickel matte is untested and the company’s timeline for ramping up output is too ambitious. Detractors also cite that producing battery-grade nickel from NPI is four times more carbon-intensive than the HPAL method, with Indonesian NPI operations largely reliant on coal-fired power. Initially, Tsingshan will focus on supplying China. It may struggle to meet expectations from western consumers such as Tesla for “environmentally sound” sources of nickel in the short-term. Tsingshan plans to alleviate concerns by investing in 2 GW of renewable energy facilities to achieve net-zero emissions from its Indonesian operations, but this could take years.

Battery Substitution Threat

Varying consumer requirements and a host of promising technologies leave the door open to a variety of prospective battery chemistries, particularly post-2030 when the industry could move beyond lithium-based batteries. Environmental issues and supply-constraints for specific metals will drive industry substitution pressures. This was made evident recently by Elon Musk, who stated Tesla were shifting to LIP (Lithium-Iron-Phosphate) batteries for its standard range cars amid concerns over nickel supply. However, in the coming decade, battery-makers seeking high-performance and long-range will struggle to avoid high-nickel chemistries. The metal is therefore well-positioned for the strong growth in demand anticipated by the market.