Surge for demand in Aluminium?

Since the onset of the global pandemic, decarbonisation has become a core pillar of government policy for most major economies. Aluminium is likely to see strong demand from low-carbon technologies and constraints on supply due to a crackdown on high-carbon production and electricity use. This shift means the long-term fundamental outlook for the metal is far more bullish. However, prices remain subject to elevated financial risks in the near term.

Aluminium Market in 2021

Aluminium demand outside China fell 11.7% in 2020, according to CRU. This was mainly due to a 16% collapse in automotive demand. Demand for packaging and consumer durables remained strong, while China consumption also rose 4.3% amid its earlier recovery from the pandemic. Ex-China is now leading the industrial demand rebound, particularly in the US and Europe, led by a booming construction sector and automotive supply-chain restocking. CRU sees 2021 primary aluminium demand growth of 6.9% in China and 12.2% ex-China. In addition to short-term drivers, investors are increasingly focussing on an improved long-term fundamental outlook for the metal as a result of the global decarbonisation drive.

Decarbonisation Drivers

Major economies including the US, the EU and China have strengthened long-term commitments to achieving net-zero carbon emissions. This necessitates reducing fossil fuel use by transitioning to electric vehicles and cutting the power consumption and reliance on fossil fuels of key industries. Aluminium is likely to feel the impact both upstream through curbs on primary metal production and from opportunities for demand from electric vehicles, electricity infrastructure and renewable energy. Europe’s proposed Carbon Border Adjustment Mechanism (CBAM) would also impose higher costs on the aluminium supply chain.

Supply Growth Faces Constraints

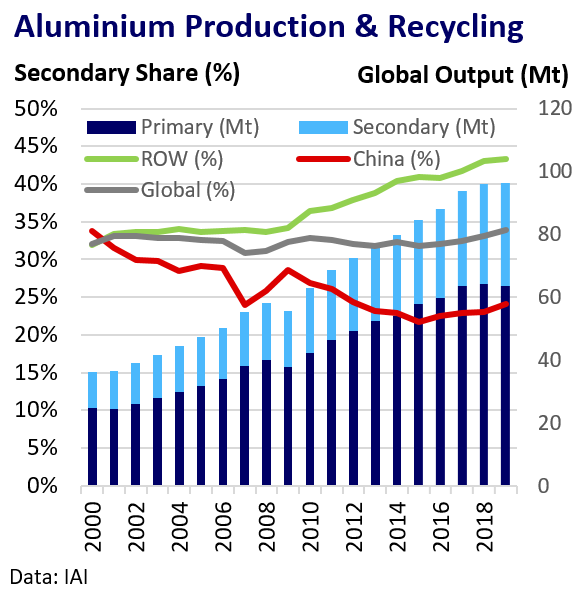

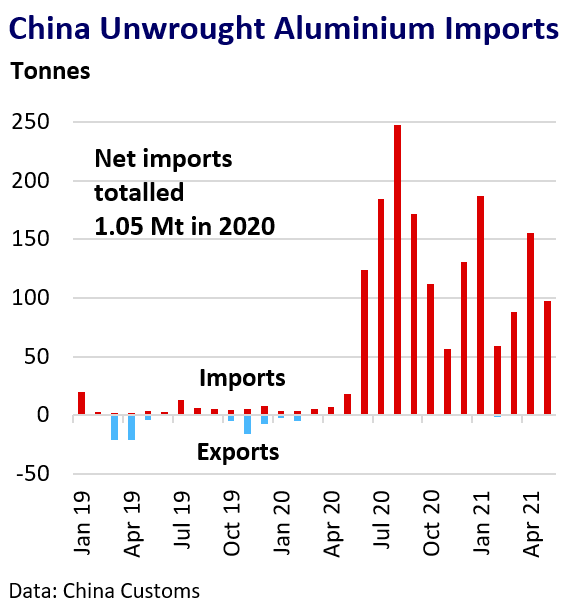

Pressure to decarbonise will likely hit primary aluminium supply growth. China’s curbs on power use, particularly in Inner Mongolia, have constrained primary output and new capacity developments. High prices continue to incentivise capacity additions elsewhere for now, but China’s capacity cap of 45 Mt provides a hard limit and could be reached by 2022-2023. China is likely to alleviate some of this pressure by investing in recycling; Rusal expects the country’s secondary aluminium production to rise 9% pa over the next decade. China’s role as a net importer of primary aluminium is likely to persist long-term as domestic supply growth fades. Imports could soften in the short term amid sales of national inventory.

Green Demand Key

Transport will likely drive long-term demand growth amid the expected shift to electric vehicles and desire to cut vehicle weight for improved efficiency; EV aluminium content can be twice that of traditional cars. Rusal expects primary aluminium demand to grow 3.7% CAGR to 2025, 3.2% in China and 4.5% elsewhere. Investment in power grids and solar power will also benefit aluminium, boosted further by substitution for copper if price ratios remain excessive.

Outlook

We see the market as effectively balanced in 2021, with analyst forecasts varying from a modest surplus (<1 Mt) to a small deficit for 2021. However, most commentators expect decarbonisation to drive widening deficits in the coming years amid robust demand and slowing supply growth. This should underpin pricing in the coming decade. For now, the market will remain sensitive to the ongoing pandemic recovery, shifting timescales for monetary policy tightening and associated US dollar volatility.