Why is lead bouncing back?

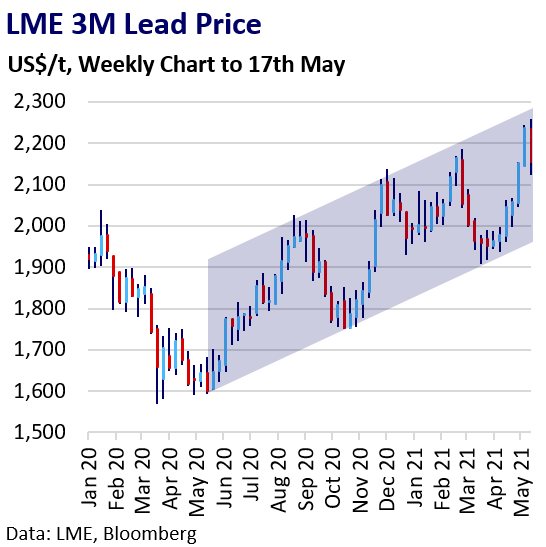

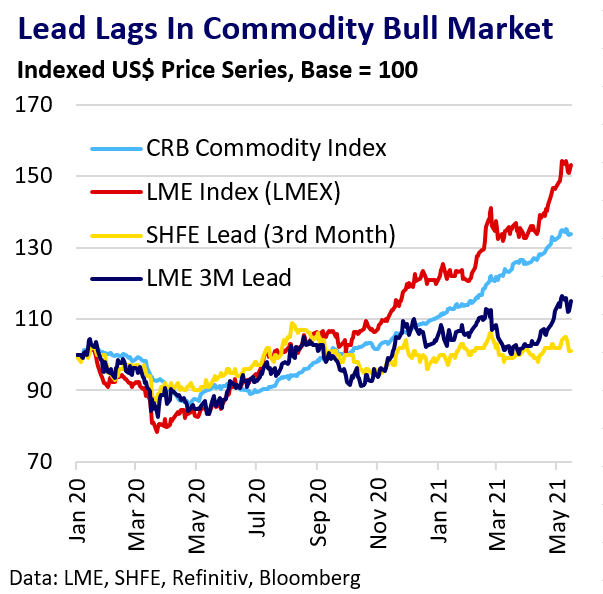

The LME lead price rebounded strongly from March lows. Macro-led fund interest in commodities and lead’s relative cheapness underpinned gains. The rise is at odds with the metal’s weak fundamental narrative, which will likely continue to weigh on its relative price performance versus the rest of the base metals complex.

Lead Price Makes Recent Comeback

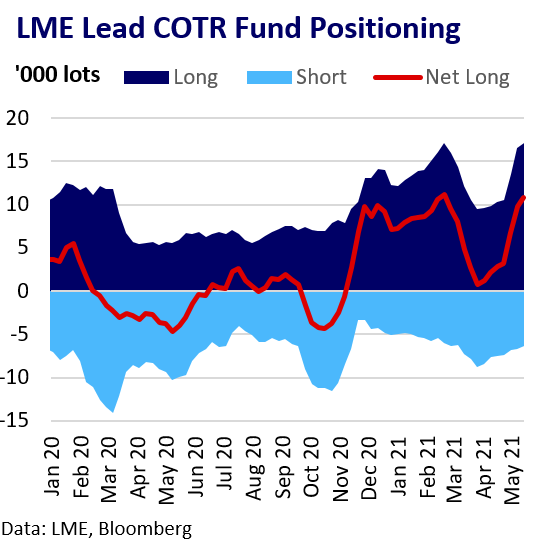

Throughout the global pandemic, lead prices have struggled to match the pace of broader base metal and commodity price gains. The metal’s comparatively weak fundamental narrative is the main culprit. However, prices rose 9% in April amid resurgent LME fund long position building. Driving interest was lead’s relative cheapness versus its peers and broader commodity interest amid renewed dollar weakness and bullish sentiment around a post-pandemic demand surge. However, physical market participation in the lead rally was limited.

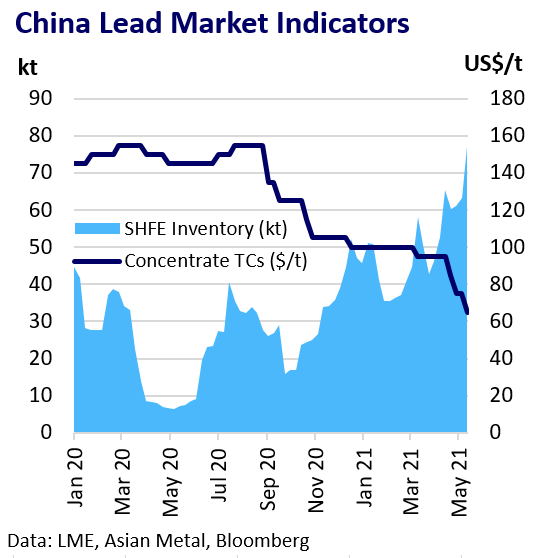

China Market Sees Deteriorating Fundamentals

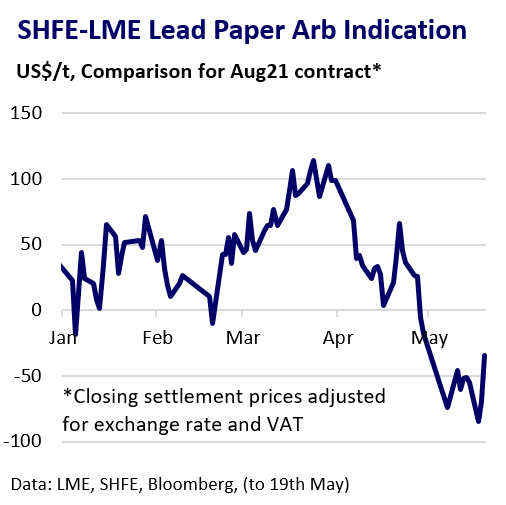

SHFE lead prices have lagged recent LME price gains and narrow export arbitrage opportunities are emerging. Struggling domestic demand and supply growth have pushed SHFE lead inventories to four-year highs. China automotive battery end-user demand has disappointed in recent months. Battery manufacturers have cut production amid high finished goods inventory and further expected low seasonal demand over the summer months. Raw material availability is tighter, with concentrate treatment charges declining rapidly. This largely reflects expectations for strong output growth at both primary and secondary smelters.

Regional Tightness But No Global Shortage

There is no global shortage of lead. The ILZSG has forecast a 96 kt global refined lead market surplus in 2021 (0.8% of consumption), vs 172 kt in 2020 (1.5%). However, the ex-China market has experienced pockets of tightness exacerbated by global freight disruption. The US lead premium reach its highest since 2012 amid persistently strong automotive battery restocking demand. The March closure of Clarios’s 80 ktpa battery recycling plant also weighed on US lead availability. Shipments of lead from Europe may provide some relief, perhaps contributing to tighter market conditions in Europe and a decline in LME stocks there. Lead producers in the EU and US are operating at high rates, with a plentiful supply of scrap. Computer chip shortages have curbed automobile production, which could affect lead consumption in H2 2021. For now, replacement battery demand remains strong in Europe and the US as new car shortages boost consumer demand for used cars. This could slow into summer, with the lagging flow of recycled dead batteries likely to keep scrap markets well-supplied.

Green Narrative Weighs

Lead has no inspiring long-term demand narrative. It lacks copper’s investor appeal as a likely beneficiary of the “green” energy transition. Li-ion batteries are a looming substitution threat as the EV transition accelerates over the next decade. Policy pressure to phase out lead usage due to its toxicity is also a concern. However, the metal is unlikely to be swiftly supplanted as a key battery metal with automotive after-market demand likely to remain strong in the next decade. Issues remain regarding the sourcing of sufficient alternative battery metals and Li-ion battery recyclability.

Conclusion

Lead may remain a reluctant participant in a continuing commodity bull market if macro-optimism and dollar weakness remain broadly supportive. However, lead’s relative underperformance may continue due to its weaker fundamental narrative. SHFE prices are likely to remain under pressure amid a soft China physical market. Extrapolating lead’s technical uptrend channel since March 2020 suggests a likely range of $2,000 to $2,300 for the remainder of Q2.