What do these tin shortages mean?

News of severe tin production disruption at Malaysia Smelting Corporation (MSC) that could last beyond the end of 2021 has helped reignite the tin price rally and tighten nearby LME spreads. While there is a lack of clarity on the potential impact on output, the news comes as yet another blow to an ex-China tin market struggling with the worst shortages of physical metal in recent memory.

Background

In mid-April, MSC reported failures at two reverberatory furnaces at its Butterworth tin smelter in Penang, Malaysia. The facility has suffered from years of under-investment amid efforts to shift operations to a converted lead top submerged lance (TSL) smelter in Port Klang. A subsequent note to suppliers in late April revealed that necessary work to rebrick the furnaces could take nine months. The LME 3M tin price reacted significantly to the news, pushing beyond $28,500. The company stated it was unable to handle its usual volume of raw materials and will change its pricing terms and delivery timescales for contract toll smelting of concentrates from 30 to 60 days from 1st June. MSC commissioned its replacement TSL smelter in November 2020 but it could take the rest of this year to bring it up to full capacity.

Quantifying the Potential Impact

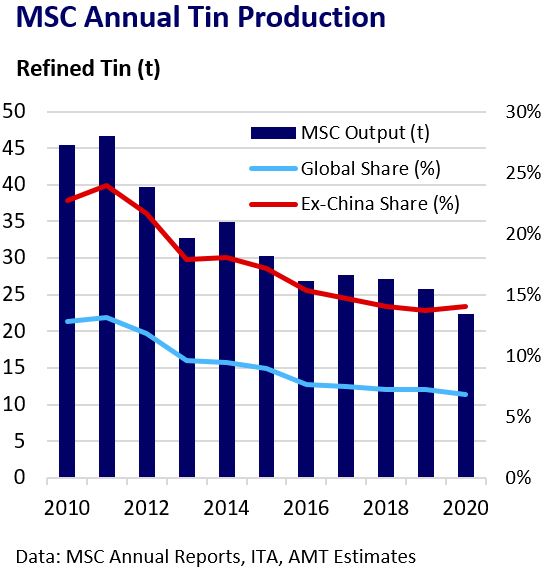

MSC is the world’s third-largest refined tin producer, with a pre-pandemic output of 25,752 t in 2019. The company has remained vague on the anticipated hit to production. Making a rough assumption that MSC experiences a 50% capacity loss and that 50% of excess concentrate supply finds its way to smelters in China and Thailand, this implies a global output loss of ~2% and an ex-China loss of ~6%. The impact may be more acute in the short-term as MSC works to optimise production and concentrate suppliers take time to seek alternative customers. ITA reported comments from MSC that the nine-month timescale was precautionary and capacity could recover sooner. MSC could also regain some capacity before the end of the year if it is able to ramp up its Port Klang facility, though TSL technology has a history of ramp-up delays due to its greater technical complexity.

Implications for the Concentrate Market

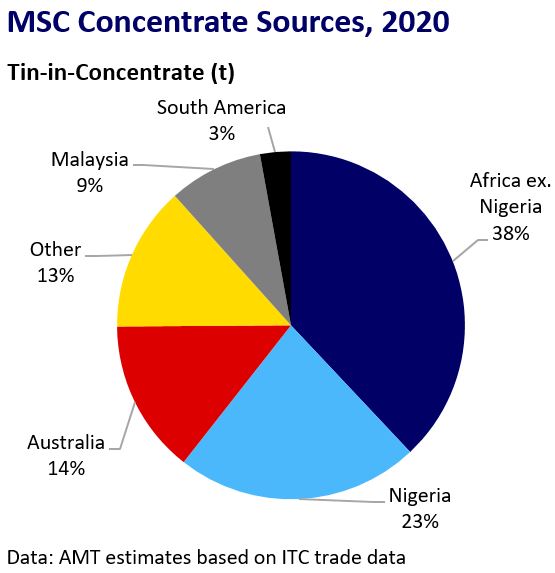

The disruption will result in greater availability of concentrate in the ex-China market. MSC’s planned changes to its pricing terms from 1 June is already causing difficulties for the company’s suppliers, many of whom do not hedge. China smelters could purchase excess concentrate amid tight supply domestically and from Myanmar, but may be hampered by the current SHFE price discount to LME. Thaisarco might also benefit. African mine supply is a significant source of MSC’s feed and is likely to be most affected. Nigeria’s production is vulnerable as MSC is the sole existing customer and the ore’s higher radioactive element content may put off alternative buyers.

Refined Market Impact

The impact of the MSC capacity loss will be felt most keenly in the ex-China refined tin market, which is suffering from an acute shortage of physical metal reflected in low LME stocks and soaring premiums. The news has dashed hopes that recovering supply from Indonesia could help ease the supply crunch in the coming months. China domestic tin prices will likely continue to lag the LME, particularly if extra concentrate imports help boost local production. This raises the likelihood of sustained China net tin exports this year. In addition to fresh fundamental price support from the MSC disruption, the macro-economic environment remains highly supportive for tin, alongside other commodities. Base metals bull market momentum linked to the broader reflation trade and pandemic recovery is also likely to aid tin’s push towards the all-time high of $33,600 in the coming months. The risk of potential policy tightening in response to inflationary pressures remains the leading macro-risk.