Will inflation effect prices?

The global reflation trade continues to buoy prices and physical demand for base metals, which have rallied strongly alongside other risk assets over the last year. As key economies continue their stimulus-led rebound in Q2 and inflation picks up, this should continue to drive the metals bull market. However, investors will be alert to any signs of policymaker unease about excessive inflation risks that could trigger an end to easy monetary and fiscal policy.

Riding the Reflationary Wave

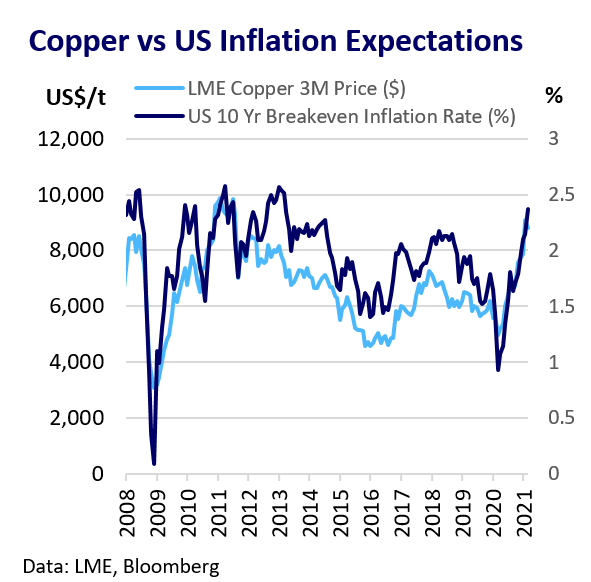

The global economy is currently in a reflationary environment. Reflation means a strong phase of post-downturn economic recovery associated with a controlled rise in inflation as policymakers use aggressive fiscal and monetary policy to stimulate spending, expand economic output and combat deflation risks. This has strongly supported base metals pricing as growth expectations, easy money and metal-intensive infrastructure plans triggered a surge in physical demand. Growth in money supply and the hunt for yield amid negative real interest rates have fuelled investor demand for commodities exposure including base metals. Dollar weakness linked to low interest rates is also an important price driver. Commodities are generally considered a good investment portfolio hedge for sudden, unexpected surges in inflation as pricing in the market is typically highly elastic.

Stagflation Fears

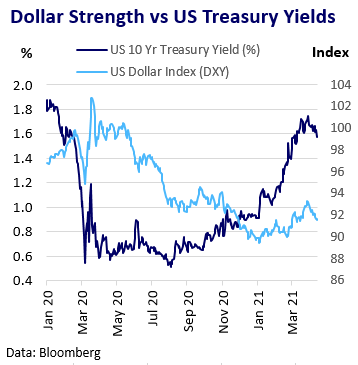

Metals typically thrive in a low-interest rate and moderate inflationary environment. However, fear of persistent and excessive inflation can weigh on prices where it threatens underlying economic growth and financial stability, so-called stagflation. This can pressure policymakers to tighten fiscal or monetary policy sooner than planned, which can also hit economic growth. Inflation concerns triggered the surge in US treasury yields that peaked at the end of March. This was accompanied by dollar appreciation as investors bet the Fed might be forced to accelerate its timeline for tapering stimulus measures. The stronger dollar and broad market risk-aversion weighed on the metal price rally.

Policymakers Allay Fears

Central banks have eased concerns about excessive inflation growth and reiterated their commitment to an accommodative policy stance. The US Federal Reserve expects that a pickup in inflation this year will be largely transitory, distorted by the base effect of statistical comparisons with last year. The ECB and Fed have expressed no immediate plans to raise interest rates or cut asset purchase programmes until labour markets have fully recovered. Bond yields and the dollar have eased since March as excessive inflation concerns receded, boosting metals.

Commodity Rally Faces Scrutiny

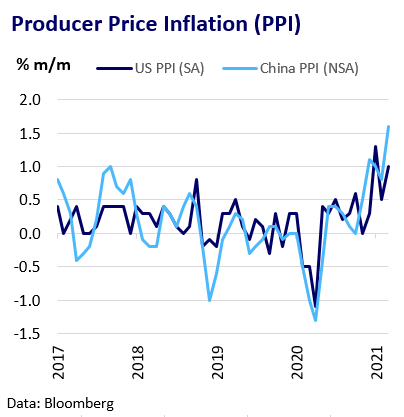

There is clear evidence that high commodity prices are directly contributing to inflation, notably for manufacturers. China Producer Price Index (PPI) rose 1.6% m/m in March, the highest since 2016. US PPI also picked up 1.0% m/m in March. China’s Vice Premier, Liu He, stated that stronger commodity market regulation is needed to ease cost pressures for businesses, although subdued domestic consumer price inflation limits the urgency to take drastic measures for now.

Outlook

Base metal prices should remain strong amid accelerating reflation as key economies continue to recover from lockdowns in Q2. China is the most pressing source of policy risk to commodity markets as the government tightens controls on debt and property markets to control credit risks. This could weigh on economic growth and metals demand in the second half of the year. Central banks may eventually be forced to trigger more aggressive policy tightening measures to contain inflation, which would slow economic growth and could trigger a major correction across risk assets. The Fed has signalled no benchmark rate rise until 2024, though futures markets suggest one could come as soon as 2022.