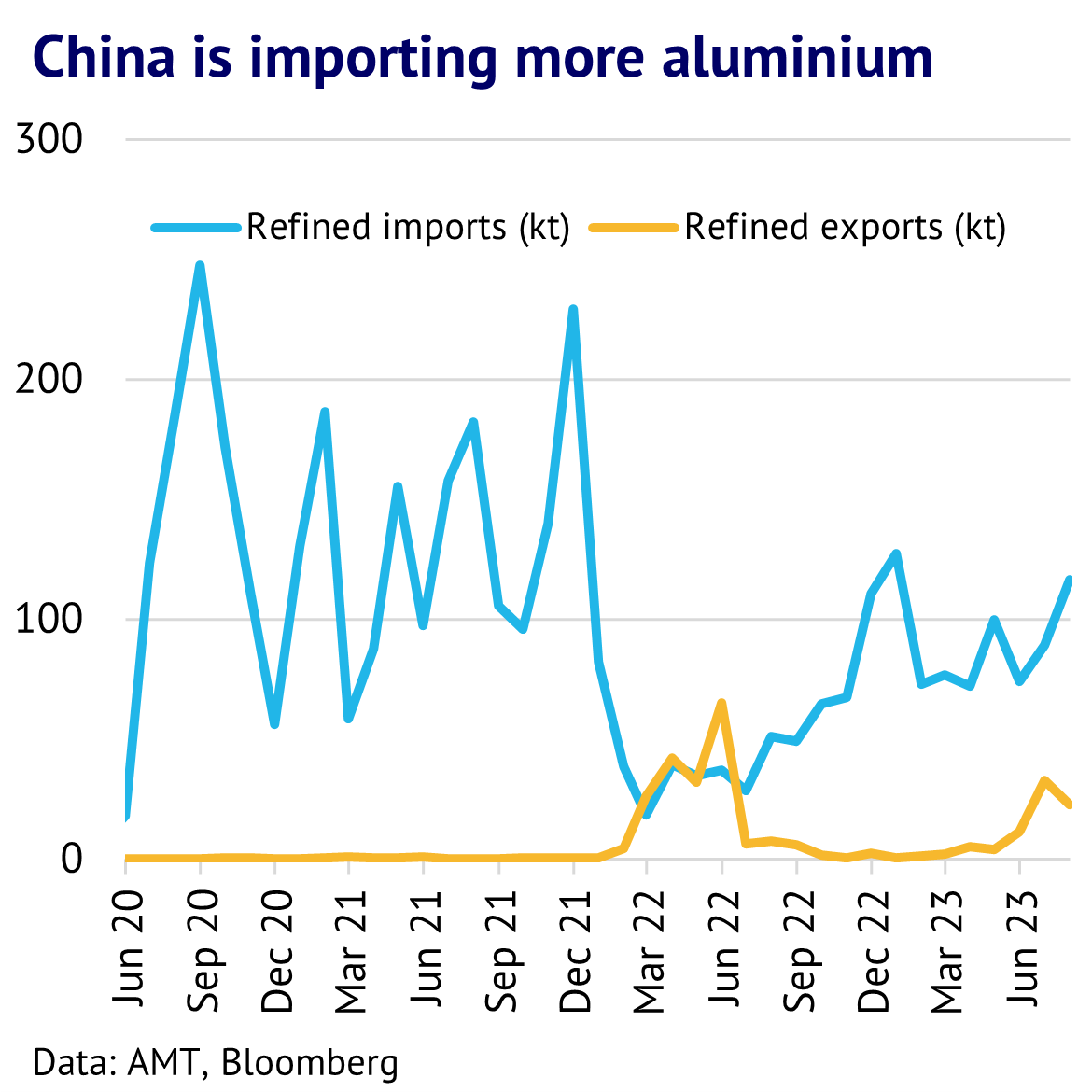

14th September 2023: LME three-month aluminium prices tumbled in the first half of this year, but the fall was halted in Q3 and we expect prices to rally in the year ahead. One reason for being bullish is that the Chinese market is starting to tighten, despite the backdrop of gloom around the property market. Demand is getting a boost from strong growth in electric vehicles, investment in the electricity grid and solar/wind power generation. This has resulted in demand consistently outpacing supply and imports are trending up as a result. Prices on SHFE are also signalling that more metal is required, with a large premium developing over LME. Inventory levels in China are very low, both on exchange and in other warehouses. Finally, LME net speculative positions are at very low levels and have started to trend up, suggesting that investors are aligning with improving fundamentals.

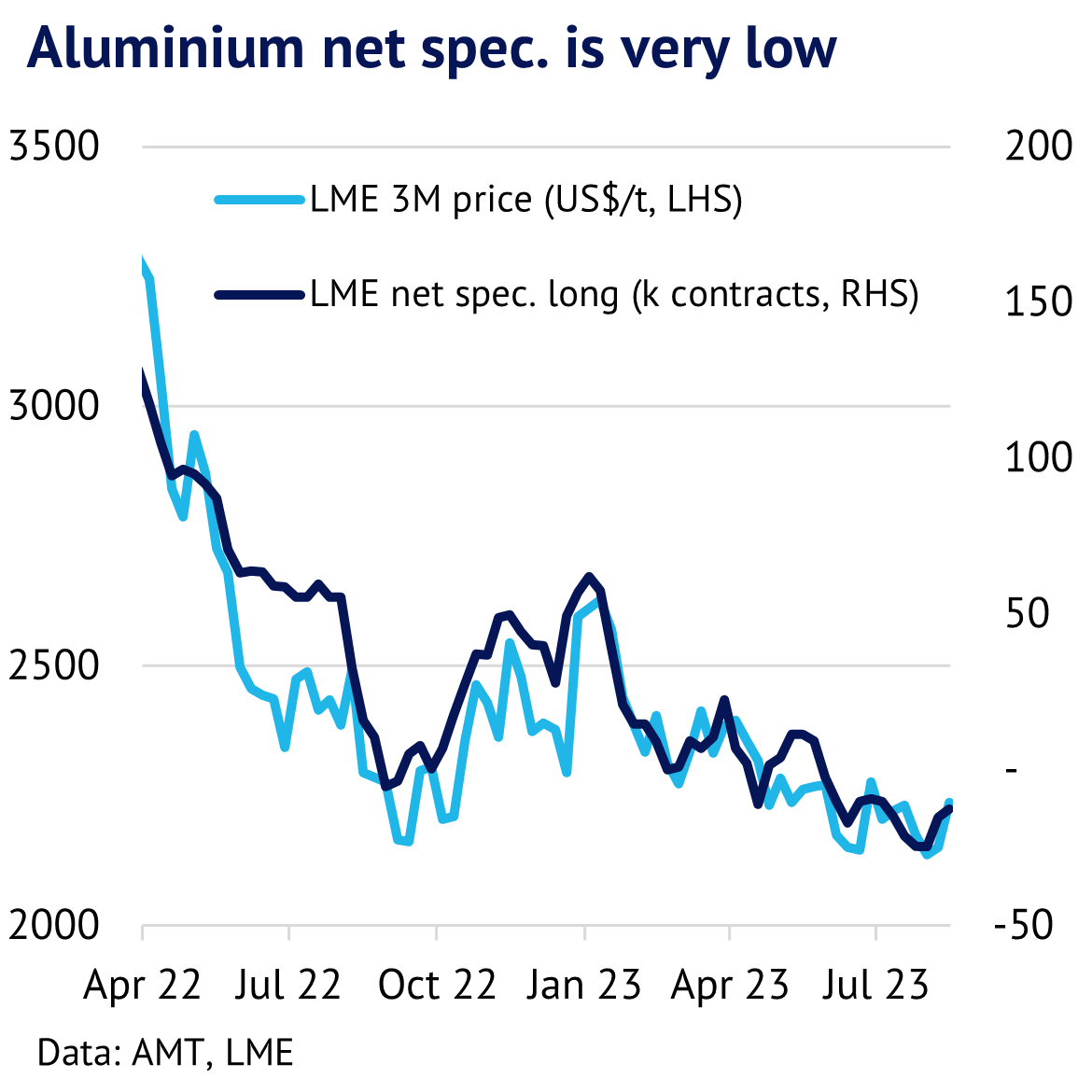

Aluminium prices find a temporary floor, as speculators run out of gas. Three-month LME aluminium prices fell in the first half of this year (see our first chart), before stabilising in the third quarter, despite a soft economic backdrop. One reason for this stability is that fundamentals are showing some signs of tightening and LME net speculative positions have already been cut to incredibly low levels, making traders nervous about sticking with aggressive short positions

Net speculative positions fell to -25k contracts in mid-August, but since then have edged higher into early September. Compared to the historical range, net speculative positions currently stand at 5% (data to 8 September) – showing that upside risks should dominate over the medium-term, given the right trigger from fundamentals. As we explained in our recent research piece, our net speculative figures add up the categories Investment Funds and Other Financial Institutions, as this shows significant correlation with prices. The research piece can be found here: LME COTR: Follow the money!

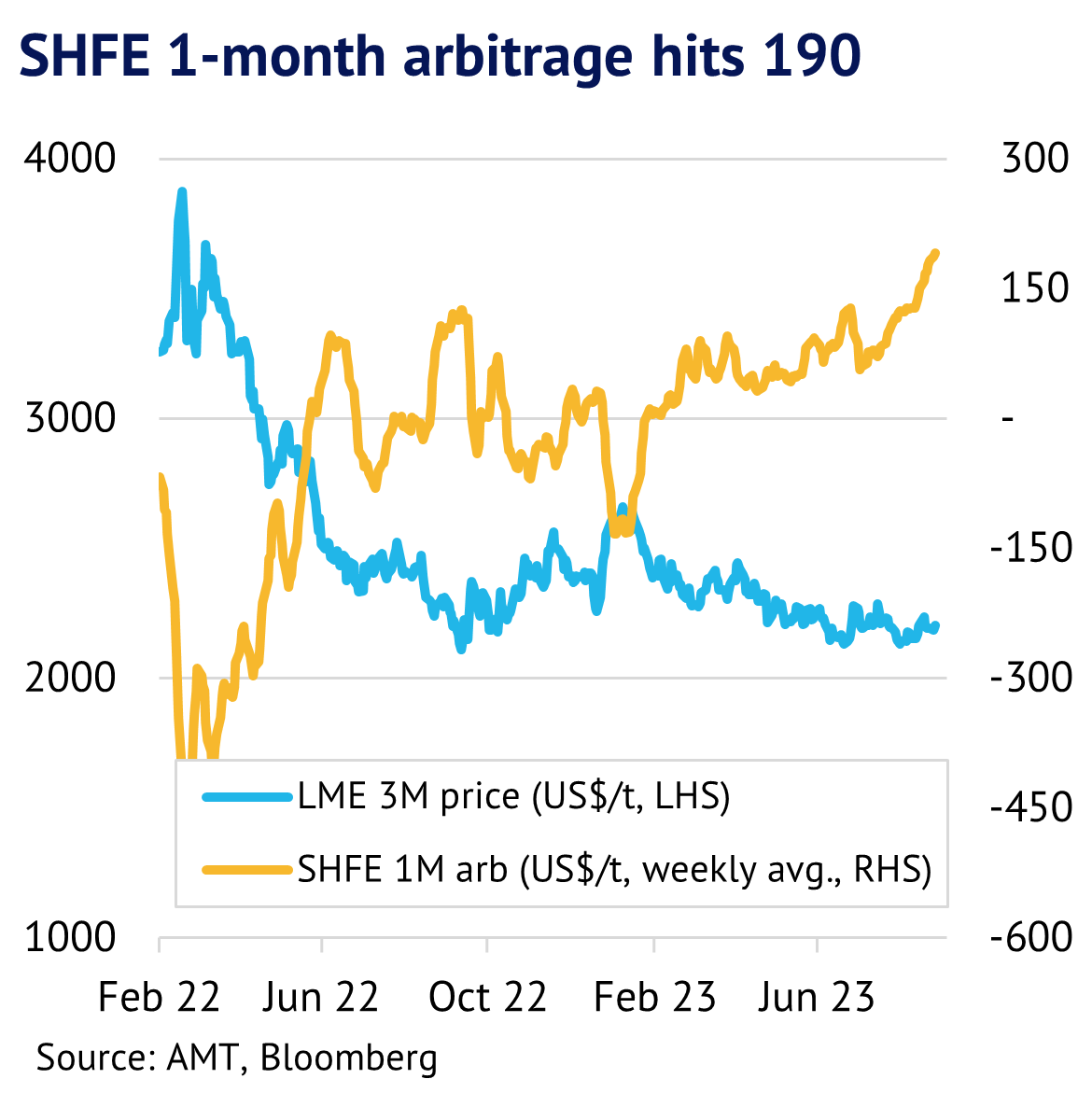

SHFE arbitrage hits 19-month high, with China looking tighter. While LME prices have been drifting, the Chinese aluminium market has been getting tighter, which is a bullish signal as it gives an incentive to ship more metal to China. Higher shipments would help to underpin LME prices, as it implies a tighter supply-demand balance outside the country. We show in our chart that the 1-month SHFE price has rallied more than the 1-month LME price and is trading at a significant US$192/t premium (12 September) – its highest level since February 2022.

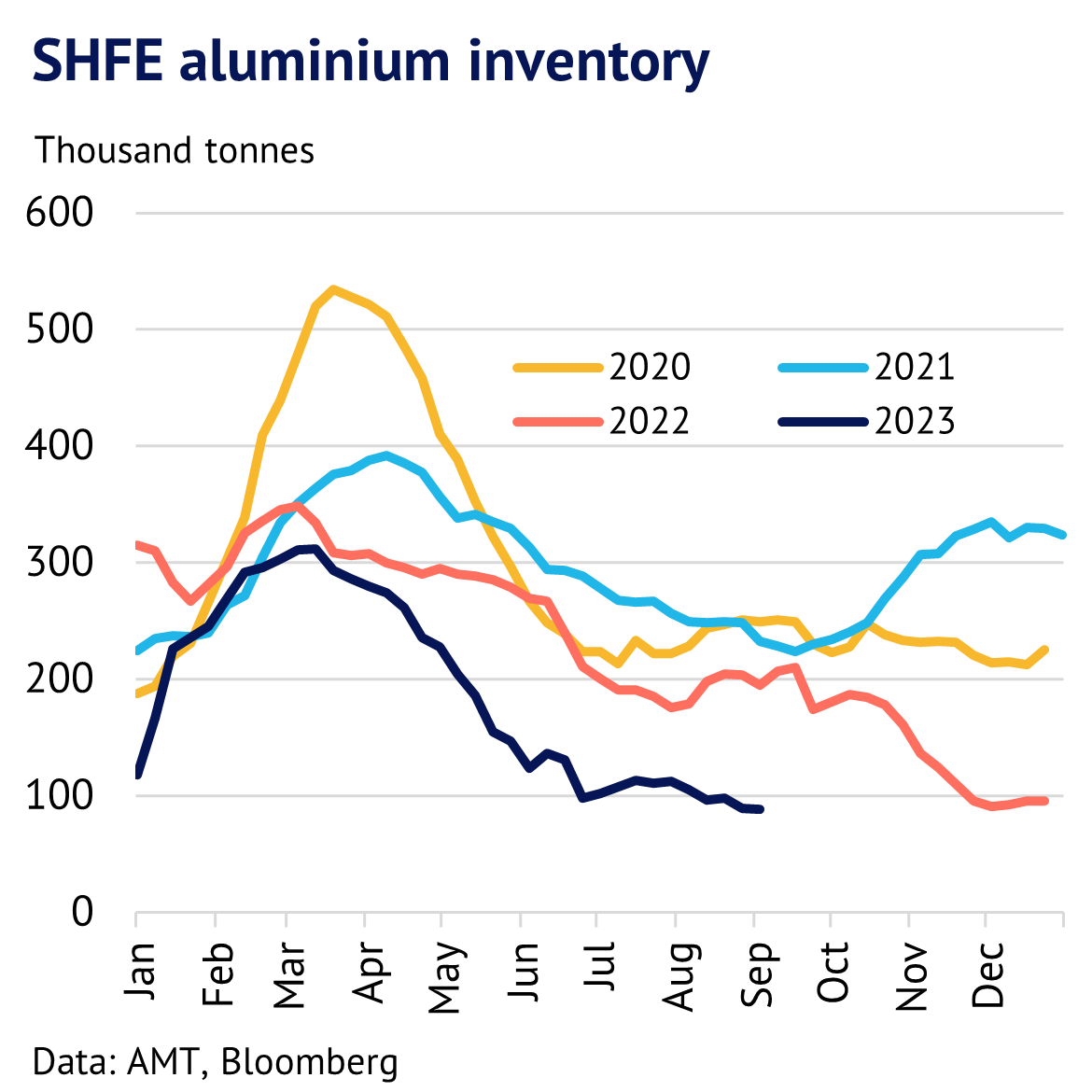

SHFE inventory comes down from recent peak. Similarly, LME inventory have been stable in recent months, but SHFE has seen a steady fall, which again supports the idea of an improving market balance in China. We can see in our chart below that SHFE inventory often increases in the first quarter of each year, but then typically trends down for the remainder of the year. This year inventory followed the normal seasonal pattern, but at a much-reduced level. By 8 September 2023 metal available for delivery was just 88kt – down 55% y/y. Moreover, data from Shanghai Metal Market shows that social inventory levels have also been drawn down and these were 49kt at the end of August – a 28% y/y drop.

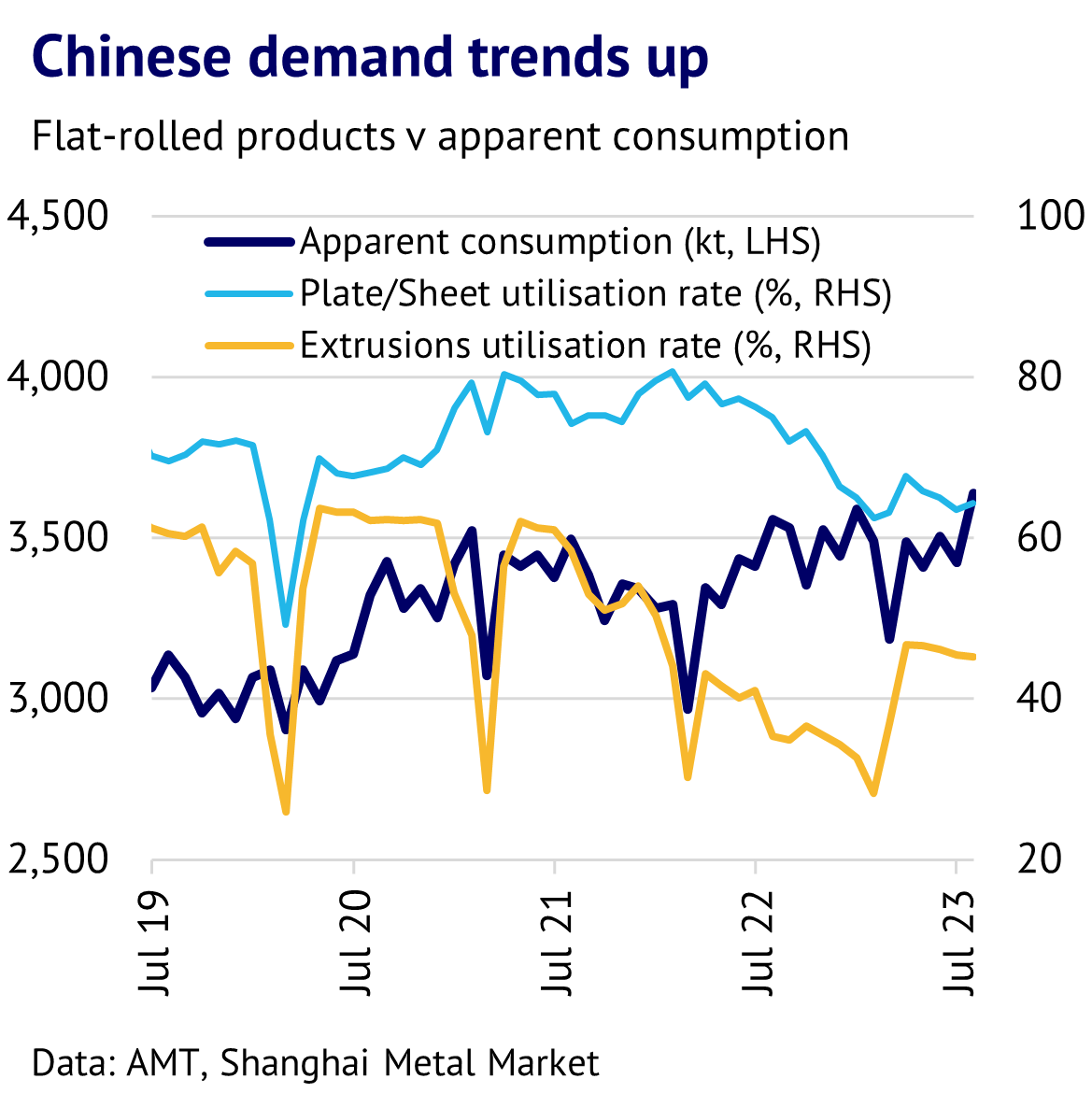

Chinese demand is growing well, despite the backdrop of problems in the property market. Economic data releases from China highlight a patchy economic story. The latest official manufacturing PMI, for example, showed activity at 49.7 in August, with a figure below 50 indicating recessionary-like conditions. The housing market is also suffering, with prices down 0.6% y/y in July.

However, aluminium demand is being boosted by rapid growth in other parts of the economy – particularly those related to the green energy transition. A recent report from Bloomberg New Energy Finance (BNEF) forecast 34% growth in electric vehicle (EV) sales in China this year, followed by 21% growth in 2024 and 19% growth in 2025. Moreover, EVs often use more aluminium than a conventional vehicle, to compensate for the extra weighed gained from massive battery packs. Other sectors such as solar and wind power generation are also booming, lifting demand for aluminium in China and other countries.

Finally, aluminium still has a monopoly in electricity transmission for overhead power lines, so an expansion of the grid to support EV charging is feeding through into higher wire& cable demand. The National Energy Administration (NEA) reported grid investment was RMB247.3 bn in the first seven months of the year, up 10.4% y/y. Overall, estimates from CRU show that aluminium consumption in China was up 5.5% y/y in August and 3% for the first eight months of the year.

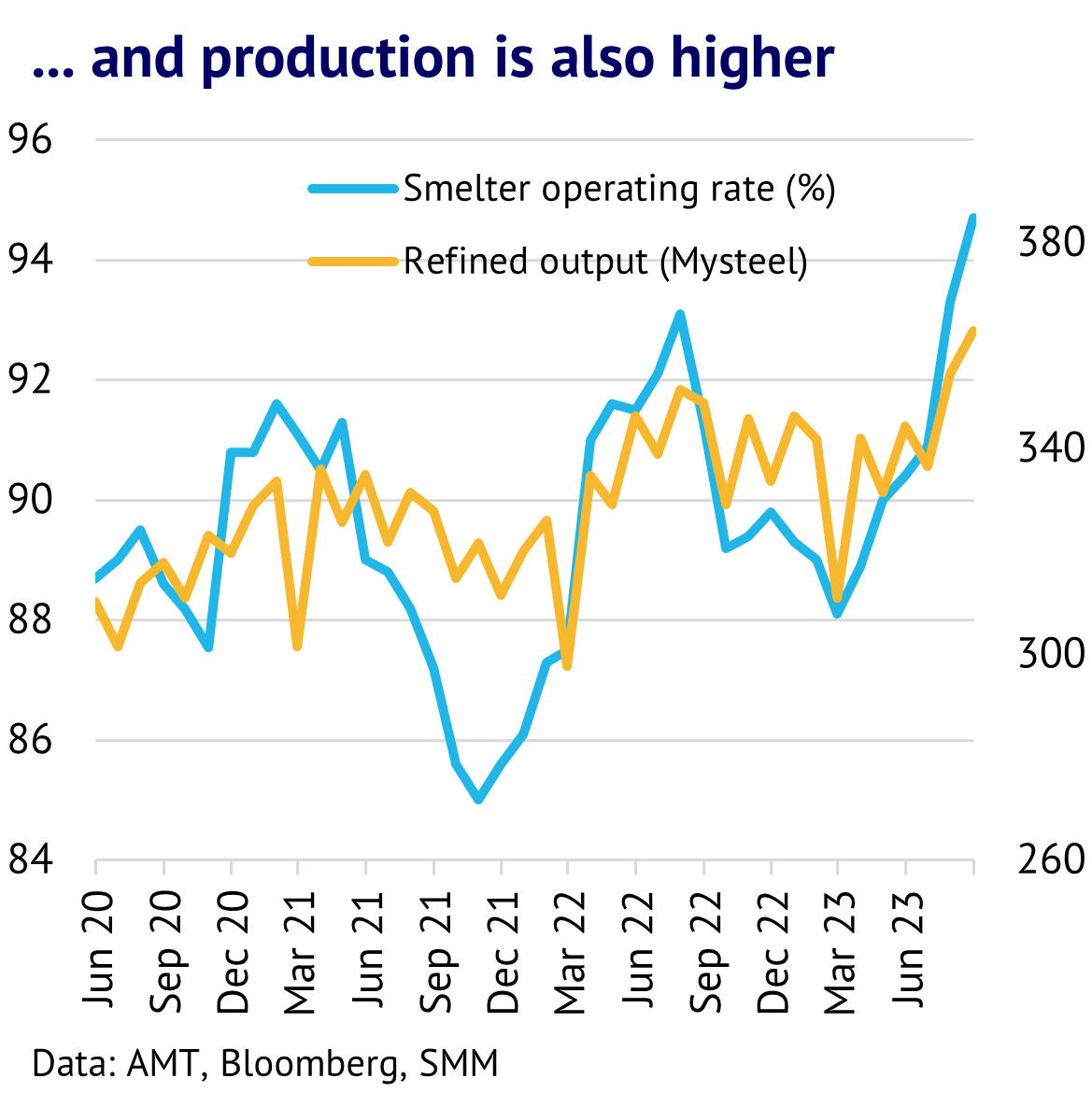

Chinese smelter output is also trending up, but slowly. More bearish is that there is also growth taking place on the supply side of the industry. However, producers have failed to keep up with consumers this year. According to figures from Mysteel, smelter output in China was up just 1.9% y/y in the first eight months of 2023. Part of this failure was due to power shortages, with a lack of water in places like Yunnan province limiting the scope for supply growth, despite decent levels of spare capacity.

Looking ahead, heavy rainfall across parts of the country helped over the summer and utilisation rates are ramping up and reached a record high of 95% in August. However, the scope for further growth beyond here looks very limited due to the government’s capacity cap, which is fixed at 45Mt/y. Output in August reached an annualised rate of 42.7Mt/y. Given that there is always a gap between output and capacity, for technical reasons, we are currently close to a solid ceiling. CRU is forecasting that primary aluminium will grow by just 0.4% per year in the period 2022-2027, which is likely to be below demand growth, adding to the need to import more metal from other countries.

Aluminium prices to trend up, as fundamentals and investors start to align. In conclusion, we see improving fundamentals in China, which will help to tighten the global picture for aluminium. We also see limited downside for net speculative positions given that we are currently close to the bottom of the historical range. Over the year ahead, we expect aluminium prices to trend higher, as the strength of the green energy transition outweighs housing-related headwinds.