Seasonal Slowdown for china?

China’s New Year Holiday will officially take place from 11th-17th February this year. We expect a seasonal slowdown in China industrial activity and strong metal inventory growth in February. However, a strong rebound in downstream activity is likely in the following months amid supportive fundamental drivers. China policy tapering remains a headwind for investor risk appetite but is unlikely to hit real metal consumption until H2 2021.

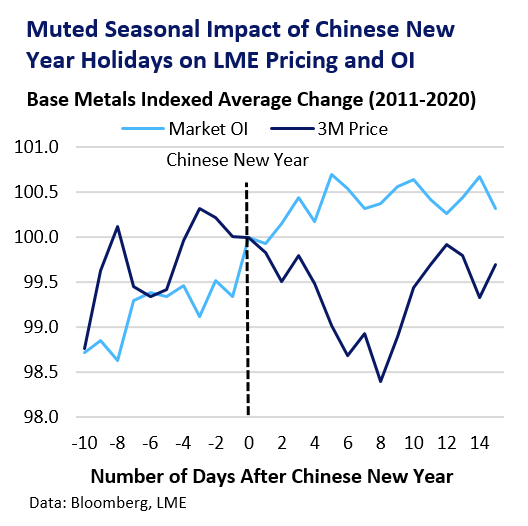

Holiday Risk Adjustment a Myth

Analysis of historical price and positioning data does not support the idea that the onset and end of the China New Year holidays period itself results in a consistent seasonal pattern of pre-holiday de-risking and post-holiday rebound across LME base metals. However, a reduction in LME trading volumes over the holidays, with the Shanghai Futures Exchange closed, typically results in less liquid LME trading conditions

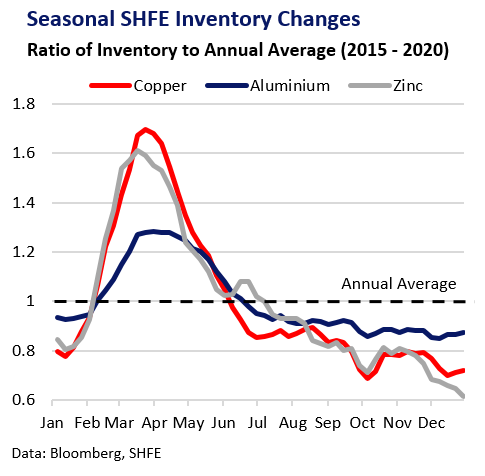

Seasonal Stock Rebuild

Market participants expect a strong seasonal rise in SHFE metal inventories throughout February, peaking in March, as producers largely continue activities while downstream plants pause or reduce operations. Global freight disruption has led to metal import delays, hampering China inventory inflows so far this year. Stock builds in nickel, tin and lead may be less visible on SHFE, having historically taken place to a greater extent off-exchange, such as at producers or in other forms than primary refined metal.

Primed for Recovery

A strong rebound in China metal demand and risk appetite is likely from March. China’s construction sector may restart faster due to warmer weather after a late holiday period in 2021. Downstream plants will be eager to resume activities quickly to meet strong order books for H1 2021, particularly where virus disruption prompted early pre-holiday shutdowns. More migrant workers staying local due to the pandemic will also support a quick return. Some downstream plants were reluctant to restock metal ahead of the holidays, which could strength post-holiday demand. Shipping problems from China and Peru could squeeze metal availability in the coming months, with copper and zinc at risk.

Policy Tapering Risks

China policy tapering and winding down of super-charged stimulus measures remains a key market risk in 2021. China’s Central bank has recently demonstrated a strong determination to managing credit risks by draining excess liquidity conditions from the financial system, putting upwards pressure on lending rates. It means China is unlikely to see a repeat of the highly aggressive, stimulus-driven, growth in metals demand and imports observed in 2020. Slowing credit growth in China’s economy could hit investor risk appetite but is unlikely to impact real metal demand in the first half this year. By H2 2021, the argument made by metal market bulls is that slowing growth in domestic China metal demand will be offset by a broader, vaccine-led, recovery in demand in other key economies globally.