Lead market sees increase

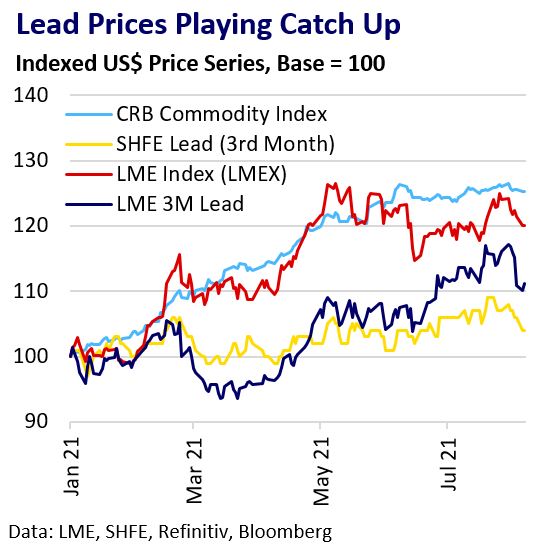

The LME lead price has risen higher overall since June amid falling LME inventories and physical tightness in the US and Europe. Shipping issues have so far shielded LME prices from significant exports of lead from China amid heavy oversupply there, but the threat of shipments may temper the potential for further lead market gains.

Ex-China Market Showing Clear Signs of Physical Shortage

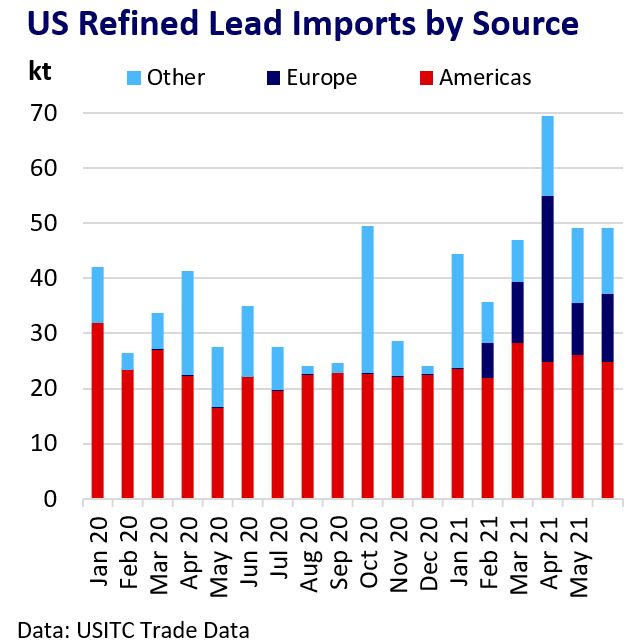

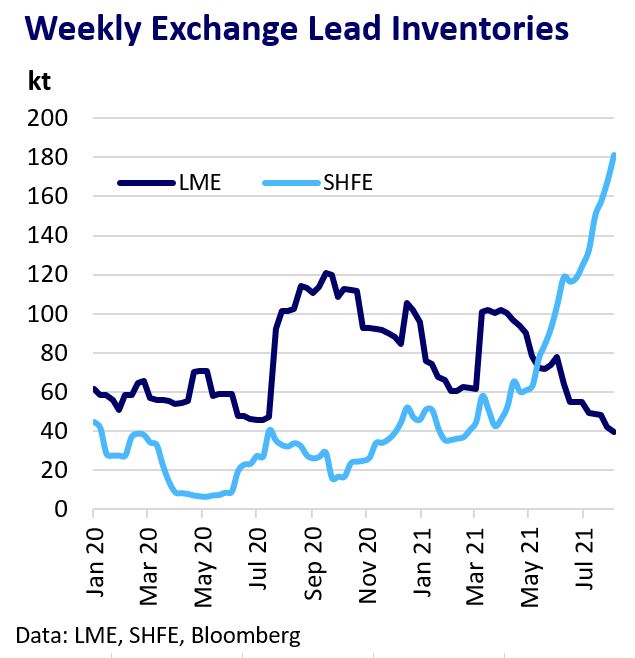

Lead has rallied with base metals overall since mid-June amid an improved macro-outlook and a tight physical lead market in the US and Europe. LME-registered lead inventories have declined steadily since April. This drawdown has occurred mainly in Europe, where LME stocks are at a 14-year low. CRU reported that Glencore was taking delivery of LME warrants to re-refine at Nordenham before shipment to the US. US lead import requirements have grown this year amid exceptionally strong lead-acid battery demand and the closure of Clarios’s US battery recycling plant in March. Scrap supply remains ample in Europe and the US, but smelters are operating near full capacity with full order books. A production halt at Berzelius Stolberg’s 155 ktpa lead recycling plant in Germany after July flooding exacerbated the tightness. The LME backwardation and strong LME cash buying are indicators of this, although the backwardation narrowed sharply over the August index roll period amid significant lending pressure. This precipitated a fund-led price correction, but the reality of tight physical market conditions remains unchanged and may provide continued support.

China Market Sees Deteriorating Fundamentals

It is the opposite story in China. SHFE lead prices have edged gradually higher since March but failed to match LME price gains. China’s lead market continues to show clear signs of oversupply. SHFE lead is in contango with inventories now at record highs since the contract launched in 2011. This is amid persistently strong lead warehouse inflows since May. Why is China oversupplied? Well, lead-acid battery demand growth has been consistently subdued so far this year. Seasonal end-use demand has failed to meet earlier strong expectations. China passenger car sales in June were the weakest for that month in eight years. Battery distributors and manufacturers are therefore holding high levels of inventory. They are reluctant to restock during a period of high lead prices. Fresh measures in China to contain a Covid case resurgence are likely to weigh further on consumer demand for lead-acid batteries. Meanwhile, strong profit margins have fuelled refined lead production growth, helped in part by several secondary smelter capacity additions. China’s Q2 lead output totalled 177.9kt, up 2.2% q/q and up 15.0% y/y.

Shipping Disruption Hinders Global Rebalancing

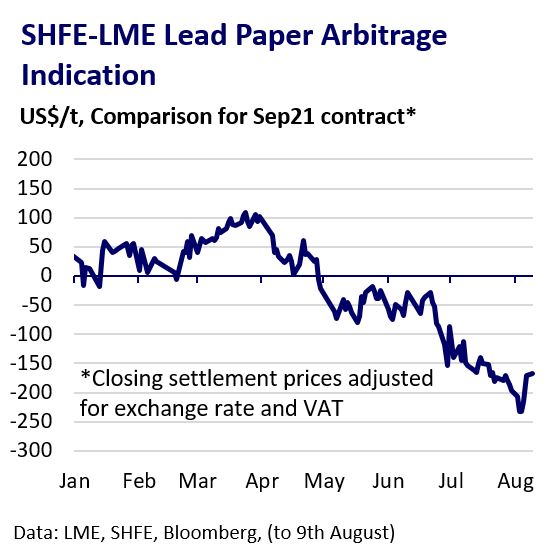

Amid such a striking regional contrast in physical market conditions in and outside China, the main threat to LME lead prices beyond macro-themes is clearly the potential for a physical rebalancing of the global market in the form of China lead exports. A widening SHFE discount since May has generated some limited lead export opportunities. However, the high cost and difficulty of securing shipping have so far been a barrier to more significant flows.

Conclusion

The global lead market remains marginally oversupplied. However, the excess supply remains concentrated and contained within China. The global shipping crisis has dislocated regional physical markets by inhibiting trade in goods. LME lead has therefore been able to trade at a growing premium to the SHFE lead market amid the sustained US and European demand strength. LME prices may remain well supported by strong ex-China fundamentals and persisting shipping issues. However, participants can’t ignore the perennial risk to LME prices from exports out of a heavily oversupplied Chinese market. Arbitrage-related selling may well restrain any attempt by prices to rally significantly higher.