Why are metal prices plummeting?

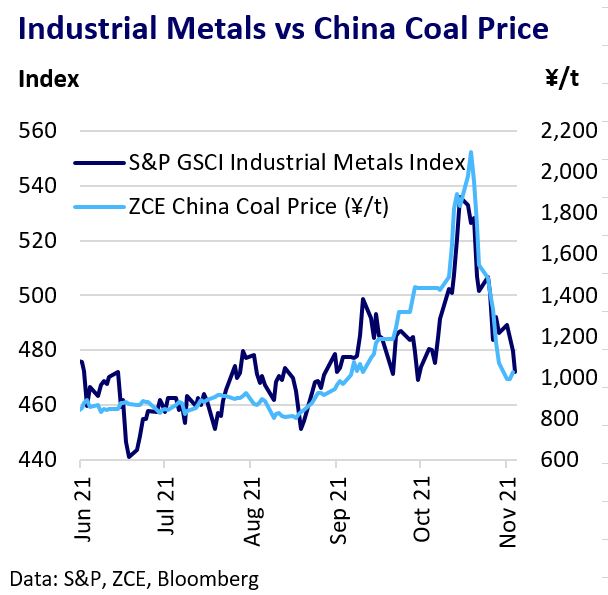

Base metals prices aggressively retreated in the second half of October after China’s coal price collapsed following government intervention. Coal’s rout suggests easing power rationing and lower energy costs for metal producers. Fresh visibility of the impact of power shortages and related supply-chain disruption on downstream industrial activity and, by extension, metals demand has added to base metal price pressure.

China’s Intervention Triggers Coal Price Collapse

An important driver of China’s power shortages since the summer has been a shortage of thermal coal for power generation. China’s coal prices surged to a peak in mid-October before Beijing’s aggressive reaction.

The government curbed financial speculation and hoarding and has taken strong action to maximise domestic coal production and imports. Bloomberg reported Beijing is considering a ¥528 ($83) per tonne coal price cap to ease pressure on loss-making electricity producers.

Domestic coal prices have since plummeted. The number of China’s Provinces experiencing significant power shortages has dropped to the low single-digits and coal power plants have largely been able to replenish coal stocks to above critical levels.

Base Metal Prices Follow Coals Lead

Global energy shortages have been a key base metals price driver in recent months. China’s power rationing of metal producers, particularly aluminium smelters is a key focal point.

The implication of far lower coal prices and greater domestic output is lower energy costs for metal producers and the potential for some easing of strict power rationing measures that have crimped metals output in recent months.

The prospect of easing desperation from China for energy imports may also provide some relief to tight power markets and metal producers elsewhere, such as in Europe and India.

Base metal prices have therefore mirrored China’s coal price decline. Aluminium and zinc pulled back significantly, with their supply being the most impacted by the energy crisis. Tin and lead proved more resistant as ongoing supply tightness for both metals is largely unrelated to power issues.

Energy Shortages Hit China’s Demand

The metal demand impact of power curbs has become more apparent. China’s NBS manufacturing PMI data showed a deepening contraction in manufacturing activity in October. Caixin PMI data, better representing smaller companies, fared better.

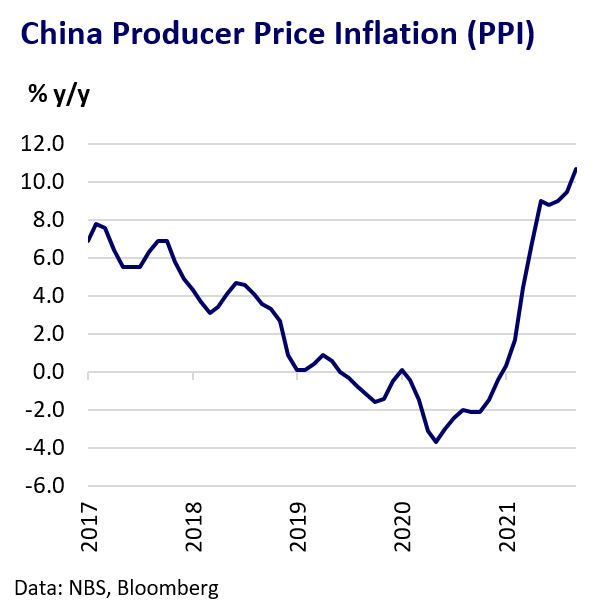

The impact of higher energy costs is also clear in producer price inflation, which hit 10.7% y/y in September, a 26-year high. China’ Q3 GDP growth slowed to 4.9%, below 5.2% expected. Most banks have cut China’s growth outlook for Q4 and 2022.

Easing power shortages could support downstream manufacturers as well as smelters, but will not resolve growth risks from Chinas property sector slowdown and measures to contain the recent widespread Covid outbreak that has hit more than half of China’s Provinces.

China Prioritises Economy over Environment

China has made the reduction of carbon emissions and fossil fuel dependency a core policy goal. However, recent action to maximise coal production as a response to the energy crisis runs counter to its decarbonisation ambitions.

While China is unlikely to abandon long-term decarbonisation goals, its recent actions suggest it will prioritise economic stability. This raises questions about the future rigidity of policies such as China’s aluminium smelter capacity cap in response to economic distress.

Power Shortages to Remain a Key Risk over Winter

The collapse in China’s coal prices has clearly softened concerns about deteriorating energy availability in China and other regions. However, the northern hemisphere has many winter months ahead.

Ongoing power rationing in China and higher energy prices globally are unlikely to abate significantly until Q2 2022 at least.

The energy crisis has eased, but it is still very much alive. It will remain a core driver of base metals supply, demand, and pricing.