Tin Price Outlook

The tin price has receded since early March but maintains its underlying bull market uptrend. China’s import demand is likely to absorb stronger ex-China production in Q2. The market remains vulnerable to scarcity pricing behaviour with global visible inventories near historical lows. However, global demand headwinds and recovering supply point to a significant pullback in prices in the second half of 2022 and into 2023.

Price Review

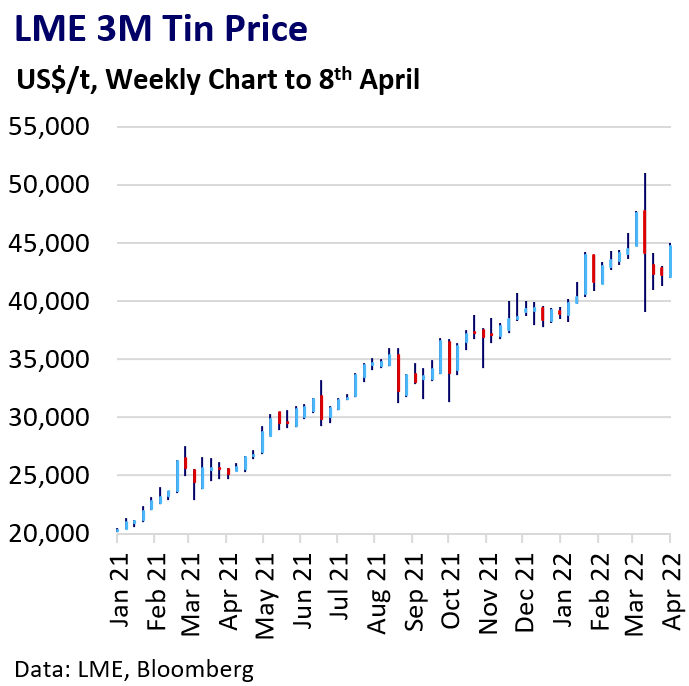

Excluding two short-lived illiquid price moves, tin has not fallen below the 100-day moving average since the onset of the pandemic in March 2020. This key technical level held even as tin retreated from all-time highs of $51,000. This was as easing Russia sanctions fears and liquidity issues hit commodities sentiment in late March.

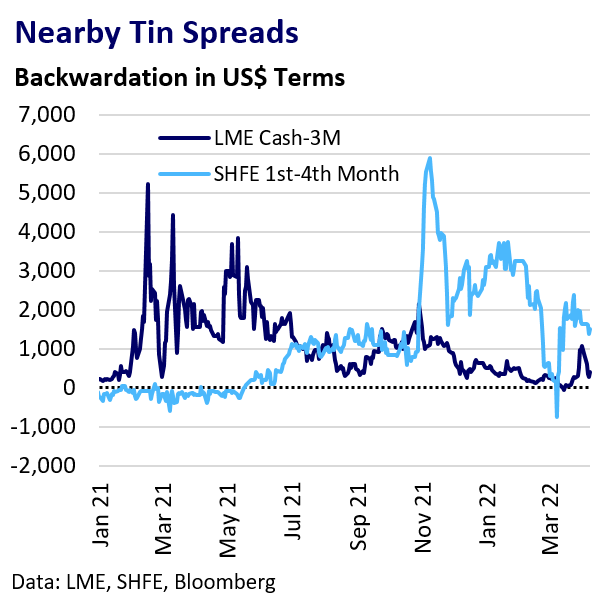

Physical tin premiums and spread backwardations on both LME and SHFE have eased from 2021 extremes but remained stronger than historical norms.

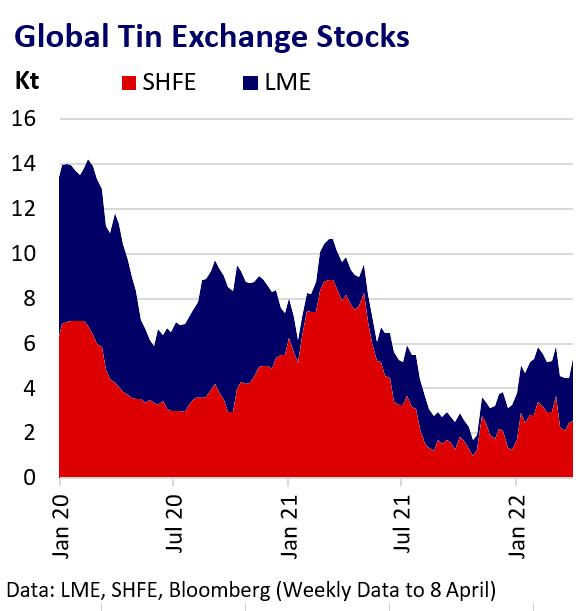

Global visible inventory levels are still historically subdued despite rising from 2021’s critically low levels.

China Import Demand

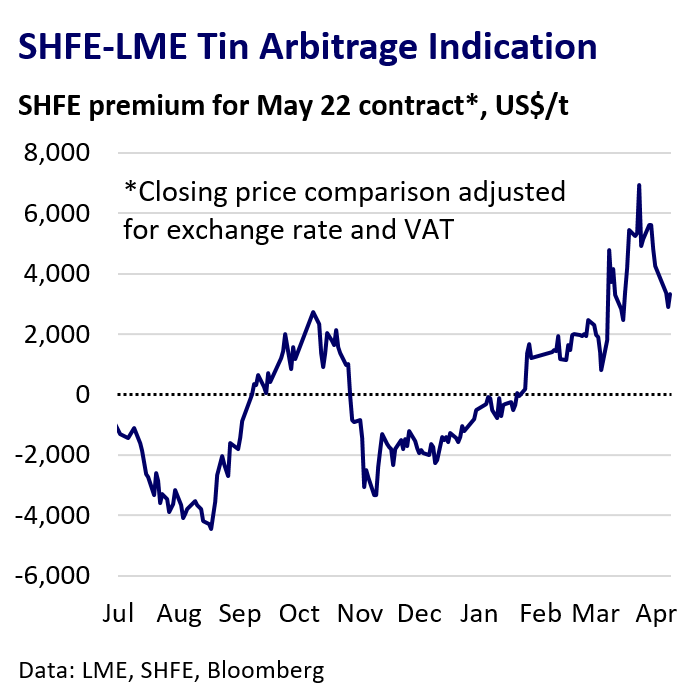

A widening SHFE premium to the LME in March and import arbitrage opportunities have underpinned LME prices in recent weeks. Improving ex-China supply vs China production constraints likely explains the widening differential. This also drove a recent spike in LME spread tightness and associated Asia inventory drawdowns.

Customs data shows China was a small net exporter from December to February. China imports likely rose sharply in March and should remain strong in Q2.

Diversion of Asia supply to China in the coming months should keep pressure on western markets in Q2, even as recent sharp European stock deliveries signal the easing of regional physical market conditions.

Recovering Supply

Physical market conditions remain undoubtedly tight, but recovering output from major producers may increasingly offer relief as we move through the year.

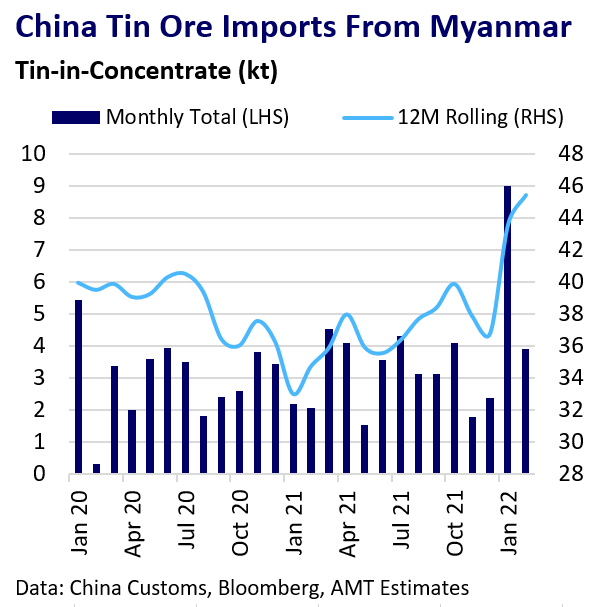

Indonesian tin exports remained strong in March at 6,675 kt. China’s imports of tin-in-concentrate from Myanmar rose sharply across the January-February period to ~13 kt as easing border restrictions allowed shipments of a backlog of processed ore from late 2021.

This should ease concentrate availability issues for China’s smelters, although resurgent domestic anti-Covid measures could yet freshly disrupt cross-border logistics. Guangxi China Tin’s return from maintenance after a planned 45-day hiatus will provide further supply relief.

MSC in Malaysia is utilising its newly commissioned smelter for tolling business and boosting output by reprocessing slags at its existing plant after significant disruption in 2021.

Demand Headwinds Loom

Despite optimism on tin supply, the narrative for tin demand is less compelling. Many tin consumers are resisting purchases at currently elevated spot prices.

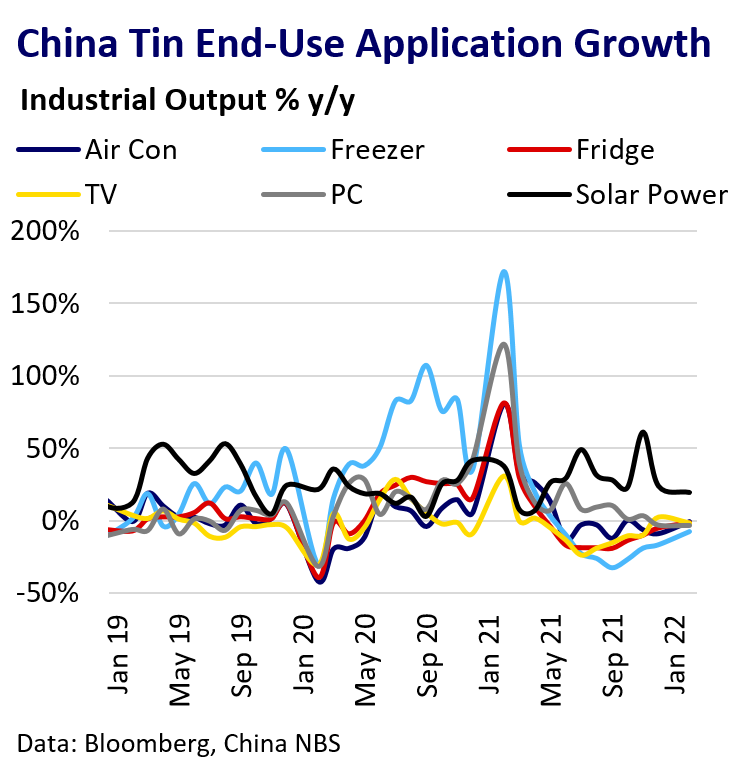

Growth in China’s output of key electrical consumer goods has flatlined, although solar-cell output expansion rates remain in the double-digits. A looming cost-of-living crisis could threaten the strong spending power enjoyed by consumers in Europe and the US.

Fiscal and monetary policy tightening is likely to weigh on broader economic growth, particularly into 2023. Promised China policy support is set to target infrastructure rather than consumer spending.

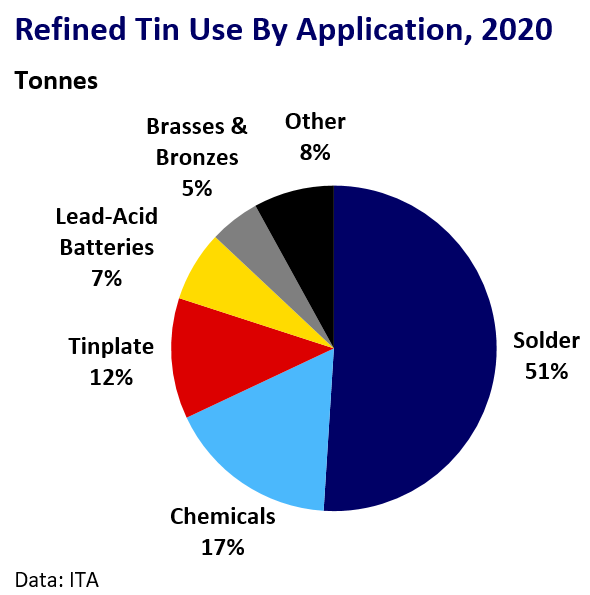

There remains long-term optimism for consumption in renewable energy applications, electronics proliferation, and future EV battery technologies. However, growth risks and personal consumer spending patterns may have more impact in the short to medium term.

Outlook

Tin continues to price scarcity with inventories still at relatively low levels and China set to suck tin from western markets. The status quo may support a continued gradual tin price uptrend in Q2 above the 100-DMA.

However, risks beyond this appear skewed to the downside; Output from leading producers is rising strongly versus 2021, particularly ex-China. Combined with waning demand growth in consumer end-uses and macroeconomic headwinds, this could herald the end of the multi-year price rally.

Assuming no major supply shocks, a repricing of LME tin back towards ~$35,000 in H2 2022 seems likely if global market tightness dissipates as anticipated. Intensifying global growth headwinds could solidify the pullback to more sustainable long-term levels in 2023.