15th December 2023: LME three-month copper prices have risen in the past month, helped by significant problems with mine supply in Latin America. Also, contract treatment charges (TCs) have been cut, as miners gain the upper hand with smelters in China, amid a tight raw materials market. Furthermore, Chinese copper imports have bounced back and SHFE is trading at a large premium to the LME, pointing to continued strength into year-end. Copper demand remains strong in the country, which is counteracting robust growth in domestic supply. However, the global copper market does not look tight, which is limiting the upside for prices. Overall, bullish sentiment is still lacking, particularly in China, although we still see upside risks in the year ahead.

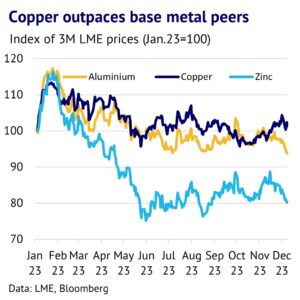

Copper prices rally, despite depressed consumers in China. LME three-month prices are up 4% m/m (data to 14th December). It has shown impressive resilience, amid a backdrop of significant declines across the rest of the base metals complex. For example, aluminium is down 2% m/m, with lead and zinc down 6% and 4% m/m, respectively. We believe that copper’s resilience is due to a combination of unexpectedly strong demand and increasing concern that supply is failing to keep up, due to challenges on the mining side of the industry. However, demand growth looks set to slow in the year ahead and supply growth is likely to accelerate. We believe that copper will continue to outperform, despite lacklustre economic activity in China.

Growth in global mine production has evaporated. This year was expected to see significant growth in global copper mine output, as several large mines were ramping-up and new projects were coming onstream. However, according to data from Bloomberg, output fell by 1.4% y/y in September and the previous two months were also down y/y. The most significant headwinds have come from Asia and North America. Indonesia has been struggling due to operational problems at key mines, including Batu Hijau and Grasberg. Meanwhile, the key region of South America has seen its growth rate stall, as we discuss below.

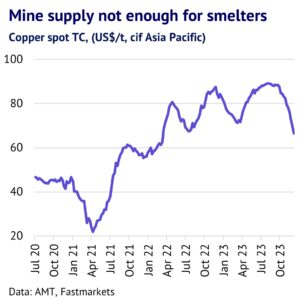

Treatment charges (TCs) are trending down. Tightness on the mining side of the industry has helped to drive down spot TCs. Recent weeks have also seen the conclusion of some negotiations between miners and Chinese smelters. The trend, once again, has been firmly downwards. For example, Freeport and Jiangxi Copper agreed to cut contract TCs for 2024 deliveries by 9% to US$80/t and Antofagasta agreed the same number with a group of Chinese smelters.

Cobre Panama closes due to protests and government licence withdrawal. One key factor tightening the market has been the unexpected closure of the 375kt/y Cobre Panama mine in November. The operation closed initially due to small boats blocking inbound coal shipments, with protestors complaining about issues around the mine, including environmental

damage and its profit share. The government has also suspended its operating licence, which presents a threat to its long-term future. Overall, it seems likely that the mine will restart at some point next year, although smelters seem to be betting on a much tighter market balance than seemed likely a couple of months ago.

Anglo American downgrades copper forecast. Also significant was the latest news from Anglo American that it would be cutting its guidance for copper. It now has a target of 730kt-790kt for 2024, down 180-210kt from previous guidance. This was due to geological problems at Quellaveco in Peru and a planned temporary closure of a processing plant at Los Bronces in Chile. Developments at Anglo American and in Panama have removed our previous assumption that the market would be oversupplied next year. We now expect a broadly balanced market instead.

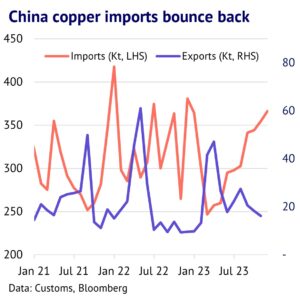

Chinese imports trending up, despite rampant supply growth. One unexpected (bullish) development is the continued ramp up of Chinese copper imports, despite rapid growth in domestic production. Latest customs data showed that imports of copper (in all forms) reached 551kt in November, which was close to a 2-year high. Meanwhile, NBS reports that Chinese production was up 13% y/y in October, although CRU is forecasting that output will rise by a more modest 8% this year.

Overall, there is something odd happening here. Strong imports imply there is still a shortage in the Chinese copper market, despite robust supply growth. Moreover, the SHFE 1-month copper price was at a US$159/t premium to the LME on 13 December (using a 5-day rolling average). This suggests continued strong imports by China in December.

Copper demand still growing in unexpected places. CRU are expecting global demand to grow by around 3% this year. China, of course, remains a dominant driver and should grow by a strong 6% this year, before slowing to around 3% in 2024. While recent economic data suggests that the manufacturing sector in the country remains weak (official PMIs, for example showed a downturn in November to 49.4), copper demand is still following its own path.

Furthermore, looking at a couple of key sectors shows a solid upturn in recent months, reflecting strong government stimulus measures, which are in the pipeline. In New Energy Vehicles, for example, growth accelerated to 36% y/y in November. Similarly, the solar PV sector, accelerated to 35% growth in November, after falling in April. Overall, this helps to explain why copper imports have risen, although we believe that there is likely to have been an inventory build outside the official reporting system, which helps to explain lacklustre sentiment, which is overshadowing the industry.

Seasonality analysis shows that copper prices often rally during the winter. An additional bullish factor for the short-term is that three-month copper prices often perform well during the northern hemisphere winter, from mid-November to mid-February – based on 15 year daily seasonal patterns. This reflects the forward-looking nature of prices, which are anticipating a seasonal upswing in demand after the winter.

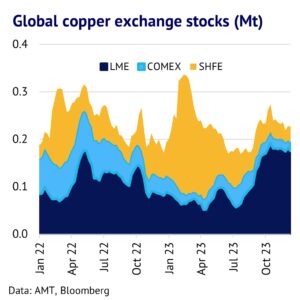

Exchange stocks are up this year and spreads are soft. However, copper’s fundamentals do not look particularly tight at the moment. This year has seen exchange inventory building by 50kt to 208kt, for LME/SHFE combined. Moreover, the cash-to-three-month spread has moved into a deep contango. This now stands at US$89/t, up considerably from US$7/t at the start of this year. This shows that consumers and traders are comfortably stocked and see no shortage of physical metal on the immediate horizon. However, sentiment can quickly change and with inventory levels low and central banks in the OECD countries set to cut interest rates in 2024, we expect copper prices to trend higher in the year ahead.