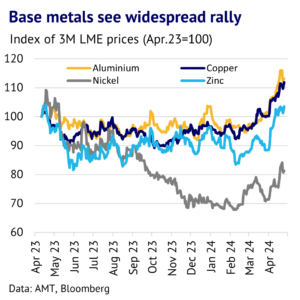

25 April 2024: Base metal prices have soared in the past month, with additional sanctions on Russia combining with improving fundamentals. The LME was forced to act twice in April to impose restrictions on Russian metal deliveries and then to tighten rules around rent-sharing deals to maintain liquidity. This has created a confusing picture of tightness on the LME and some additional tightness for fundamentals, as Russia tries to divert shipments to non-sanctioned countries, such as China. The bottom line is that base metal prices have jumped across the complex, although we see the rally in aluminium, nickel and zinc as being poorly supported, while the rally in copper is largely due to other factors, including raw material shortages.

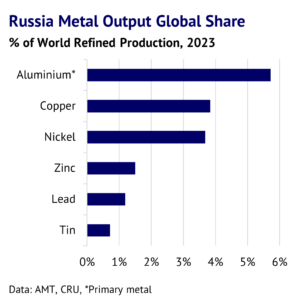

LME reacts to new Russian sanctions. Recent weeks saw a surge in prices for many of the base metals, with the LME responding to fresh UK/US sanctions by suspending the delivery of Russian metal produced on or after 13 April 2024. This particularly impacted aluminium, copper and nickel because Russia is a key producer, with a global market share of 6%, 4% and 4%, respectively. The UK/US also banned imports of Russian metal, although this is will not make much difference because neither are significant buyers in the physical world.

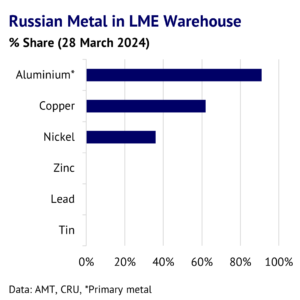

One feature planned by the LME is that Russian metal already in LME warehouses would be classified as Type 1, which is tradeable by UK nationals and companies. However, if the metal was withdrawn and then returned it would become Type 2, which becomes subject to sanctions/restrictions, with a more limited pool of buyers. This resulted in a big surge in planned warehouse withdrawals by traders looking to set up rent-sharing deals with warehouses, in the hope of locking away the metal for an extended period. The most attractive warehouses are typically difficult for consumers to access and often have high exit charges and limited storage space, which tends to boost rental income. On top of this, Type 2 metal now has a limited pool of buyers.

And cracks down on attempts to lock metal away within rent-sharing deals. However, the LME was forced to react again on 23 April, to limit these rent-sharing deals because it was concerned about market liquidity. First, it will allow Type 2 metal to be reclassified as Type 1, if certain conditions are met. This particularly relates to metal which has remained in the same warehouse. Second, it clarified the rules around Post-Sale Economic Incentive Arrangements, to limit any restrictions on withdrawing metal from a warehouse. Third, there will be increased compliance scrutiny around metal tied up in these deals and tracking of Russian material during warehouse movements and warrant re-issuing.

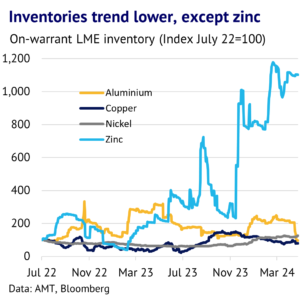

It remains to be seen how effective this latest guidance will be, although from a fundamental point of view, excess metal sitting on the LME is a clear sign of weakness, even if bottlenecks are limiting the ability of consumers to access surplus material. The bottom line for us is that the recent rally for nickel looks particularly poorly supported, while the rallies in aluminium and zinc looks overdone. By contrast, copper is largely being driven by other factors, such as raw material tightness and a lack of concentrate, while the impact of Russian sanctions is less important.

Russian companies feel the squeeze, as sanctions get tighter. In terms of the broader impact of sanctions, Russian metal producers have not been directly targeted, but profits have fallen, as selling prices have tumbled and the cost of getting metal to customers has risen. For example, Nornickel, the world’s largest nickel producer, reported a 5% drop in output in 2023 to 209kt, while company profitability slumped by 51%. Company full year guidance for this year is for another fall to around 189kt, with unsold inventory accumulating. Particular problems for the company include equipment shortages and as a result, it plans to close its Arctic copper plant and build a new plant in China to avoid sanctions.

Meanwhile, Rusal, the giant aluminium producer, maintained its output at 3.8Mt in 2023, unchanged from 2022, but profits dropped by 84%. Realised prices for aluminium were down 18% and the company was also impacted by a 14% drop in alumina output. While China can buy Russian aluminium, prices on SHFE are trading at a substantial discount to the LME, which highlights the ongoing squeeze on profits and the lack of buying interest. The July SHFE contract was trading at a US$118/t discount to the LME (24 April), a substantial shift from the US$40/t premium at the start of the month.

Overall, sanctions are therefore creating additional tightness in aluminium and nickel, but these are not significant enough to justify the jump in LME prices on their own. Our latest price forecast piece was released on 12 April – Base Metals: Speculative Bubbles Build. We expect all the base metals to trend lower in the year ahead.