31 January 2025: LME aluminium prices outperformed the other base metals in the past year, helped by falling inventory levels and good growth in demand in China. Furthermore, China has a primary smelter capacity cap, which has encouraged inflows of both primary aluminium and scrap. More bearish though is that we expect to see Russian output levels being maintained at high levels, despite EU sanctions. While we see some upside for prices, fundamentals softened in late 2024 and early 2025, which will create headwinds.

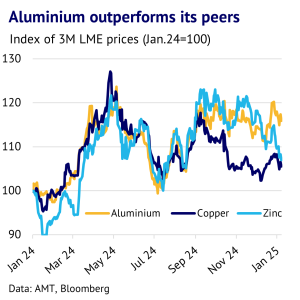

Aluminium prices outperformed copper in the past year. LME three-month aluminium prices are up 15% in the past year, comfortable outpacing copper, which is up just 5% (data to 30 January). The contango from cash-to-three months has also largely disappeared and now stands at US$6/t, a big shift from US$40/t in mid-December. While we expect the aluminium market to remain tight in the year ahead, current fundamental trends suggest that the upside for prices is getting limited.

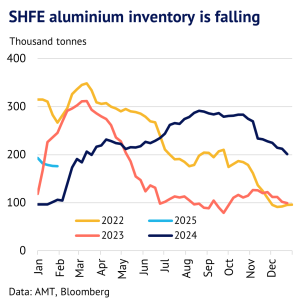

Exchange stocks are low, but trader stockpiles are likely to be elevated. One reason for being bullish on aluminium is that exchange inventories are falling and are now at a very low level. We calculate that exchange stocks are just 2.2 days of global consumption (data to 30 January), the lowest level in the base metals complex and LME stocks have been on a downward trend since 2021. Furthermore, our chart for SHFE inventory shows that it has fallen by 17kt so far this year, in contrast to 2022 and 2023, when we saw significant builds at this time of year. Social inventory in China is also low at 492kt.

However, there seems to be a significant disconnect between inventory trends and fundamentals. According to CRU estimates, the global market will be oversupplied by 321kt in the first quarter of this year. So far there is no sign of this appearing on exchange. We suspect that with all the noise about potential US tariffs, traders have been building inventory outside the official reporting system, as a temporary protection against future barriers to trade. For example, an indication of US tightness comes from the Midwest premium, which increased from USc17/lb in early December to USc24.5/lb by late January, according to Fastmarkets.

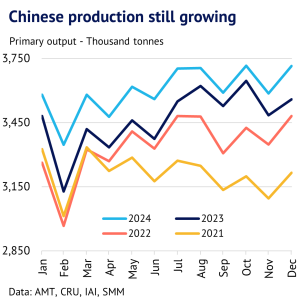

China smelter cap should boost imports. Another reason for being bullish is that a capacity cap on Chinese primary smelters should restrict growth in the year ahead and domestic demand has generally been outpacing supply. The IAI estimates that primary production in the country reached an annualised 44Mt in December (with y/y growth of 4.4%), very close to the 45Mt/y cap. The government is trying to limit growth to reduce power consumption and is encouraging growth in secondary aluminium, which is far more efficient. However, this has been a challenge and China has also been boosting its imports of primary metal to keep up with downstream demand. Imports reached 161kt in December, up from 73kt in January 2023. Meanwhile, secondary smelters are struggling to source enough scrap domestically and imports of aluminium scrap reached 1.79Mt in 2024, up 1.8% from the previous year.

With China increasingly reliant on overseas markets for both primary metal and scrap, the supply side looks likely to remain tight, helping to support global aluminium prices. However, the next few months will be important to watch, with the primary industry’s desire for growth, potentially clashing with national objectives. Recent experience with the steel industry has shown that output often overshoots, before being pushed back down by central government pressure.

Chinese demand growth is slowing. While the supply side in China looks challenged, demand growth is slowing, which could easily undermine the bullish narrative. As we show in our seasonality chart, consumption through last year was always comfortably above 2023, but then growth slowed into December. This is consistent with NBS data for fabricated aluminium output that showed growth of just 2.6% in December, close to the low for the year.

Furthermore, according to CRU, the Q4 consumption numbers flattered the underlying trend in end-use demand. Fabricators rushed to export semis, before the government removed a VAT-rebate on 1 December. This pulled forward a lot of shipments that would ordinarily take place in Q1 2025. Chinese fabricators are also likely to face a tougher export market this year, with US tariffs potentially going up and Europe launching a mass of new models for electric vehicles, to try to regain lost ground. In 2024, China exported a substantial 6.7Mt of aluminium and fabricated products, which could now be pushed back into the domestic market.

Russian sanctions to have a limited impact. There is also a lot of discussion about the EU imposing further sanctions on Russia, in response to the invasion of Ukraine, which is helping to encourage higher aluminium prices. However, the evidence from recent years has shown that Russian output has been immune to sanctions. Indeed, CRU figures estimate 1.9% growth in 2024, in the face of previously imposed sanctions. The EU still imported around 6% of its primary aluminium requirements from Russia last year (estimated at 350kt) and the new sanctions regime could see this cut to zero by 2026. However, a reallocation of trade flows is more likely than an overall loss of supply, and so we do not see this as adding to the bullish story for the market.

Many moving parts, but we see limited upside for aluminium prices. The aluminium market is facing a great deal of uncertainty today. Donald Trump is threating to impose tariffs on key suppliers, such as Canada and Mexico. Also, Russian shipments to Europe are facing another crackdown. Spot alumina prices have also tumbled recently, undermining the cost floor for smelters. While we see the aluminium market as being tight in early 2025, many of the factors that have boosted prices look set to fade, reducing upside pressure on prices. We are currently forecasting that the three-month LME price rallies to US$2,791/t by Q4 2024, but other markets like copper and tin are likely to outperform the light metal.