6th September 2022: Aluminium prices fell in August, as demand weakness combined with a stronger USD and declining risk appetite. Meanwhile, gas prices surged in Europe and the US, putting 1.2Mt/y of smelter capacity at risk from high electricity prices. Aluminium fundamentals still look lacklustre, but the downside for prices is starting to look limited as high-cost producers are already underwater for both aluminium and alumina. We expect prices to find a floor soon and then rally in the year ahead.

Prices drop on declining risk appetite

Three-month LME aluminium prices fell significantly in August to reach $2,403 by month-end, despite a backdrop of surging European natural gas prices and a margin squeeze on alumina and aluminium producers. However, a small backwardation has returned from Cash-3M of $8, reflecting very low levels of available inventory on the LME.

Speculative interest is still trending lower

Meanwhile, global equity markets have been falling due to fears about recession, amid high inflation and rising OECD interest rates. The USD surged by 3% in August, which is helping to depress investor appetite for aluminium and commodities more generally.

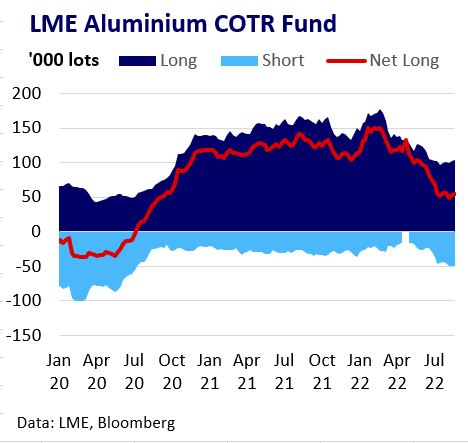

LME COTR data shows that speculative positions in aluminium were a net long 2.9% of open interest (26 August), down from a recent high of 8% in February 2022. There is therefore potential for speculative positions to be rebuilt if risk appetite recovers and the USD turns. There has also been some buying of calls in the options market, which might indicate that downside risks are now becoming limited as prices cut into the upper part of the cost curve for aluminium and alumina. For example, recent days have seen increased interest in $2,600, $2,800 and $2,900 out of the money calls for December 22 expiry. Open interest is currently highest for $2,800 calls at 7,384 lots.

European smelters are collapsing like dominoes

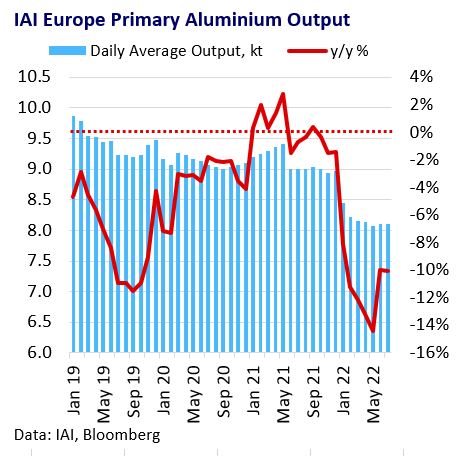

The latest data from the International Aluminium Institute highlight the sharp drop taking place in West European aluminium output, with a 10% y/y fall in July due to rising power prices. Looking ahead the squeeze on European energy supplies looks set to get worse. TTF European natural gas prices were up by 35% m/m (31 August). With the region heading into winter soon and the war with Russia rumbling on, further smelter closures seem almost inevitable. CRU estimates that 720kt of capacity in Western Europe looks vulnerable to closure in the months ahead. Around 550kt of US capacity is also under threat due to high spot power prices.

China is ramping up, but there is limited scope for growth

By contrast, China is still on a growth path. According to CRU data, smelter output rose by 4.5% y/y in July. While the country is facing its own energy problems, the current priority is on growth rather than worrying about the green energy transition, as illustrated by the 19% y/y in jump in coal production in July. Over the medium term there is limited scope for growth in aluminium from here due to the government imposing a 45Mt/y ceiling on producers.

Demand is looking depressed

One of challenges for aluminium bulls is that demand growth is so weak. Growth in China was -1% y/y in the first seven months of 2022, compared to a 5-year average of 5%. The government has been stepping up stimulus measures, but so far they have been mild relative to headwinds coming from Covid-related lockdowns and weakness in the property market. Some leading indicators are turning up though – electricity consumption was up 6% y/y in July and rail freight rose 12% y/y. With China currently accounting for 59% of global demand, it remains a key swing factor for sentiment and the price outlook.

Important Information: All information and materials contained within this note are intended to be confidential and for the use of clients of AMT only. Please ensure that it is not circulated outside your organisation. This publication is intended to be for general information only. It is not investment research (whether independent or otherwise), nor is it intended to be any form of recommendation or suggestion (whether explicitly or implicitly) to buy, sell or otherwise deal in any instrument under the provisions of EU Directive 2014/65 (“MiFID II”). As such, AMT does not regard it as a ‘marketing communication’ because it is not intended to constitute any form of ‘recommendation’ within the meaning of Article 36.2. of the MiFID II Delegated Regulation 2017/565/EU. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing ahead of the dissemination of this information. All information contained within this note is obtained from sources already in the public domain and believed to be reliable but we make no representation as to its completeness or accuracy.