What is the Outlook for Aluminium Prices?

The aluminium market is experiencing an array of supply pressures and threats. Combined with robust demand these have underpinned the metal’s rally to near all-time highs. Supply headwinds from surging energy prices and Ukraine tensions could prove transient. However, decarbonisation goals will constrain output growth in the coming years amid rising demand. This could exacerbate inventory pressures and support long-term pricing.

Price Recap

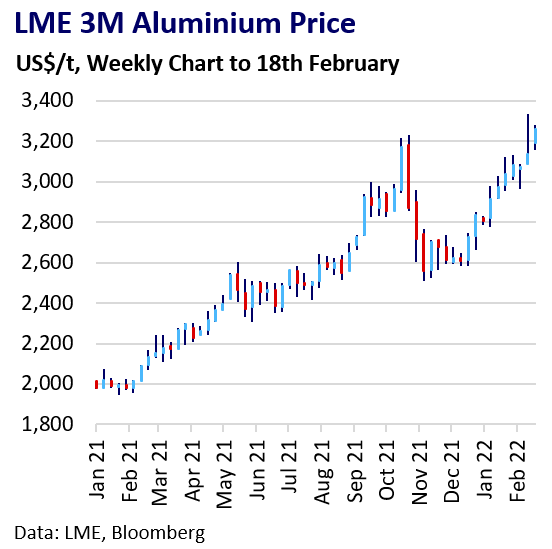

Aluminium prices have rallied strongly since mid-December. 3-month LME prices surpassed October’s high of $3,229 in mid-February and are in reach of 2008’s all-time high of $3,380. This recent surge adds to pandemic-era gains, with prices up 125% from April 2020 lows.

In addition, this month the LME Cash-3M backwardation reached $51.25, the widest since 2018. Physical premiums are at seven-year highs in Europe and record levels in the US.

Current Supply Pressures

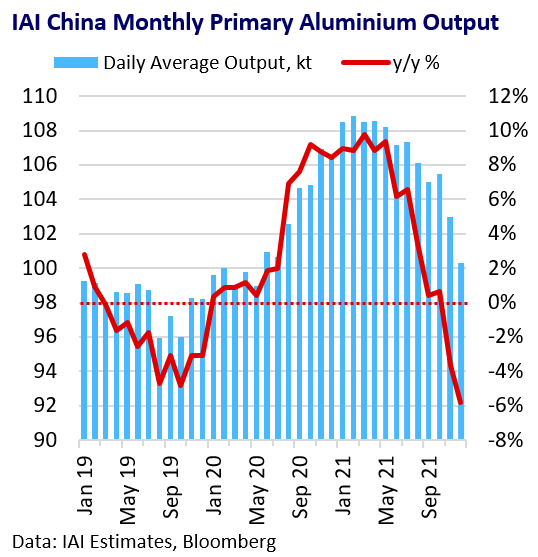

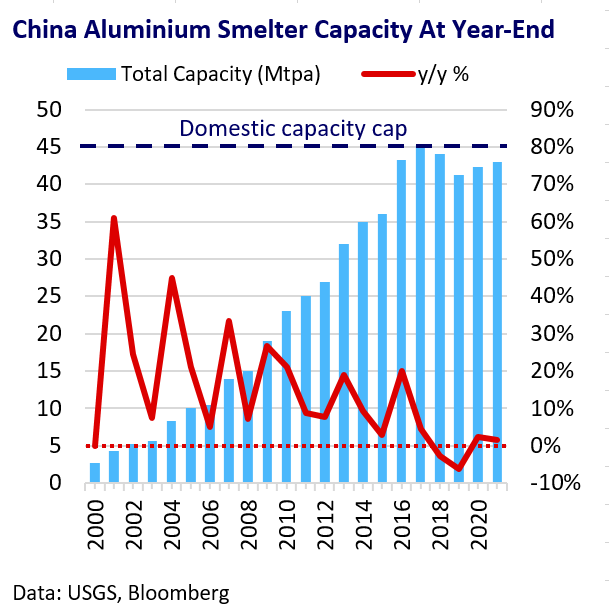

China’s decarbonisation drive and autumn energy shortages significantly hit aluminium smelter output in 2021. However, China’s energy shortages eased in Q4. Environmental shutdowns during February’s Beijing Winter Olympics and Covid-related production halts in Guangxi have also eased.

Winter energy shortages in Europe are now the primary cause of supply constraints. CRU estimates up to 750 ktpa of European smelter capacity could be shuttered by March due to elevated power prices.

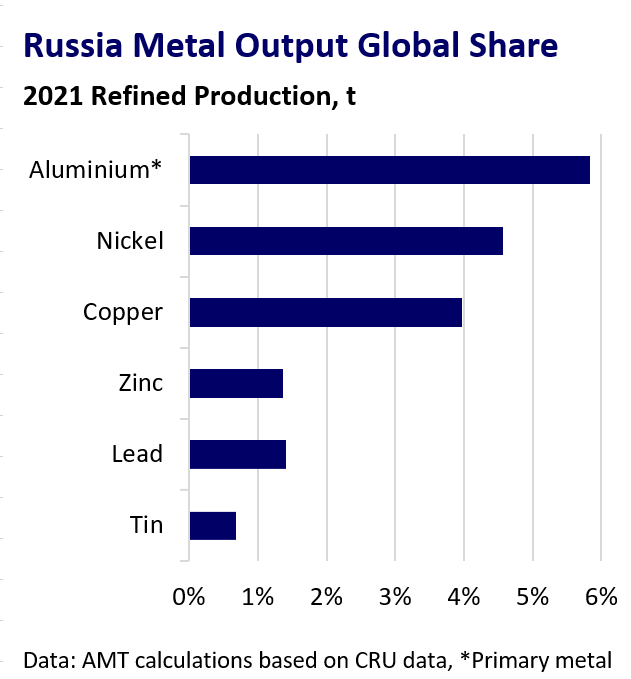

The market is also concerned about disruption to the flow of Russian aluminium and a fresh surge in European energy prices if Russia decides to invade Ukraine.

Norsk Hydro has also indefinitely cut 110kpta of capacity at its 460 ktpa Albras smelter in Brazil after a power failure.

Role of Demand

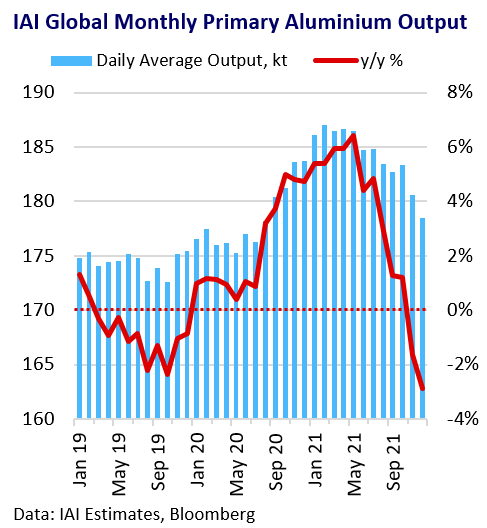

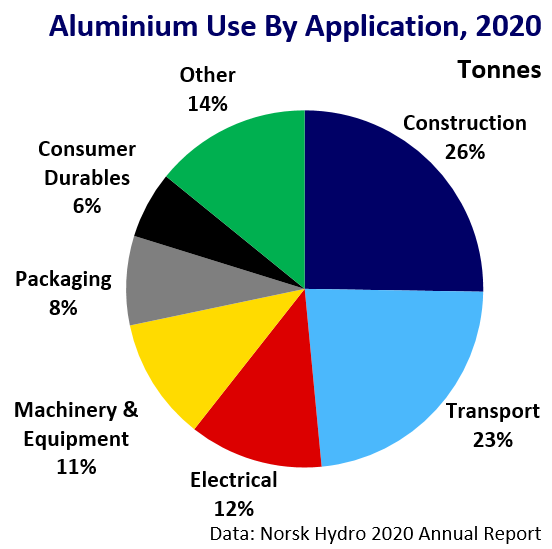

Where production issues acted as the catalyst for higher aluminium prices, robust consumption was the foundation. CRU estimated global consumption rose 9% y/y in 2021 and +14% ex-China.

The post-pandemic economic recovery and strong fiscal and monetary stimulus drove strong global demand growth across key sectors such as construction and packaging. This is despite automotive sector demand weaknesses due to chip shortages.

China’s faltering construction sector was a demand headwind in late 2021, but markets are optimistic that Beijing will bolster China’s economy with easier policy in 2022.

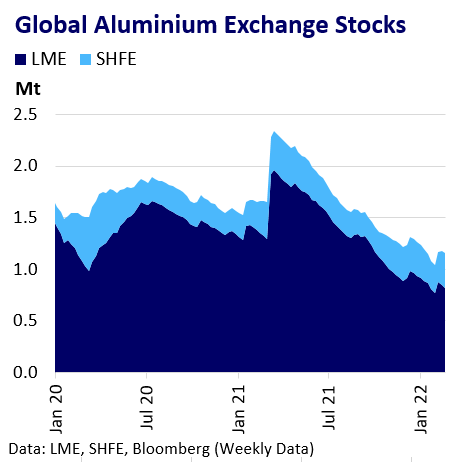

Inventory Depletion

The primary aluminium market saw a global market deficit exceeding 1Mt in 2021 and an equivalent decline in visible and non-visible inventories. Global shipping tightness is exacerbating regional inventory pressures, particularly in Europe and the US.

Inventory scarcity will likely remain a key market driver, with Morgan Stanley forecasting a further 1Mt deficit in 2022. Trafigura has warned of global inventory depletion by 2024.

Long Term Optimism

“Green” demand opportunities such as lightweighting of electric vehicles should underpin steady, but modest, long-term aluminium consumption growth. The Aluminium Association expects global demand to grow 80% by 2050, or 2% CAGR.

The main bullish “green” theme for aluminium is the supply impact of global pressure to decarbonise global energy generation and use. The reliance of China’s aluminium capacity on coal-fired power generation and its hard cap of 45 Mtpa of domestic capacity risks severely constraining supply growth in the years ahead.

Outlook

The situation in Ukraine will remain a key source of headline-driven price volatility in the short term, which could see aluminium prices breach all-time highs. However, the possible easing of Europe’s energy crisis as demand drops in spring and any evidence of Russian military de-escalation could act as headwinds to prices in Q2.

Regardless, sustained market deficits and global inventory pressures will likely persist as a key source of price support in 2022. Tough constraints on global smelter capacity growth as economies try to decarbonise underpins aluminium’s longer-term bullish narrative.

Macro-economic developments remain the primary downside risk for aluminium prices. In particular, growing efforts by central banks to try to temper rampant inflation leave the global economy and commodities demand exposed to recession risks from the tapered withdrawal of pandemic-era support.