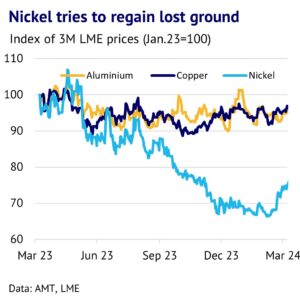

19 March 2024: LME nickel prices have outperformed the rest of the base metals complex in the past month, with fundamentals starting to tighten. The market was in significant oversupply in 2023, but this drove prices down to rock bottom levels and producers then reacted quickly by cutting output. Also bullish is that nickel demand is still growing well, despite weakness in the electric vehicle battery market. We expect LME nickel prices to move broadly sideways in the year ahead, with support at US$15,850/t and resistance at US$20,050/t.

Nickel prices rally, despite weak fundamentals. LME three-month nickel prices are up 6% so far this year (data to 19 March), making it the second best performing base metal during this period. This largely reflects the market’s view that the downside for prices was getting limited, with high-cost producers forced to cut output. Also, short sellers have started to buy back their positions. While nickel’s fundamentals are still weak, the market is slowly tightening. We are currently forecasting that nickel prices move broadly sideways in the year ahead. Prices are trapped between a high-cost floor relative to prices, but the upside will be capped by weak fundamentals and the likelihood of producer hedging, if prices rise above US$20,000/t.

Nickel producers suffer from margin squeeze. One reason for the recent recovery in nickel prices is that a significant part of the industry has been losing money and looming supply cuts will help to tighten the market in the months ahead. In November 2023, LME three-month prices fell to a low around US$16,000/t and prices remained depressed into early 2024. This in turn prompted a wave of closure announcements. In January, BHP, First Quantum and Glencore all started to cut output at loss-making operations in places like Australia and New Caledonia.

The problems for the nickel industry have been building for a while. A wave of investment helped lift mine production in Indonesia from 57kt of contained nickel in January 2020, to 178kt by November 2023, according to Bloomberg data. The next two major mining countries – New Caledonia and the Philippines – saw little change over this period and they lost market share. Indonesia reached 56% of global mine output, up from 26%.

Indonesian mining ban helped fuel downstream boom. The Indonesia government banned nickel ore exports back in 2020 and so this growth in mining, fed into a boom in local production of nickel-containing products, including nickel pig iron and stainless steel. To start with the glut in nickel was unable to reach the LME market directly, because constraints in the supply chain trapped the nickel surplus in Class 2 products (mainly nickel pig iron and ferronickel), while the LME system was insulated at it requires Class 1 nickel (cathode of 99.8% quality or above).

However, the gap between Class 1 and Class 2 has been rapidly closing, as the supply chain adapted in response to economic signals from the market. The LME has been trying to recover from the market dislocation of early 2022 and has been boosting its relevance by listing more brands for delivery from China and Indonesia. This has helped the glut in Class 2 spread into the broader industry. As a result, LME inventory rose by 74% y/y to 78kt by 19 March 2024, which highlighted the market glut. Industry sources estimate that more than half the nickel industry was losing money at the nadir. Macquarie bank estimates that nickel supply outpaced demand by 170kt in 2023.

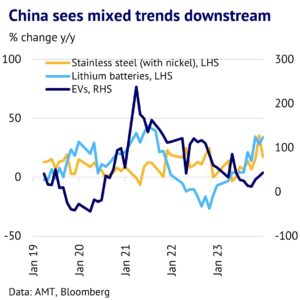

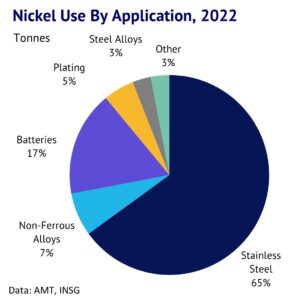

Demand boom was also strong, but not strong enough. The boost to Indonesia supply was also a response to rapid growth in demand, helped by a boom in electric vehicles. Nickel demand grew by 19% in 2021, helped by EVs and a bounce back in economic activity after the Covid pandemic. However, demand growth slowed into 2022 and 2023 to around 6% in both years, according to CRU estimates. While the Chinese economy held up well during the pandemic, EV sales were down sharply in early 2020, before booming in 2021 and then slowing once more in 2022 and 2023, as we show in our chart.

While the initial boom in EVs required a lot of nickel in batteries (28-43kg per battery), China is now finding cheaper alternatives, with LFP batteries (which contain no nickel) now a favoured technology for small cars. According to Adamas Intelligence, LFP technology captured 31% of the global EV market in November 2023. Nornickel estimates that nickel used in batteries fell by 1% in 2023, due to headwinds from LFP and destocking. The Chinese stainless steel market also saw a downturn in late 2023, with growth slowing to 4% y/y by December. Looking ahead, prospects look brighter for global nickel demand, but we expect production to remain responsive to both higher demand and prices. This will cap nickel prices for the foreseeable future.