31st January 2023: Last year was a weak period for most of the base metals and prices trended lower through the year, although nickel was an exception and followed its own bullish path. By contrast, aluminium, copper, tin and zinc prices have all rallied this year, despite a weak fundamental backdrop. While there is currently a clear disconnect between fundamentals and recent price action, we remain bullish for the year ahead for aluminium, copper and tin. On the other hand, we are bearish for nickel and zinc and neutral on lead. Inevitably, Chinese demand will be a key driver for all markets and we expect to see a strong bounce back in demand in the weeks and months ahead. This will help to underpin the complex and will create a very tight market for copper.

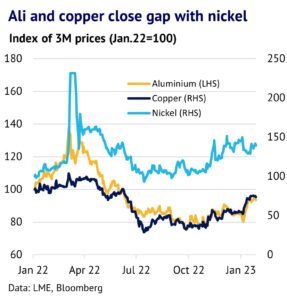

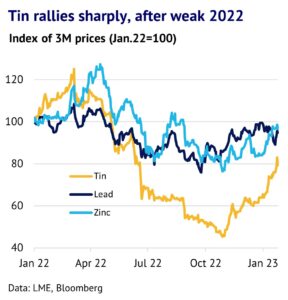

Base metals tumbled in 2022, although nickel followed its own path. Last year was a volatile one for base metal prices. Prices across the complex were buoyant in the first four months of the year, amid Russia’s invasion of Ukraine, but they fell sharply in the remainder of the year, as US interest rates were hiked in response to rising inflation. Aluminium, copper and zinc all fell by around 15% during the year, with tin down by 35%. Lead held up relatively well with prices little changed by year-end. Nickel was a notable exception and prices ended the year up 46%, This was due to short-covering and lower volumes, after a market crisis and LME intervention earlier in the year. Other base markets were largely driven by macroeconomic and political factors, while fundamentals were of largely overlooked.

Economic slowdown started to be felt, after Ukraine invasion and inflation spike. Last year saw global economic activity slow sharply and inflation surge. This was due to Russia’s invasion of Ukraine and because of supply-side challenges due to tight labour markets and Covid’s impact on supply chains. Global GDP fell 3% in 2020 (due to Covid lockdowns), then rose 6% in 2021, before slowing to 3.2% in 2022. CPI inflation jumped from 4.7% in 2021 to 8.8% in 2022. According to Oxford Economics, 2023 will see GDP growth slowing to just 1.3%, while CPI will remain high at 5.3%.

China has gone through a rough patch, but future looks brighter. While the world economy looks set to slow, China is following its own path, set by Covid and government stimulus measures. Last year saw severe lockdowns hampering economic activity in both Q2 and Q4. The country was slow to move away from its zero-Covid policy and vaccination rates were low compared to global levels. As a result, a massive wave of infections swept through China in December 2022 and January 2023.

While Covid is currently causing problems in terms of labour shortages and logistical bottlenecks, we do not expect these to cause long-lasting damage. The Chinese government is worried about slow growth and has been stimulating the economy through fiscal and monetary policy, with extra measures being directed at the construction/property market to boost confidence. Oxford Economics is forecasting that GDP growth in the country accelerates from 3.1% in 2022 to 4.2% in 2023 and 4.7% in 2024.

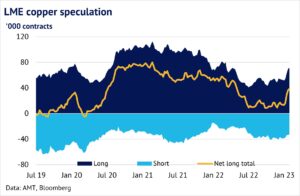

Copper price to rally, with speculative positions to rise from moderate level. In terms of the base metals, we expect to see significant divergence across the complex in terms of price trends and market balances. We are most bullish on copper for the remainder of this year. By December, we expect 3-month prices to average USD 11,417/t, up 30% from its 2022 average. Fundamentals will remain supportive. We expect both production and consumption growth to accelerate from last year and the market should remain in deficit. We also see scope for speculative positions to keep growing from here, which will help to underpin prices. According to the LME’s most recent COTR report (week ending 27 January), speculative net longs have risen for four weeks in a row, but are still just 51% of the historical range i.e., they could double from where we are now.

In terms of key risks, mine supply from Latin America could easily disappoint, as structural problems continue to hamper producers in Chile. The Covid crisis delayed progress with key projects and the government is predicting modest 2% growth for this year and has revised down its longer term forecast by 6%. Anti-government protests are also creating problems in Peru, where the large Quellaveco mine is due to boost country output by 17% this year. Furthermore, countries such as Mongolia and Panama are proving to be unpredictable sources of supply, due to ongoing disputes about profit sharing between miners and governments. Copper will also get an extra boost from the green energy transition, which is helping sectors such as electrical vehicles and renewable energy.

Tin to follow copper higher, helped by mining challenges. We are also bullish on tin and expect 3-month prices to rally to USD33,174/tonne by December 2023. Similar to copper, we expect both supply and demand growth to accelerate this year and the market should remain in deficit. In this case, the market is particularly reliant on Indonesia, which accounts for 20% of world mine supply. The government is trying to restrict refined tin exports and capture more of the value-chain by consuming more tin domestically. In addition, Peru accounts for 9% of world mine supply and anti-government protests are taking their toll on operations, such as the major San Rafael mine.

Meanwhile, China has significantly boosted its imports of refined tin. Imports soared from 4.9kt in 2021 to 31.3kt in 2022. Given that demand was relatively weak, this suggests that speculative and strategic stockpiles have been building in the country. In the remainder of this year there is scope to draw down these stockpiles, but with LME stocks at very low levels we still see a tight market as China pulls out of its recent slump.

Aluminium to rally, but headwinds to come from capacity overhang. We are also bullish on aluminium and expect the three-month price to rally to average USD2,930/t by December 2023, an 8% rally from its average in 2022. China once again proved to be a key swing factor last year and this year trade flows will inevitably be important for LME prices.

The first half of 2022 saw an unusual situation, with China exporting significant tonnages of aluminium. However, this proved to be short-lived and by December 2022 net imports decisively returned, reaching 127kt. While some smelters were struggling with power shortages in Q4 2022, output held up reasonably well; CRU figures indicate 6.3% y/y growth for the quarter. Meanwhile, demand growth was 2.8% y/y. Overall, China stockpiled significant amounts of metal in Q4,

even though visible inventories trended lower (CRU calculates a 228kt drawdown in their warehouse survey). Some of this started to appear in January 2023, when SHFE rose by 135kt and other warehouses saw a 278kt inflow.

Looking ahead to the remainder of this year, we expect both consumption and production growth to accelerate and the market should be broadly balanced, with a small 72kt deficit. In terms of consumption, we are expecting China to emerge strongly from its recent Covid-slump and there should be a V-shaped recovery due to strong stimulus measures, which are already in the pipeline. In terms of production we also expect decent growth, helped by some smelters restarts in Europe as well as increased output in China. There is the potential for sales of excess inventories to dampen the price outlook, but we see this as a minor risk to our price forecast.

Lead, nickel and zinc markets to be in surplus and prices to fall. For the remaining base metals, we expect to see prices trend lower in the remainder of this year. Lead and zinc are both expected to move into surplus from a deficit last year, helped by smelter restarts. Nickel is expected to remain in surplus for the second year running. Comparing our forecast for December 2023 with the average for 2022, we expect to see lead, nickel and zinc prices fall by 5%, 10% and 11% respectively.

Base metals should benefit from China bounce back. One of our key assumptions for the base metals complex is that Chinese demand will accelerate strongly in the weeks ahead, which should help to tighten all markets. Looking at daily data for metro movements across thirteen key cities we can see that activity in China slumped in November and remained very weak into mid-December, before recovering after the Chinese New Year (CNY) holiday, which started on 22nd January. February should see activity starting to recover more strongly and we will be following this closely. Moreover, seasonality trends also look favourable for the short-term. Copper, for example, normally has its strongest increase for the year in February of 4.4% (based on 20-year seasonality trends). For aluminium, February is the second-best month of the year. Potentially funds and fundamentals should therefore combine to create a bullish cocktail for the weeks and months ahead, with copper set to outpace its base metal peers.

Important