15th May 2023: Base metal prices have diverged so far year, as fundamental drivers have started to reassert

themselves. In particular, tin was supported by concerns about supply shortages, due to problems in Myanmar

and copper prices have been resilient, helped by the green energy transition. By contrast, significant weakness

was seen in aluminium, lead, nickel and zinc, with fundamentals looking lacklustre. Looking ahead, we expect

copper and aluminium prices to remain weak in the short-term before rallying in H2 2023. Zinc prices are forecast

to keep falling, reflecting weak signals from the construction market in China.

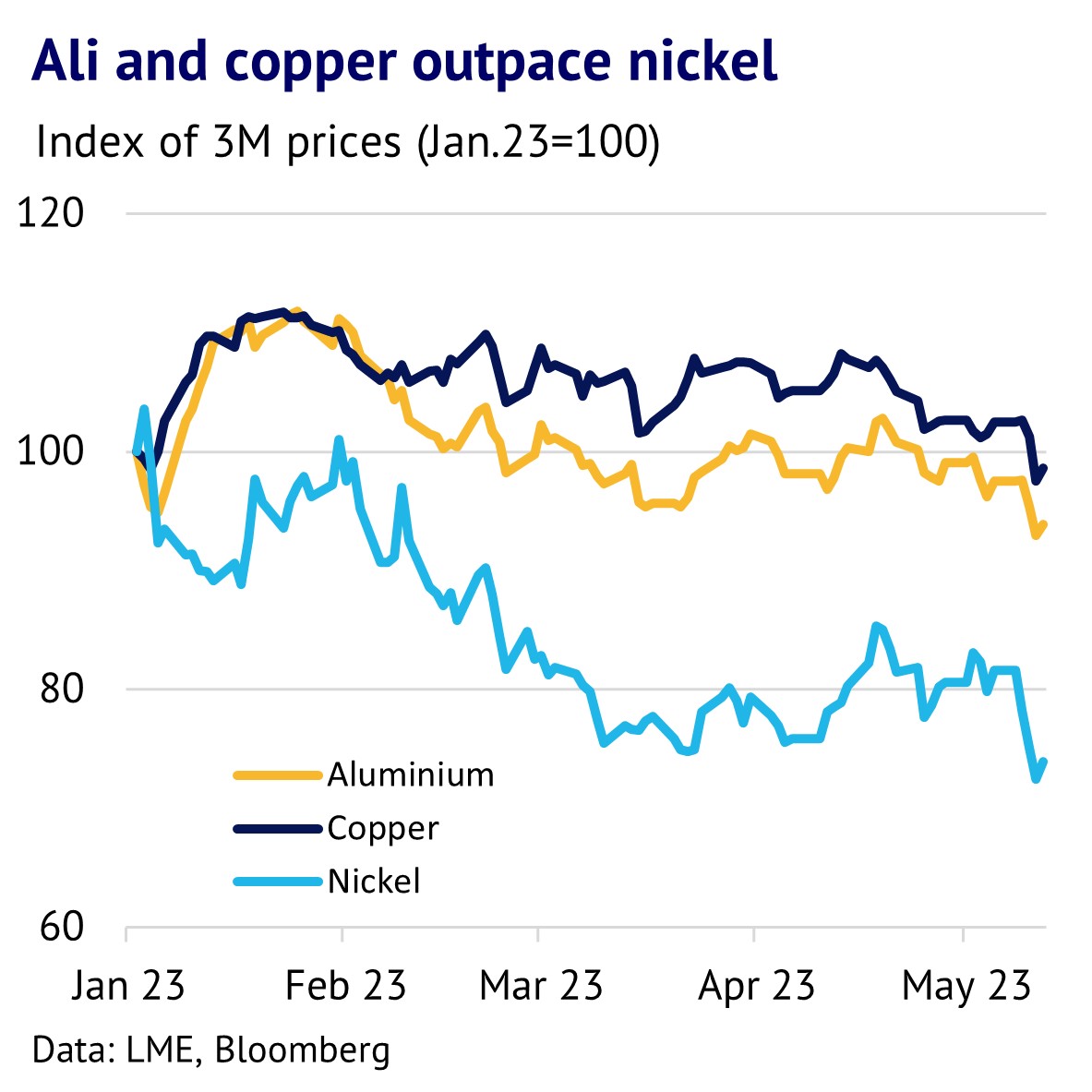

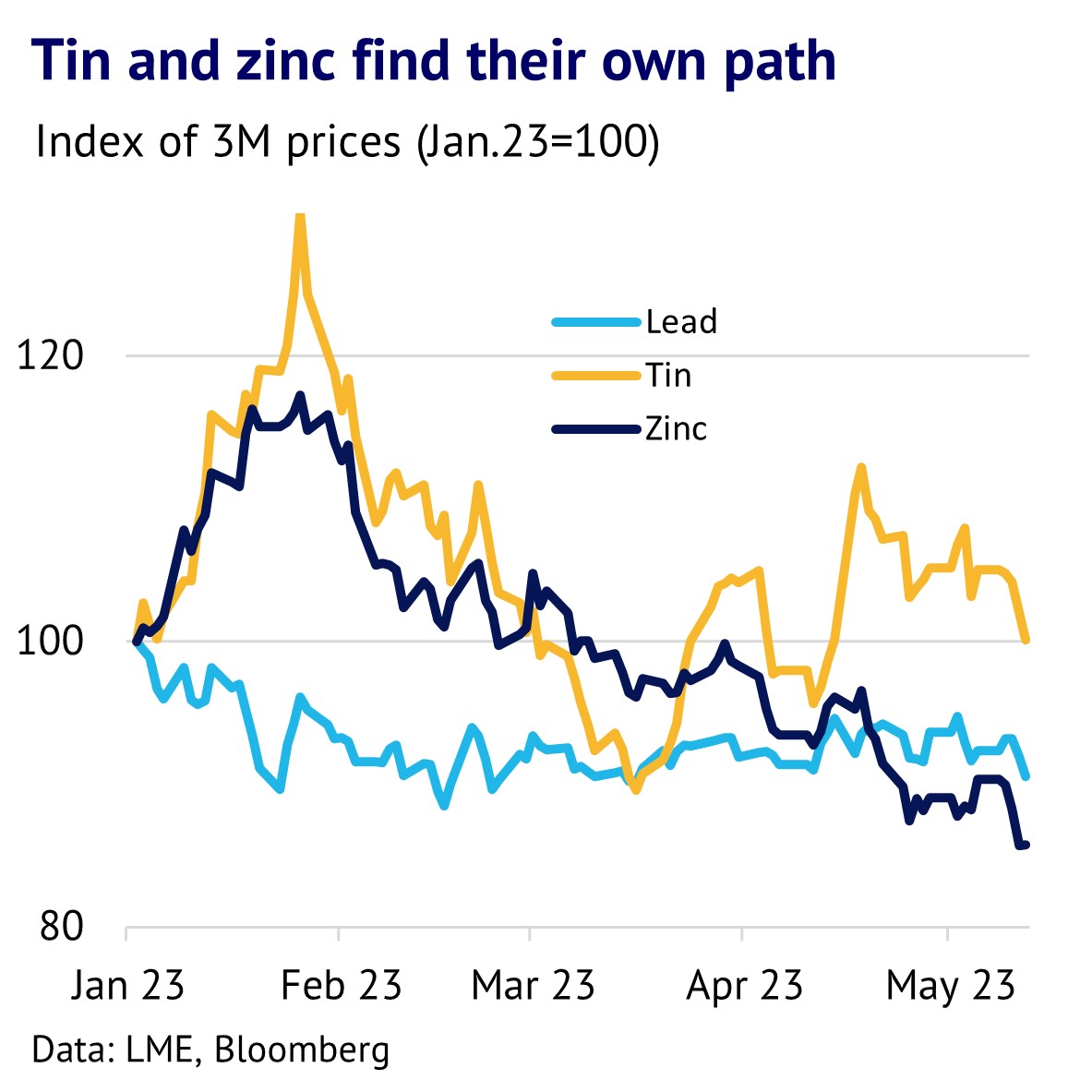

Base metals see mixed price trends in early 2023. The first part of this year saw diverging trends across the base metals

complex. While risk appetite returned and China improved after its Covid-related slump, fundamental drivers started to

reassert themselves, particularly concern that supply might be insufficient in some cases, amid a decent medium-term

demand picture. Three-month LME tin prices were firm, helped by fears about a mining shortfall in Myanmar, while copper

prices were little changed, with strength in Q1 being offset by weakness in April and May. By contrast, aluminium, lead,

nickel and zinc prices trended lower.

China’s economic bounce back is patchy. This year has seen a strong recovery in the Chinese economy, but there are pockets

of weakness hidden beneath the surface. Bulls took heart from Chinese GDP growth which accelerated to 4.5% in Q1, up

from 2.9% in the previous quarter. However, the official manufacturing PMI dropped to 49.2 in April, down from 51.9 in

March – below 50 indicates recessionary conditions. The construction market is also showing mixed trends, giving

ammunition to both bulls and bears. While new home sales rose 4% y/y in March, property starts were down 19% in the

same month. Overall, while economic data has been mixed, some base metals have been benefitting from the green energy

transition, which is creating a nuanced picture.

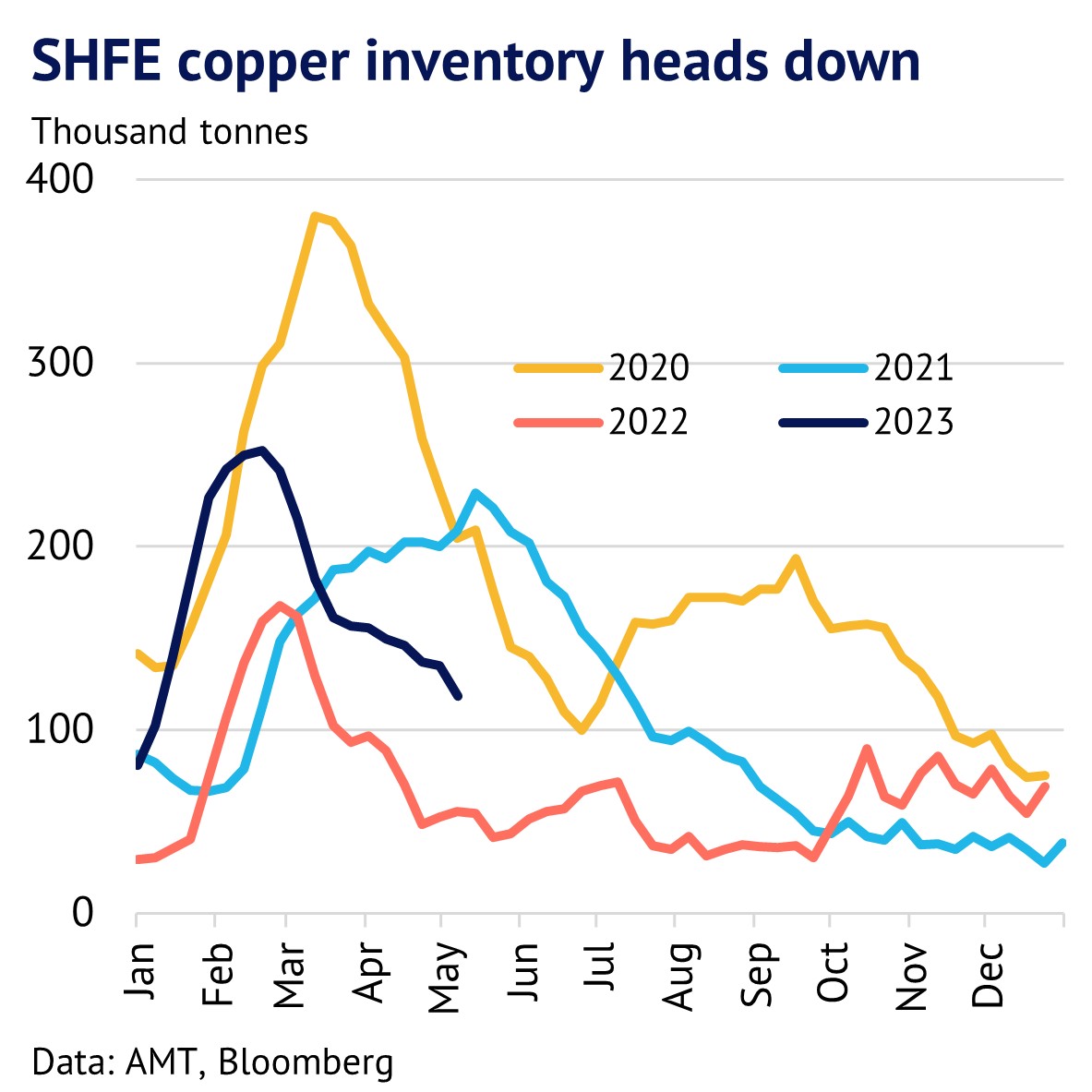

SHFE metals inventory is up, but this is not bearish. The first part of this year has seen a substantial build in SHFE inventory

(on-warrant and cancelled) for aluminium, copper and zinc of 113%, 71% and 189% respectively (data to 12 May). However,

this happens virtually every year, as demand slows around the Lunar New Year holiday period, with February seeing the

most significant build. Moreover, in April this year there was an unusually large drop in copper inventory of 38%, compared

to an average drop of 14% m/m over the past 10 years. Also, the Chinese market is heading into a tighter period from a

seasonal perspective as copper has typically seen an average 35% drop in May and June combined. All of this suggests low

inventory levels should be expected in China in the second half of this year.

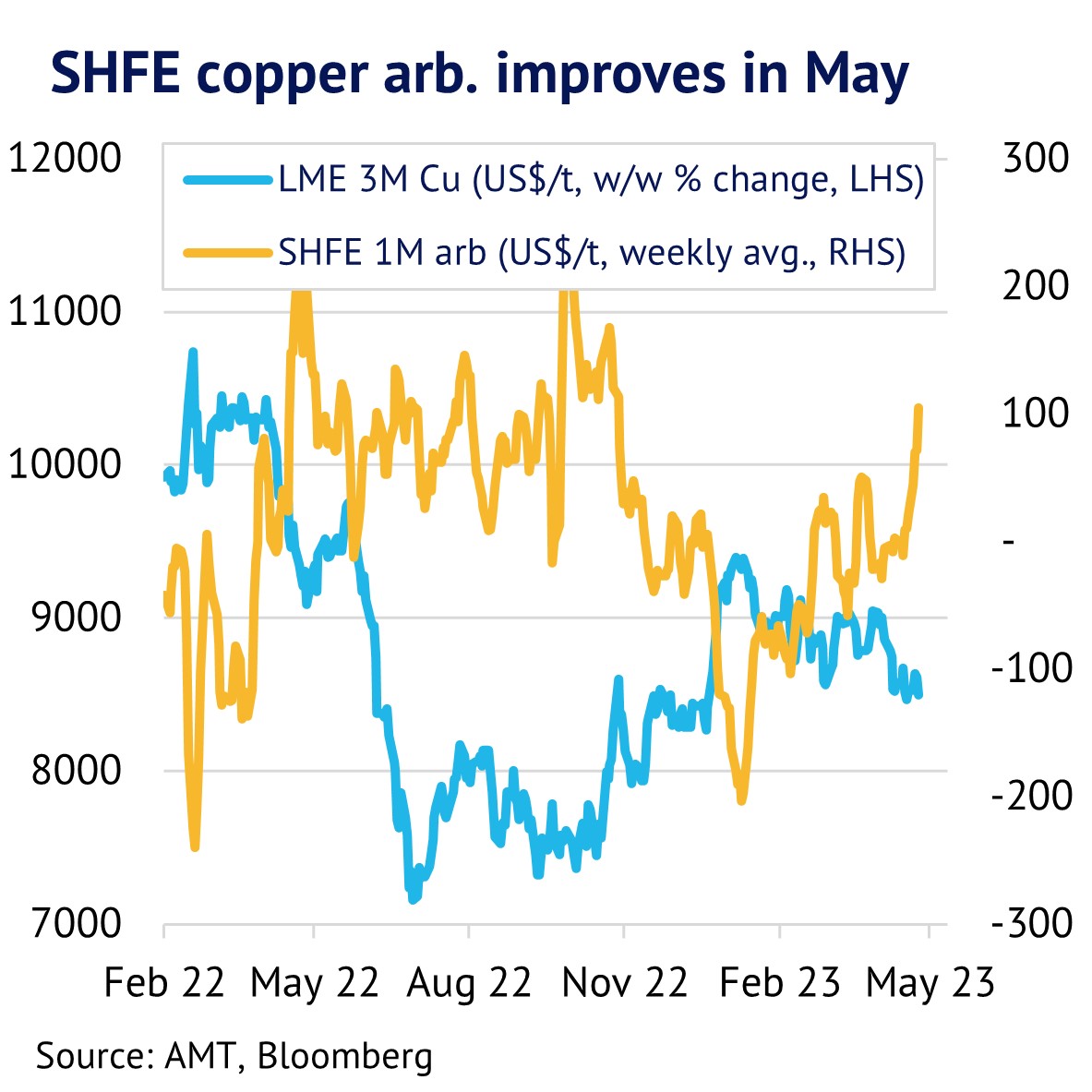

SHFE arbitrage tightens for the three largest base metals. Another way of assessing the state of the Chinese market is to

track the arbitrage between SHFE and the equivalent LME price. When the SHFE price is above the LME one, there is an

incentive to import more metal. We can see in our chart that SHFE copper was trading at a significant discount around US$-

200/t in February and as a result refined copper exports rose above 40kt. However, in May the Shanghai market moved into

positive territory, indicating fewer exports are likely for the time being, consistent with a tighter global copper market. The

aluminium market also looks tighter, with the 1M SHFE price trading at a US$56/t premium to the LME on 12 May and SHFE

zinc also moving well above the London price.

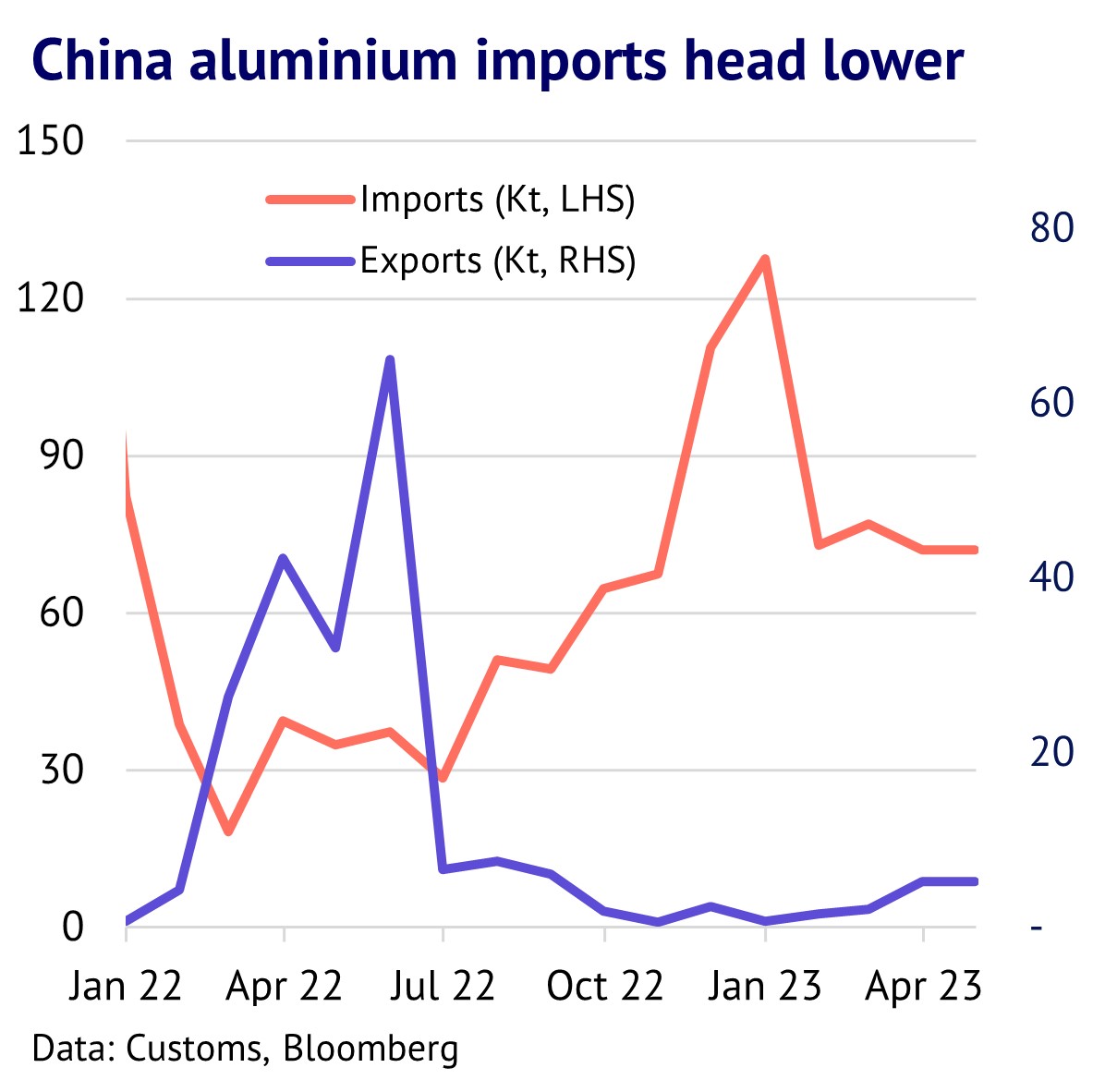

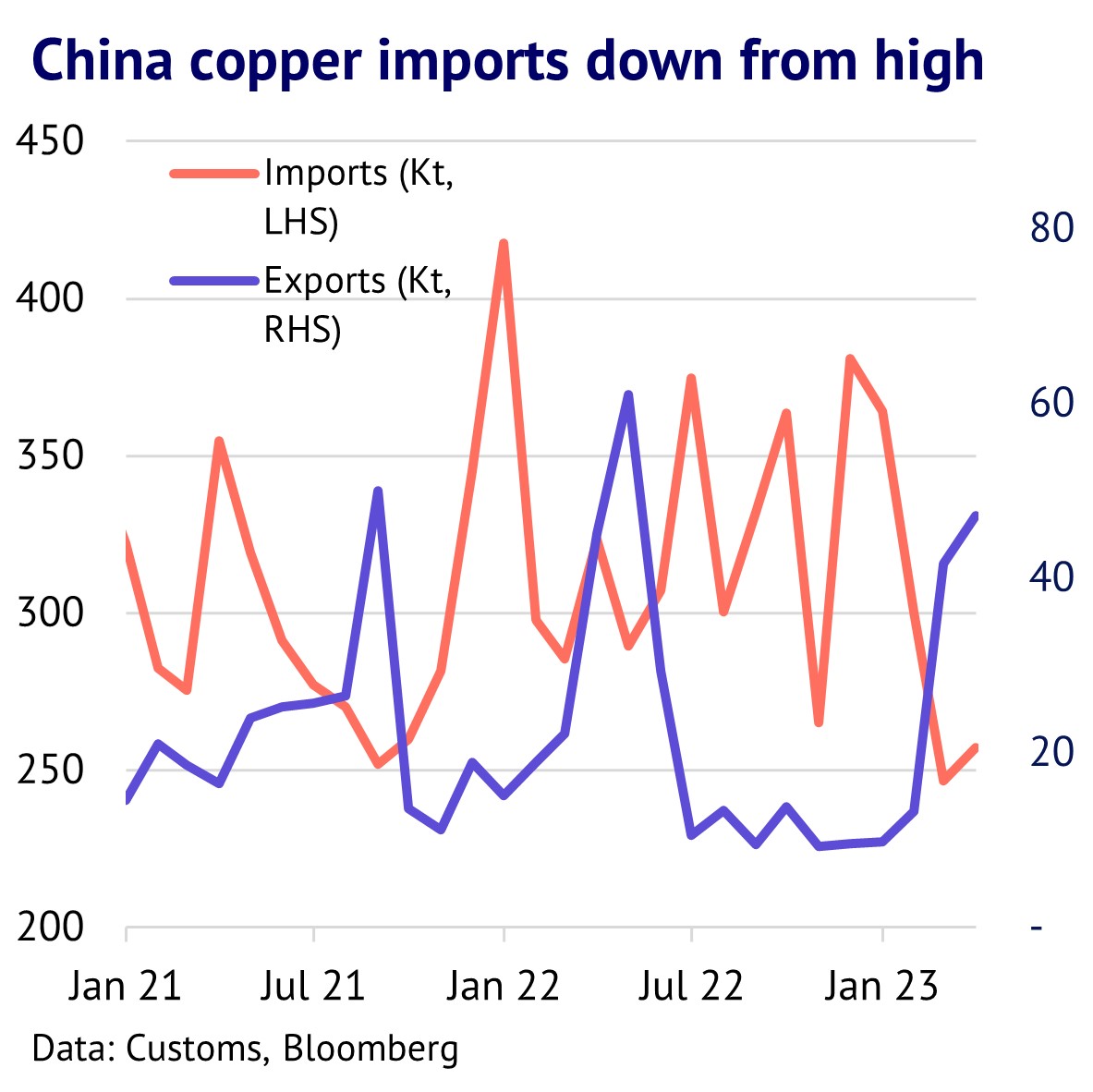

China trade data looks mixed. Ultimately the impact of China on the world picture is felt through trade and here the story

is moderately bearish for aluminium and copper, but bullish for zinc. Net imports of primary aluminium surged to 213kt in

Q1 this year, up from a modest 24kt in Q1 2022, but on a monthly basis net imports are down from their December 2022

peak of 127kt, at 67kt in March 2023. Similarly for refined copper the trend has been mildly bearish, with net imports falling

to 701kt for Q1 2023, down from 820kt in Q1 2022. China seems comfortable for the time being with reducing imports and

letting domestic inventory levels run down. By contrast, net zinc imports rose to 12kt in March – a 12-month high.

Global copper and zinc supply set to increase … The global

market for copper is also looking softer for the months ahead. In terms of copper mining, Q1 was very tight with Latin

America struggling to cope with political unrest in both Chile and Peru. Moreover, the large Tenke Fungurume mine in the

DRC was forced to stockpile metal due to a dispute with the government. However, by early May, disputes in both the DRC

and Peru had been largely resolved, which resulted in increased exports in both cases. This boosted Asia spot TCs to US$83/t

by early May, up from US$75/t a month earlier. Meanwhile for zinc, CRU estimates that global production will increase by

1.6% y/y in the second quarter of this year, helped by strong growth in China.

… but production challenges are significant for aluminium. Aluminium production, on the other hand, is heading in the opposite direction. China is being forced to cut smelter production in response to reduced hydroelectric power in places like Yunnan province. According to CRU figures, average daily output in March fell 1% m/m – the third consecutive m/m drop. Global output was also down 1% m/m, with falls in all key regions, except for North America.

Aluminium demand drops in first quarter. However, aluminium consumption looks depressed and this is likely to push prices down in the short-term. CRU estimates that global consumption was down by 5.9% y/y in Q1. Weakness was spread across the world, with China down 3%, with Europe down a sharp 16% y/y, while North America was down 6.9%. The most recent order data from the Aluminum Association suggest that these problems in North America will extend into Q2, with a 12.6% y/y fall in March.

Copper and zinc demand provide upside surprise. Copper consumption, by contrast, is proving to be resilient and is still trending upwards. Global growth averaged a decent 1.8% in the period 2018 to 2022, despite the headwinds from Covid-related lockdowns. While global manufacturing growth was depressed in the first quarter of this year (PMI data for March fell to 49.6), copper demand still grew by 1.6% y/y, according to CRU figures.

Copper received a significant boost from the green energy transition, with sectors such as electric vehicles (EV) particularly important. EVs contain 3-4 times more copper than a traditional vehicle and sales are growing rapidly. For example, in China, sales of EVs rose by 22% y/y in March. The rollout of solar and wind power in China and the OECD countries is providing an extra boost for copper. Global zinc demand has also been resilient and grew by 0.3% y/y in Q1, which was a notable improvement on the average 1% fall during the previous five-year period.

A complicated picture for base metals. In summary, the base metals have seen different price trends in the early part of this year. Aluminium has fallen, with demand looking very weak, but production has also started to fall both in China and the rest of the world. Overall fundamentals look lacklustre, which will weigh on prices for the short-term.

In terms of copper, demand is looking relatively strong, but supply should receive a temporary boost from the easing of bottlenecks in both the DRC and Peru in the months ahead. We remain bullish though in terms of the medium-term picture. Finally for zinc, the latest signals from China are mixed. SHFE has moved into a premium over the LME and net imports have picked up. Global demand has also proved to be resilient in Q1.

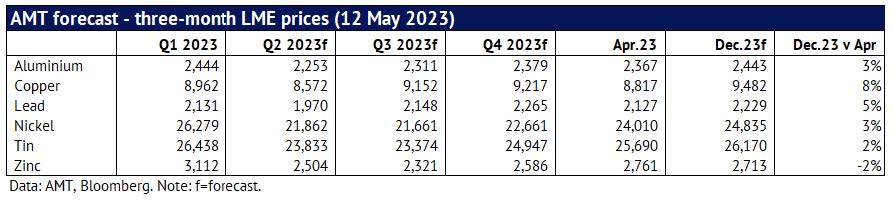

We expect base metal prices to remain weak in Q2, but then rally by December. In terms of our price forecast for the remainder of this year, we take into account seasonality, the outlook for fundamentals and market sentiment and also whether we believe that markets are correctly pricing in all these factors. Comparing LME three-month prices for December 2023 with April 2023, we expect copper to lead the way higher with an 8% rally (see table below). After recent sharp price falls, we are also moderately bullish on the rest of the complex and expect aluminium, lead, nickel and tin to rally. By contrast, zinc is expected to fall by 2%, reflecting ongoing weakness in the China construction market.