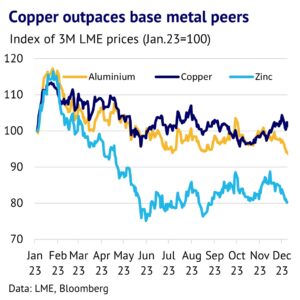

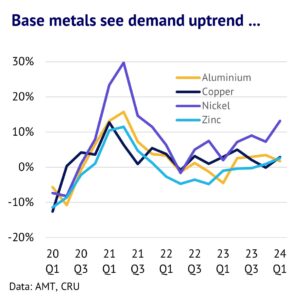

19 January 2024: After a weak start to 2024, the major LME base metals are likely to trend higher in the year ahead. Interest rates are expected to fall and key parts of the global economy, such as China and the US should continue to grow. Furthermore, base metals demand is receiving a significant boost from the green energy transition and is trending up in early 2024. Supply growth, on the other hand, is coming down from its recent peak and setbacks in copper mining highlight the disconnect between hopes and reality for the sector. Inflationary pressure is likely to lift the cost floor for base metals and this will help to support prices, as investors buy back short positions, amid a general improvement in global risk appetite.

Prices should trend higher in the year ahead, reflecting upward cost pressure and inflation. We have a bullish view on the base metals complex for the year ahead, despite the drop in prices in early 2024. Our forecast takes into account, seasonality, fundamentals and market sentiment and whether markets are correctly pricing in all these factors.

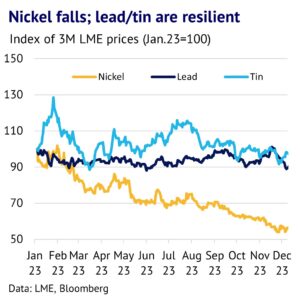

Historical trends give us a good guide to the future. The average increase in LME three-month prices over the past 20 years was a significant 1.05% per month, with strength concentrated in Q1. Nickel and tin saw the greatest gains, followed by lead, copper and zinc. Aluminium was the weakest performer. Our forecast assumes that these trends will extend into the future, but strong fundamental factors can potentially override inflationary factors on a one-year view or moderate the normal uptrend in prices. Overall, we expect copper and tin prices to outperform the rest of the complex in the year ahead.

Global economic outlook should remain supportive, amid lower US rates and Chinese government stimulus. In terms of the year ahead, the US economic outlook looks positive and interest rates are likely to come down this year, helping to support base metals demand. Recession risks for the country receded in Q4 2023, despite high interest rates and the labour market remained tight. This should be close to the “Goldilocks” type slowdown that central banks have been wishing for.

Meanwhile, the Chinese economy is still in reasonably decent shape (GDP growth was 5.2% y/y in Q4) and problems in the property market are being contained. The government added extra stimulus measures in Q4 2023, which should lift GDP in 2024. Also, further stimulus is planned, including a USD139bn debt issuance via sovereign bonds to fund projects relating to food, energy, supply chains and urbanisation. Globally the base metals are receiving an extra boost from green energy related sectors, such as electric vehicles, wind and solar PV. For example, BNEF is forecasting 21% growth in global EV sales in 2024.

Upside risks for net speculative positions, with inventory levels very low. Investor sentiment is already depressed, reflecting concerns about the Chinese economy, increased tensions in the Middle East and the ongoing battle against high inflation in the OECD area. However, mean-reversion is likely from here as interest rates fall and we expect LME net speculative positions to trend higher in the year ahead, which will help to boost base metal prices. Exchange inventory levels remain low, which is an additional bullish factor.

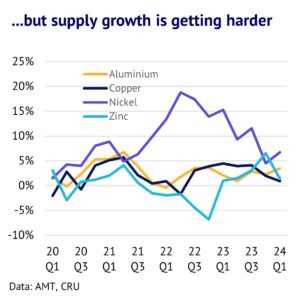

Producers are facing many challenges, as ESG lobby restricts growth. Global mine supply growth remains very challenging across many of the base metals, amid a backdrop of resource nationalism and pressure from the ESG lobby to stop investing in extraction and mining. Moreover, low prices are forcing high-cost mines to close or cutback. We show in our chart that production growth across the key base metals is set to trend down into Q1 2024, according to CRU forecasts.

In copper, for example, recent problems in Panama highlight the difficulties faced by miners trying to diversify away from traditional mining areas, such as Chile and Peru. In aluminium, the industry has become over reliant on Guinea for bauxite supply, which is representing a threat to Chinese smelter supply.

Building a new mine takes around 16 years, meaning supply is inelastic. The typical time taken to develop a new base metals mine is getting longer and now stands at around 16 years (this including the whole process of government permitting and building the mine/related infrastructure), according to S&P Global, which means that there is limited scope for supply to adjust to improved demand. While market sentiment is currently depressed, we do not expect this to last for too long.

Our latest price forecast table is available on request and has our forecasts to Q1 2025.