Base Metals Prices Pull Back From Early March Extremes

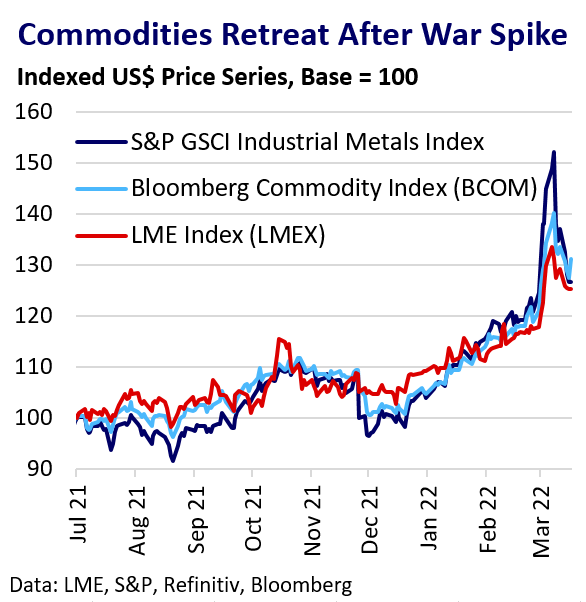

Base metals prices have retreated from early-March extremes. Risk-aversion hit the complex despite tight underlying physical markets and feared disruption to Russian supply amid sanctions. Damaged confidence in the LME and liquidity issues following nickel’s price spike and trading halt, hopes for a diplomatic resolution to the Ukraine war, and risks to growth from higher inflation and China’s Covid resurgence have all weighed on pricing.

Price Recap

Russia’s invasion of Ukraine and Western sanctions acted as the catalyst for rampant commodity price gains in late February and early March.

Energy markets led the sector higher, with precious metals and wheat also seeing aggressive rises. All of the major six LME base metals except lead surged to fresh all-time highs.

Most commodities have since pared gains, with all LME base metals except zinc and nickel now back to below pre-war levels.

LME Liquidity Crunch

The historically unprecedented pace of LME nickel’s move higher was a result of a self-reinforcing spiral of short covering and price hikes. This occurred as short-position holders, including top China producer Tsingshan, struggled to meet escalating margin call requirements.

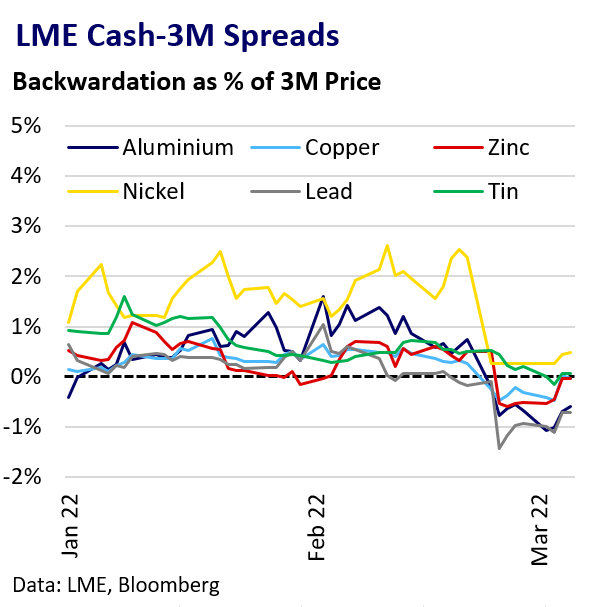

This scramble for liquidity affected other metals, with nearby spreads pushed into contango amid a reluctance to tie up capital financing metal.

The suspension of the LME nickel contract and reversal of trades executed on the 8th of March also damaged confidence in the LME among parts of the fund community, incentivising outflows.

The return of a negative roll yield across most nearby base metal contracts for long-position holders likely supported long liquidation, particularly by investors.

Ukraine War Volatility

The threat of disruption to Russian metal and energy exports due to Western sanctions was a key driver of price gains to recent extremes.

Markets appeared to have priced in a worst-case trade disruption scenario that has not yet been realised. In reality, there is no evidence yet of a de-facto embargo on base metal and energy flows, which remain largely exempt from sanctions. However, many consumers are reportedly taking steps where possible to secure alternative suppliers to Russia for practical and reputational reasons.

The recent commodity-price pullback therefore partially represents a decaying risk premium for Russian supply disruption, helped by signs of growing willingness by Russia and Ukraine to negotiate an end to hostilities. However, fresh escalation of military activity, sanctions, or a collapse in peace talks could all spur renewed gains.

Covid Resurgence

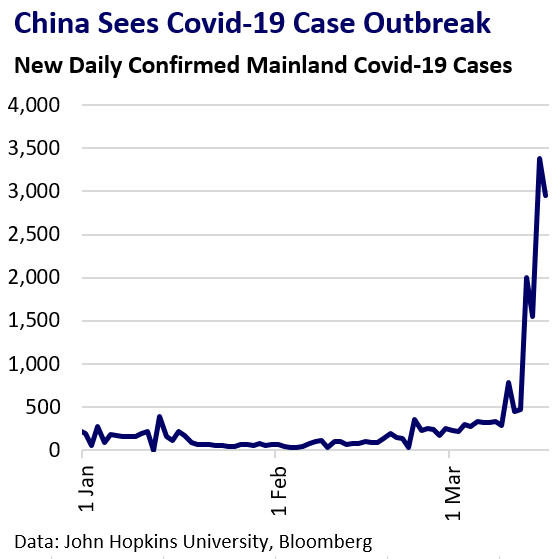

Resurgent Covid cases are also weighing on global growth prospects and commodity prices. China is in focus although Europe is also tackling rising cases.

China has maintained its zero-Covid approach as it struggles to contain its worst outbreak in two years. Reported infections have surged in over a dozen provinces. The tech hub of Shenzhen and industrial hub of Changchun were both locked down this week while Shanghai is under strict restrictions, although there are now signs that measures are easing.

Risks here to metal prices appear skewed to the downside, as the locked-down areas are key hubs for metal consumption. However, likely disruption to port activities may extend global supply-chain woes. Combined with a likely slowdown in China’s manufacturing activity this risks exacerbating global inflationary pressures.

Inflation Considerations

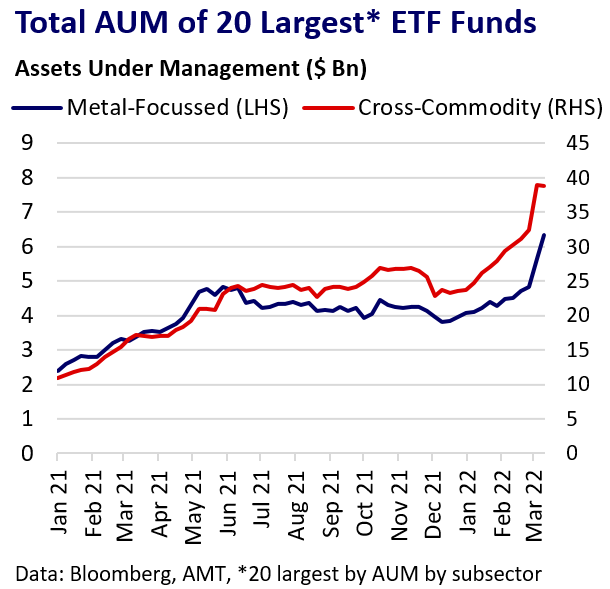

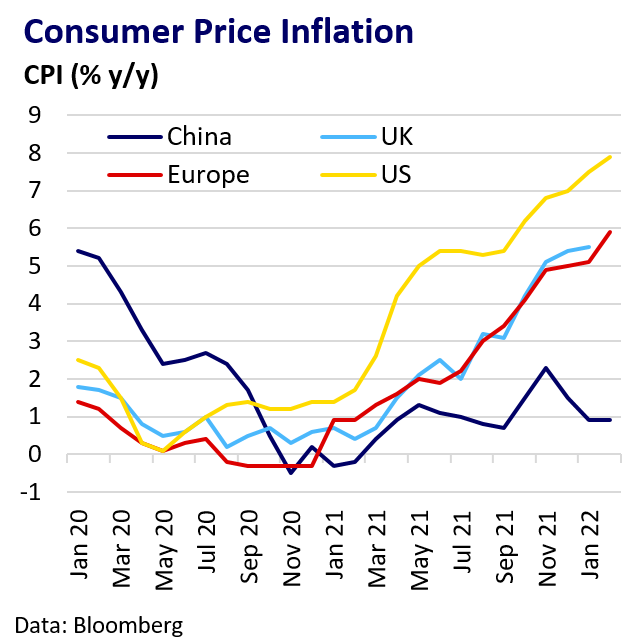

Commodities’ utility as an inflation-hedging asset has supported metal prices over the last year as investors increase their allocation to the sector.

However, while the “reflation” trade defined 2021, “stagflation” will likely define 2022 as excessive inflation risks undermining economic growth. This is observable in recent faltering equity market valuations.

Industrial metals may be less desirable as an inflation hedge in a stagflation environment as the underlying physical markets are far more vulnerable to demand shocks; Leading Central banks will try to temper high inflation through tighter monetary policy, in effect slowing global economic growth to bring it more in line with supply.

Outlook

Prices clearly moved too far and too fast earlier this month on LME market dysfunction and panicked pricing of Russia supply risks. LME liquidity issues, the war in Ukraine and China lockdowns will continue to direct prices and drive volatility in the weeks ahead.

However, base metals remain fundamentally tight markets with low inventories. It is hard to see a near-term solution without demand destruction at higher metal prices or a severe global demand shock triggered by strong energy prices and or tighter monetary policy.