Why is china facing obstacles?

Strong growth in China aluminium smelting capacity and primary output over the last year have weighed on aluminium market sentiment and kept the global market in surplus. However, fresh determination in China to clamp-down on energy-intensive and high-carbon industries threaten approvals for new projects and expectations for continued supply growth in 2021 and the years ahead.

Recent Drivers of China Aluminium Supply Growth

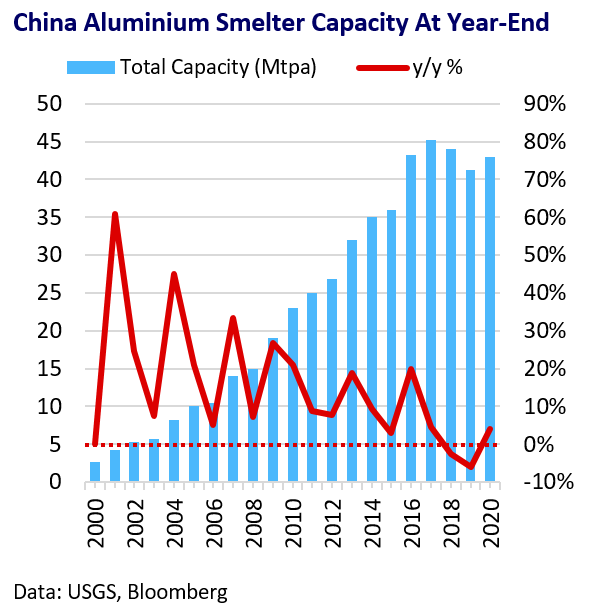

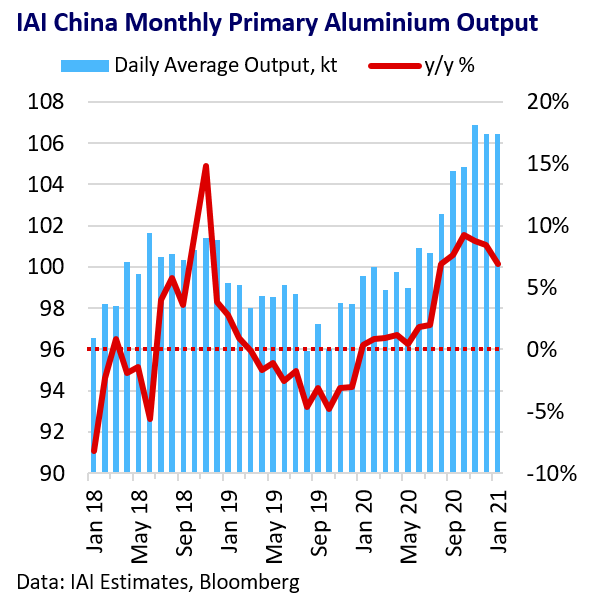

China’s commitment to supply-side reform from late-2015 accelerated the end of the surging growth in aluminium smelter capacity observed in the early 2000s. Recent years saw some contraction in capacity and “capacity swaps” focus on replacing older coal-powered smelters with new plants using hydro-electric power, mainly in Yunnan Province. But strong aluminium prices in 2020 meant healthy profit margins for China’s aluminium producers, incentivising additional capacity and output. The IAI estimate China’s aluminium output rose 4.3% in 2020, with capacity growing 4.1% according to USGS data.

Energy Goals Threaten Expected 2021 Growth

Analysts expect further growth in China aluminium smelter output and capacity in 2021, with previously forecasting a ~7% growth rise in capacity. However, in February, China moved to curb energy-intensive industries, including steel and aluminium plants, in Inner Mongolia. This was after the Province failed to meet energy consumption reduction targets. Inner Mongolia accounts for around a seventh of China’s aluminium smelter capacity, with the majority coal-powered. Inner Mongolia announced it will ban capacity expansions for aluminium smelting and alumina refining from 2021; 400 ktpa of previously planned expected capacity growth in Inner Mongolia could be shelved. Small amounts of existing capacity have also been impacted this year in line with efforts to reduce coal consumption in line with targets.

Climate Goals to Limit Long-Term Capacity Growth

The developments in Inner Mongolia have broader implications by demonstrating China’s strong commitment to a decarbonisation agenda at the expense of traditional industries. China may make net-zero carbon targets a top national priority. There will likely be growing pressure across China to reject coal-powered aluminium capacity, although replacement of existing capacity to use renewable generated power will take years. This fits into a growing them of aluminium consumers globally calling for “green” low-carbon aluminium. A national capacity cap of 45 Mt will also act as a barrier on any net capacity additions and could be hit by 2022. China is unlikely to be flexible on this limit.

Implications

Pressures to meet climate goals and deal with upstream aluminium overcapacity will likely act to constrain China’s aluminium output and capacity growth beyond what was previously forecast. Goldman Sachs and other analysts now expect capacity growth of ~5% in 2021 (down from ~7%) as a result of restrictions in Inner Mongolia. This estimate could be revised down further if tough measures against energy-intensive aluminium smelting broaden quickly to other provinces. Capacity growth is likely to flatten out in a few years as the 45 Mt cap is reached. Supply growth could slightly outpace capacity growth as producers maximise utilisation rates (~87% in 2020).