What does this mean for the market?

China policymakers have taken strong verbal action to tackle inflationary risks from surging commodity prices. This has moderated bullish speculative enthusiasm for metals, but could be short-lived; China lacks meaningful options to temper any further global surge in commodity prices without jeopardising other policy priorities.

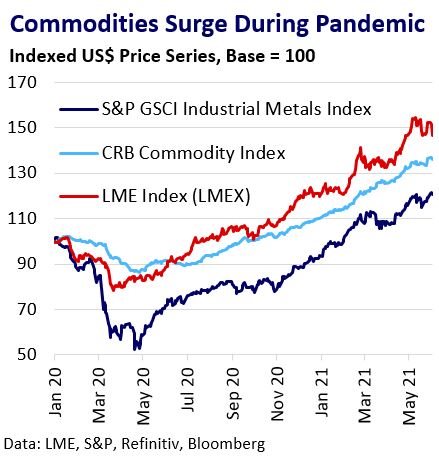

Commodity Price Surge Drives Inflationary Pressures

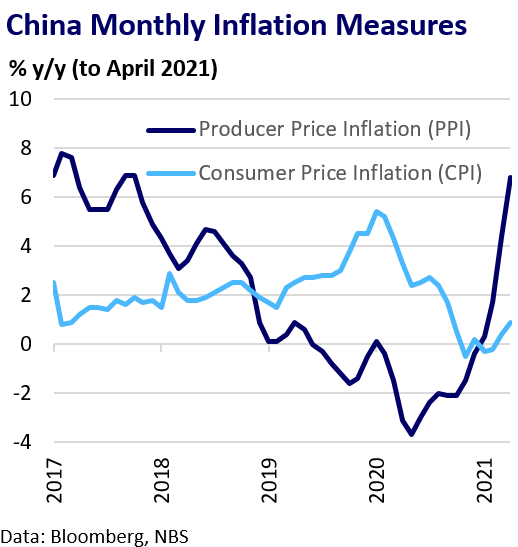

The continuing surge in global commodity prices is exacting clear inflationary pressure on China’s economy. This is evident in China’s Producer Price Inflation measure (PPI), which rose at the fastest rate in three years in April. 8.5% is the consensus analyst estimate for May, which would be a 13-year high. Consumer Price Inflation (CPI) growth has picked up but remains relatively subdued. This is evidence that manufacturers are currently struggling to pass on increased costs to consumers. This risks growing losses, defaults, and reductions or delays to market orders throughout commodity supply chains.

China’s Regulators Respond

China’s regulators are clearly alarmed by the inflationary pressures linked to surging commodity prices. The National Development and Reform Commission (NDRC) has taken increasingly strict, though largely verbal, steps to cool the pace of gains. Top producers of aluminium, copper, steel, and iron ore were warned last week that commodity price control is their social responsibility. Regulators have warned of “zero tolerance” for excessive speculation, “fake news”, hoarding and monopolies in spot or futures markets. Lenders have been asked to wind down retail investment products linked to commodities futures.

Market Reaction

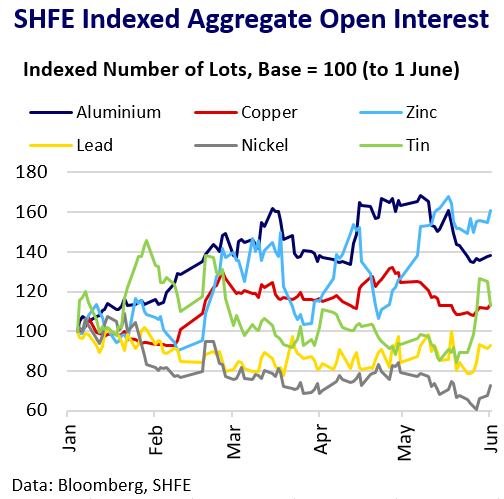

Domestic commodity exchanges increased certain transaction fees and margin requirements to discourage speculative activity. Funds and commodity traders are unlikely to build long positions and have likely pared-back existing long positions. Market commentators are likely to refrain from circulating bullish commentary. Unsurprisingly, SHFE contracts for aluminium, copper and nickel saw aggregate open interest decline during May. LME and COMEX also experienced broad unwinding of net long speculative positioning across base metals in recent weeks. The actual price reaction has differed by commodity and exchange. Metals prices largely consolidated or retreated from recent highs in May. However, most saw renewed strength in late May and early June.

Policy Challenges

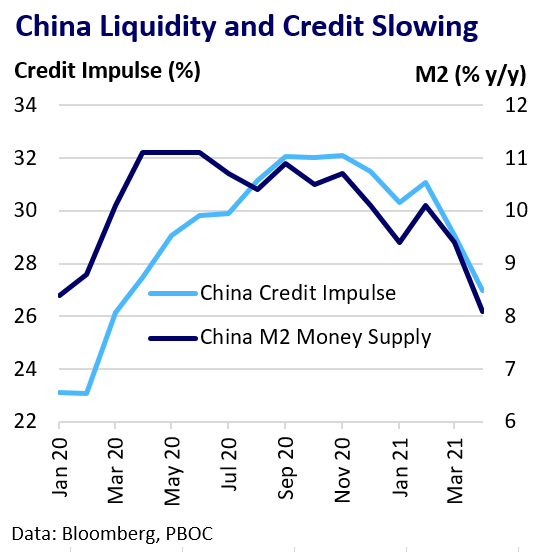

China’s recent efforts to dampen commodity speculation provide some limited price relief, but this may be short-lived. China’s pricing power as the world’s top commodity consumer has diminished amid a stimulus-fuelled demand rebound in the US and Europe. Conflicting policy, namely China’s climate goals, is also exacerbating commodity price appreciation as efforts to reduce upstream carbon emissions impact metal supply. Verbal action will do little to address the underlying longer-term drivers of commodity price appreciation, namely easy global monetary policy, rebounding post-pandemic demand, and constraints on supply.

Outlook

China has few effective options to cap a continuation of the bull market trend in commodities without derailing its own economic recovery or climate policy efforts. An acceleration of China’s monetary policy tightening is unlikely; it would help cool demand but poses a risk to the broader economic recovery. China is also unlikely to compromise its climate policy to ease supply pressures. Higher tolerance for yuan appreciation could help offset high raw material costs but the People’s Bank of China (PBOC) has pledged to keep the yuan stable. Drawdown of strategic stockpiles and adjustments to trade tariffs barriers to boost imports and discourage exports are other possible options. Market participants should therefore retain focus on more important market drivers. These are the longevity of easy global monetary policy and the extent to which stimulus-fuelled demand from Europe and the US can offset slower expected China demand growth as it maintains its gradual deleveraging.