Growth Headwinds Emerge as China Tackles Fresh COVID Wave

Aggressive measures to tackle China’s COVID-19 resurgence have badly hit its economy, but Beijing remains resolutely committed to its zero-COVID approach. Along with a soft stimulus-response and deepening property sector weakness, this has undermined commodities demand prospects and triggered a pullback in prices. China’s supply-chain issues risk exacerbating global inflationary pressures and accelerating policy tightening by central banks.

China’s COVID Battle

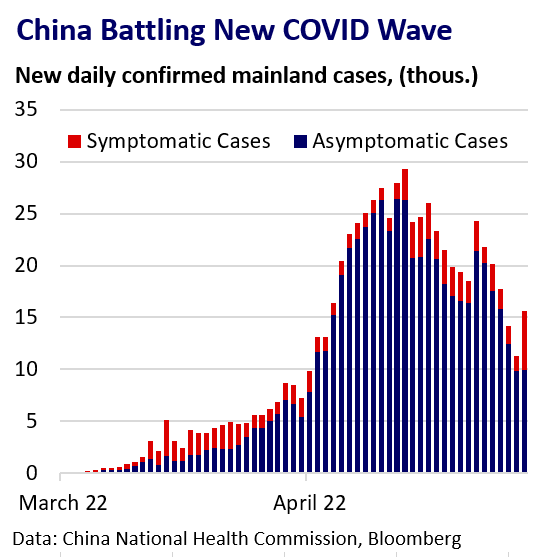

China has struggled to contain a fresh outbreak of the COVID-19 Omicron variant that emerged in March. New cases have emerged across China, but Shanghai remains the epicentre. The city’s population of 25 million is still subject to strict curbs on movement after weeks of stringent lockdown measures.

Rising new cases and evidence of community transmission in Beijing have stoked fears the city could see similar measures imposed.

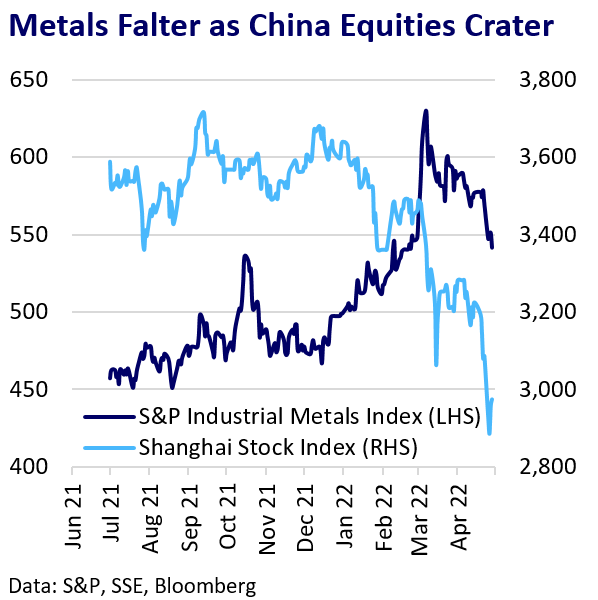

Policymakers are sticking rigidly to the zero-COVID approach despite the clear impact on the economy and growth prospects for 2022. China’s equity markets have retreated, as have commodities prices.

Economic Impact

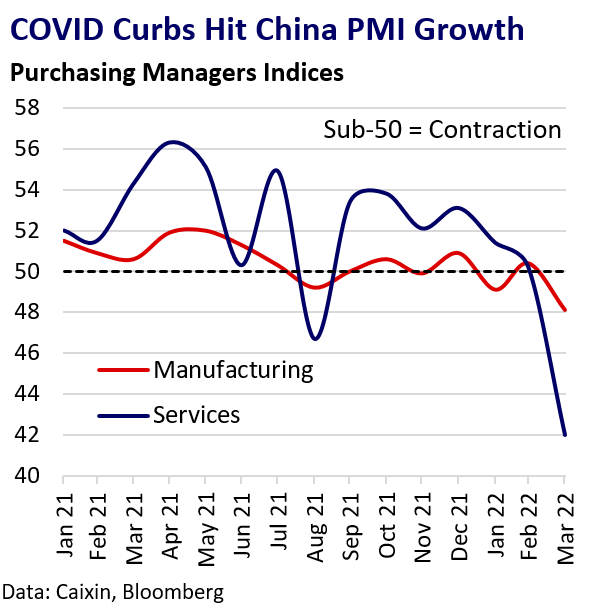

Measures have hit metals consumption harder than production, stoking bearish sentiment and weaker prices. Strict travel restrictions between provinces and cities have severely hit trucking and logistics causing supply-chain turmoil.

Shortages of raw materials and components have forced manufacturers to cut operating rates. The steel hub of Tangshan and the electronics hub of Kunshan are both subject to strict measures. Car manufacturers in affected regions have also seen output hit.

Disruption to metals producers is limited and mainly logistics‑related; some inventory is stuck at smelters and scrap supply issues have hit secondary lead smelters. Difficulties shipping metal to warehouses have contributed to net SHFE stock outflows.

Policy Support Underwhelms

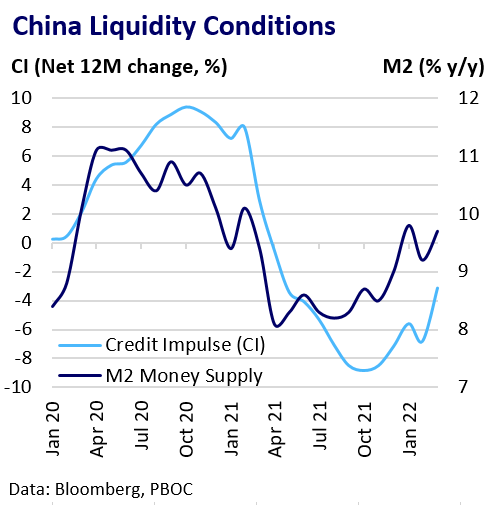

At the beginning of 2022, the market expected Beijing would announce significant policy support to bolster the economy amid a deepening property sector slowdown. The recent COVID outbreak fuelled further expectations for stimulus measures to offset the economic damage from strict virus controls. However, meaningful action has failed to materialise.

The PBOC has pledged to maintain ample liquidity but has kept the headline Loan Prime Rate steady and made only modest cuts to bank Reserve Requirement Ratios. Aggressive expected tightening by ex-China central banks limits China’s policy room to cut key rates without provoking capital outflows.

Policymakers continue to promise targeted fiscal support but announced policies have been underwhelming. Local governments are struggling to allocate infrastructure funding even as President Xi calls for a massive infrastructure spending push, with pandemic control clearly the current focus.

Property Sector Distress Persists

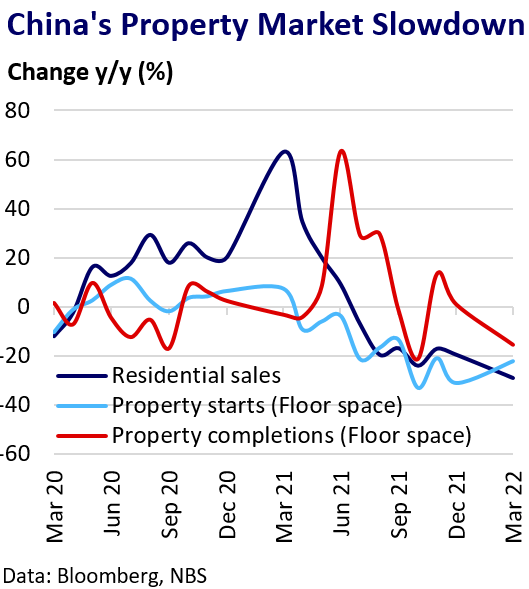

China’s struggling property sector also remains a key headwind for the economy and for base metals demand. Housing starts, sales and completions remain notably weak during what is typically the peak season for construction demand.

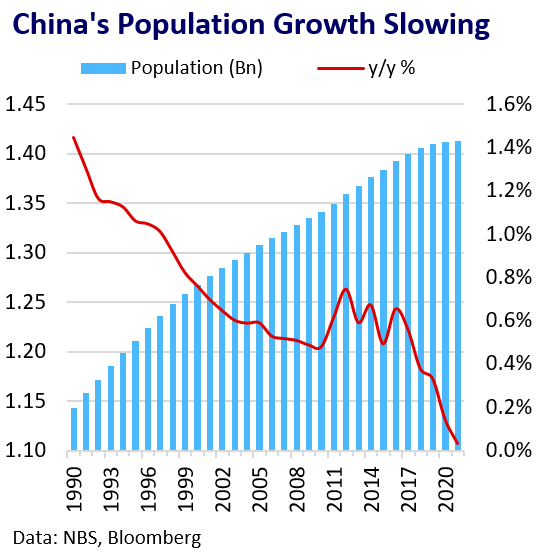

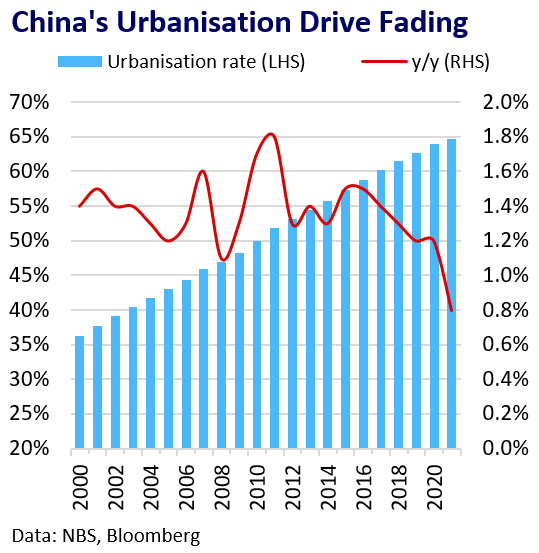

In the past, Beijing has relied on the property sector to boost growth in times of stress. However, China’s population growth and urbanisation rate have both stalled in recent years and Beijing is accordingly trying to reduce dependency on real estate as an engine of economic growth.

China has maintained its “Three-Red-Lines” policy and is unlikely to meaningfully relax constraints on the sector.

Implications

Ex-China base metal markets remain inventory-constrained, but we are now seeing synchronised headwinds to global growth. China’s zero-COVID policy will continue to undermine economic activity and confidence as the use and threat of lockdowns persist.

The virus is not disappearing anytime soon and a policy U-turn is unlikely. With China’s zero-COVID approach paralysing the economy and stimulus measures lacking, it is unlikely to hit its 5.5% GDP target for 2022, weighing on domestic metals demand and broader investor sentiment.

Targeted policy support and measures to boost infrastructure spending may offer some limited economic relief, but Beijing is unlikely to rely on the property sector as a silver bullet.

Monetary policy tightening, waning consumer confidence and the war in Ukraine remain key growth risks elsewhere. China’s supply-chain woes and port disruption will likely add to ex-China inflationary pressures and growth headwinds. Extended global shipping woes should extend regional metal supply dislocations.