Copper Price Outlook

Copper prices set an all-time high of $10,845 in early March after Russia’s invasion of Ukraine, but have since pared gains amid LME liquidity issues and rising headwinds to global growth. “Green demand” optimism underpins copper’s bullish long term prospects, but fading ex-China stimulus and strong mine supply growth could see prices moderate from elevated levels over the next couple of years.

Consumption

Copper consumption faces short- and medium-term risks. China’s zero-Covid approach and property sector weakness will hit domestic economic growth in Q1. However, copper consumption may ultimately benefit from reactive policy support from Beijing for financial markets, the property sector and fixed-asset investment.

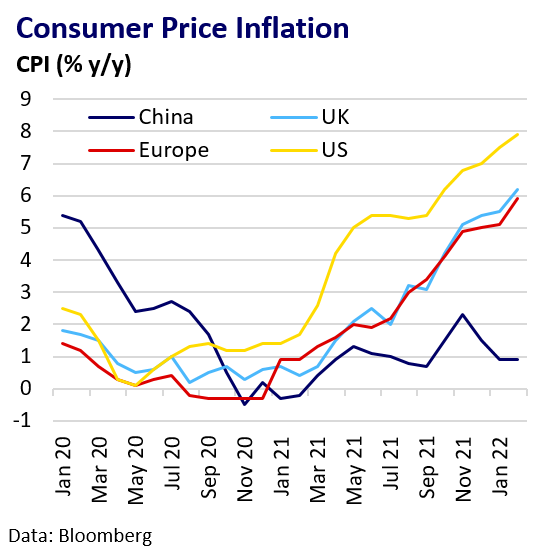

Reliance on strong export demand is a concern as major ex-China markets face growth headwinds and high inflation. Markets have lost confidence in the “Fed put”. The Federal Reserve is now committed to aggressive rate rises to contain rampant inflation. This limits policy room to react to emerging growth pressures such as labour shortages and elevated energy prices. Slower growth may increasingly weigh on copper consumption in late 2022 and into 2023.

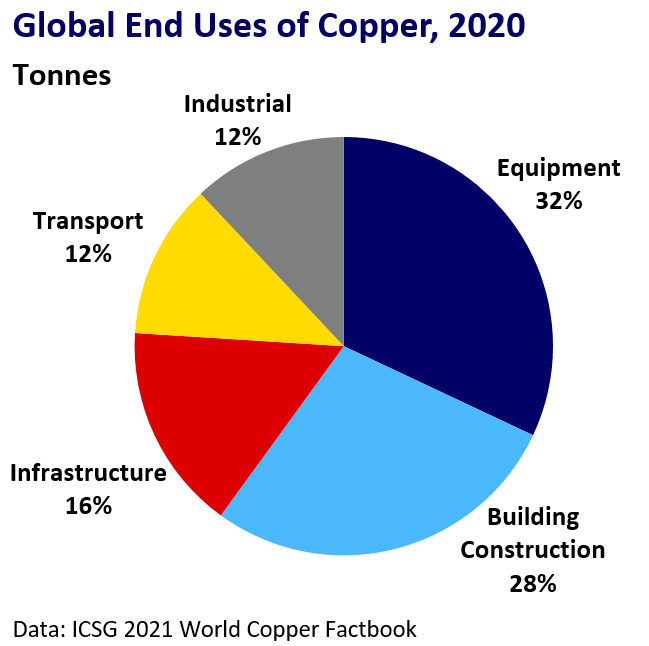

Long-term global demand prospects from the “green revolution” remain strong. Power-grid and renewables investment offer near-term opportunities. Electric vehicle demand will play an increasing role but the impact may be greatest towards the end of the decade.

Production

In the short term, the copper market remains wary of disruption to Russia’s copper supply amid self-sanctioning by Western consumers. This heightened geopolitical event risk makes the short-term supply outlook difficult to project with confidence.

However, the underlying expectation is that recovering mine production will underpin robust supply growth this year. Macquarie sees global mine output rising +4.9% in 2022 and +8.6% in 2023. Mine output in Peru and Chile should lead the way, helped by new mines and mine expansions.

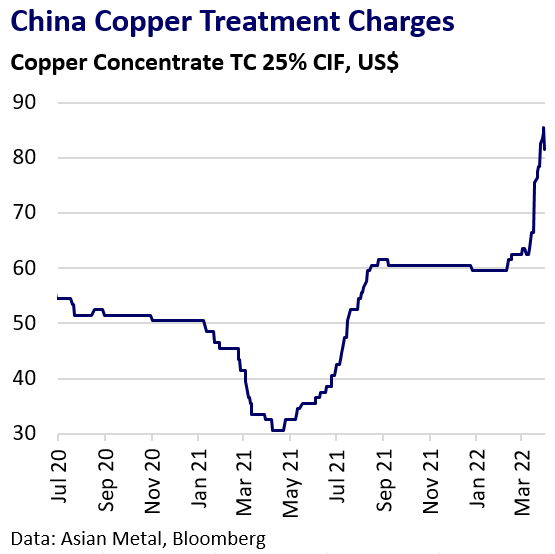

Recovering smelter treatment charges in China indicate easing concentrate market tightness. Bloomberg sees China’s refined copper output up 4% y/y to 10.33 Mt in 2022 amid fresh capacity additions.

However, a thin project pipeline could see output growth slow and contract by the middle of the decade. Rising political risks in Chile and Peru and growing regulatory hurdles for new mine production globally may also frustrate efforts to boost supply in the long term. Focus on ESG targets and a decade of drought in Chile presents further constraints on capacity growth.

Increased copper scrap recycling, particularly in China, will only partially offset projected deficiencies in long-term copper mine output.

Inventories

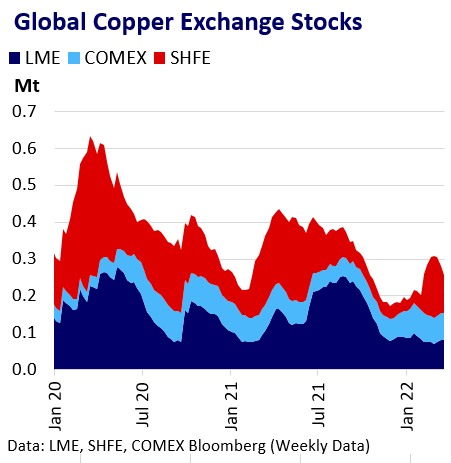

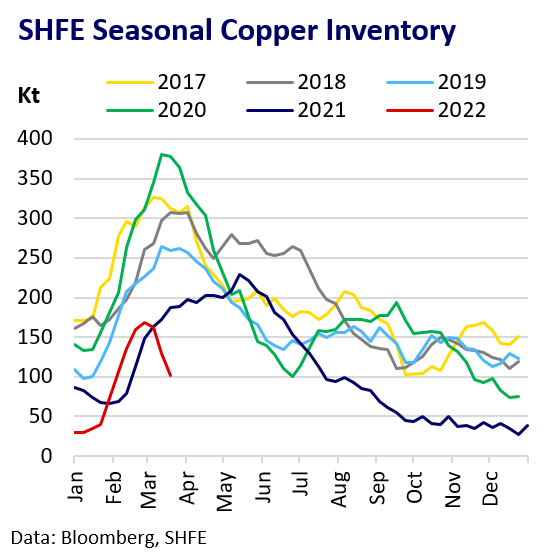

The copper market appears to retain some capacity to absorb further supply shocks without an extreme price reaction, at least in the short term.

While global exchange inventories remain historically subdued for the time of year, copper does not have the same degree of US and European inventory shortages as its base metal peers.

SHFE stocks are under renewed pressure, drawing down abruptly in March against seasonal norms. However, China retains the ability to auction national stockpiles to the physical market if domestic inventories hit critical levels, as it did in 2021.

Market Balance

Consensus expectations are for a broadly balanced copper market in 2022. A Reuter’s poll in January pegged the copper market in a 475 kt deficit in 2021, with expectations for a 37 kt surplus in 2022 and 286 kt surplus in 2023.

Deficits are likely to re-emerge in the second half of the decade as mine supply growth slows and “green demand” accelerates.

Price Outlook

Whether we see prices retest early March’s all-time high is very much at the whim of geopolitical developments and investor metals risk appetite. For now, investor confidence remains depressed by commodity market liquidity issues and the LME nickel debacle.

The inflationary environment remains a price-supportive factor in the near term. However, growing economic headwinds including stimulus withdrawal are likely to weigh increasingly on prices in late 2022 and 2023.

Softer pricing is likely through to the mid-2020s. At this point, stronger mine supply growth will likely start to stall while “green” demand accelerates, with resultant deficits likely to underpin renewed gains in the latter half of the decade.