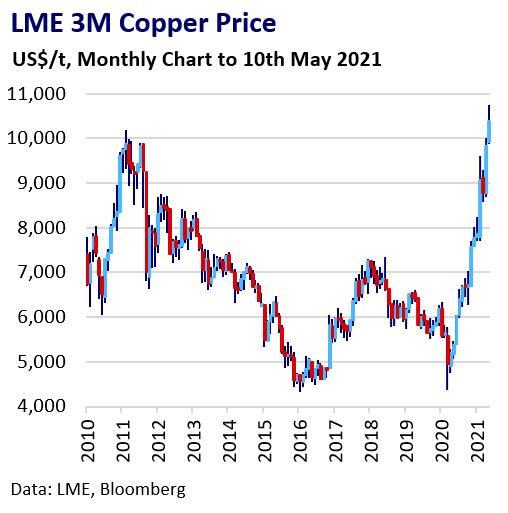

Copper hits all time high

The LME copper price has surpassed the all-time high of $10,190 from 2011. Reflation-led investor interest in commodities continues to drive the bull-market uptrend. This is in addition to copper-specific projections that mine supply growth may struggle to meet potential demand from the global energy transition. Slowing physical interest in China has done little to temper gains as investor focus shifts firmly to the ex-China economic recovery.

Ex-China Rebound Drives Commodities Higher

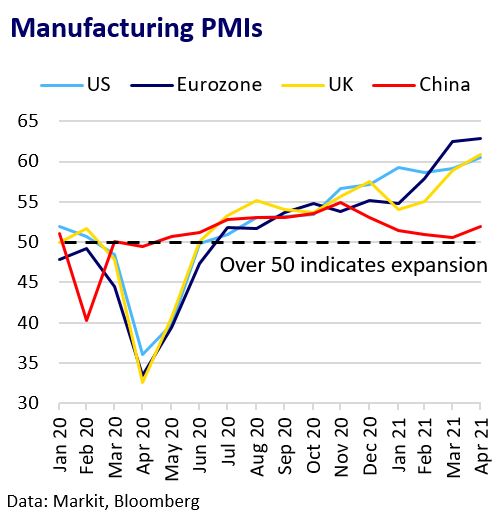

An improving demand outlook and renewed dollar weakness since April spurred the renewed rally across commodities. Economic activity outside China is rebounding strongly amid vaccine progress among major economies and easing lockdown restrictions. Manufacturing PMIs in April were at, or approached, record highs across the US, Eurozone, and UK, outpacing China. Concern that near-term inflationary pressures could trigger accelerated Fed policy easing has subsided. This is amid persisting labour market weakness and a belief by policymakers that higher inflation will be transitory.

Forward-Looking Optimism Driving Gains

Aggressive investor buying dominated copper’s move higher. Comex money manager net long positions hit a ten-week high on 5th April. Copper has outperformed the rest of the base metals (tin aside) in 2021 and since the start of the pandemic due to its stronger fundamental outlook. Goldman Sachs expects copper prices to reach $15,000 by 2025 as governments and wider society invest in clean-energy projects in order to meet net-zero carbon emission targets; Glencore believes this price level is necessary to incentivise sufficient mine supply from this demand amid a thin project pipeline.

China Physical Indicators Weakening

Physical copper demand in China has slowed as consumers reacted to surging prices by delaying purchases and idling production. Wire producers were hard-hit as high prices led to delays to power grid projects. SHFE prices lagged recent LME gains, creating export arbitrage opportunities. Premiums for imported copper cathode fell to multi-year lows and SHFE copper inventories are yet to decline meaningfully from seasonal Q1 highs. Surging prices for copper and other commodities have prompted Chinese authorities to warn against speculative enthusiasm to temper price gains, with limited effect. There is an ongoing risk that China could take more drastic steps to temper prices through the release of national copper stockpiles, tighter monetary policy or amending regulatory barriers for copper trade.

Shifting Focus

The muted reaction to weaker China physical copper market participation is unsurprising. Before 2021, most metal analysts had anticipated a slowdown in China demand growth that would be offset by the ex-China rebound. This is now being realised, with resurgent ex-China demand and stronger LME pricing relative to SHFE likely to remain a feature of the market in the coming months. Forward-looking fund buying on expectations for an acute medium-term shortage in copper demand may well lead to further disconnects with the spot-market. This does not necessarily signal overbought conditions but does leave prices vulnerable to hot money outflows if the narrative changes swiftly.

Outlook

Some short-term price consolidation may be due after the sharp rally of recent weeks, particularly if China takes further steps to discourage speculation. However, “Buy and Hold” and momentum-based trading strategies have generated the best returns for copper over the last 12-months. While the macro and fundamental narrative continue to drive fund buying appetite, the underlying bull market price uptrend is likely to persist.