Can the tin market recover?

The ex-China tin market remains in the grip of the severest physical shortages in recent memory. Driving tightness is strong pandemic-era demand for electronics and electrical goods, supply disruption across top tin producing regions, and critically low global inventories. Market tightness is likely to persist in H2 2021, even as consumption growth and output constraints ease. Tin’s long-term fundamental narrative will continue to provide underlying support.

All Eyes on Supply

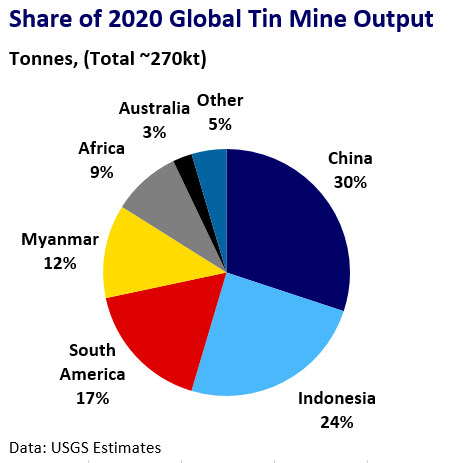

The main sources of ongoing ex-China supply constraint are subdued shipments from Indonesia and Malaysia. Malaysia Smelting Corporation was forced to halt production from June due to strict and ongoing national lockdown measures. MSC’s furnace failures in mid-April will likely limit output for the rest of the year. A severe wet season early this year and ongoing Covid-related workforce curbs are impacting Indonesian output. Myanmar tin mine output remains constrained by worker shortages, with lockdown measures impacting concentrate shipments to China. South America’s output is vulnerable to social and political pressures, with Minsur’s San Rafael Mine in Peru recently subject to blockades.

Future Output Prospects

ITA says supply from new mines could potentially hit 40 kt by 2025 while top existing producers struggle to maintain output. Mine projects have struggled for investment since 2011, but prices are now at decade-highs. This will draw in capital, but investors will need to be confident that the recent rally is sustainable; high current prices elevate the risk of a new small-scale mining boom, a recurring feature of the tin market in recent decades.

Demand

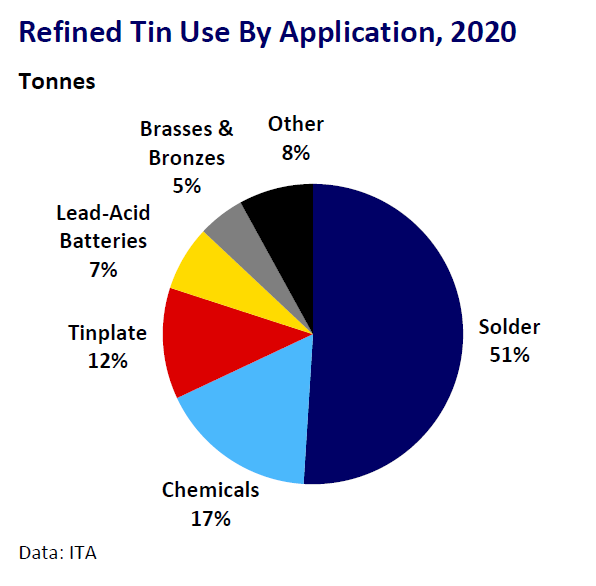

ITA estimates that global tin consumption rose 1.2% in 2020 as demand for consumer durables and electronics from individuals stuck at home outweighed the broader contraction in global economic activity. Consumer demand for goods may soften as spending shifts back to services, though auto-sector demand should grow as semi-conductor shortages ease. A slowdown in China’s economic growth could hit demand in H2, but has been so far offset by strong, stimulus-fuelled, US and European recoveries. The ITA says consumption growth could average 3.5% pa through to 2025 amid strong growth in end-use markets like electronics. Opportunities beyond this are potentially huge but highly uncertain.

Market Balance & Inventory

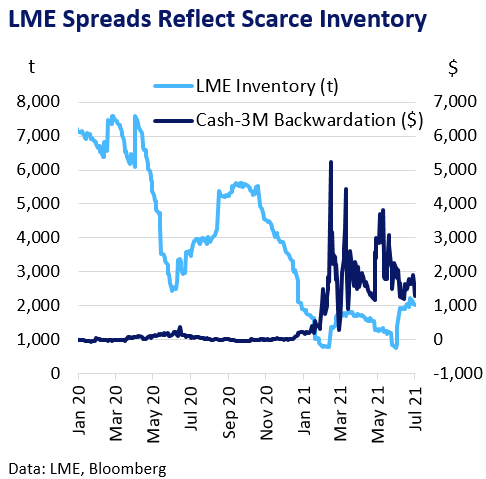

The ITA is forecasting persistent rising deficits over the next decade as mine capacity additions struggle to meet the pace of expected consumption growth. The problem is that inventory levels across exchanges, consumers, producers, and traders have all been severely depleted over the last year with the impact of inventory scarcity observable in the extreme LME spread backwardations and record physical premiums. Exports from China accelerated in recent months as the tighter ex-China market creates arbitrage opportunities, a potential ongoing source of relief.

Outlook

Consumption growth might ease in H2 as China’s economic expansion slows. This could temper, if not eradicate, severe physical tin market tightness through higher China tin exports. However, a significant pullback in prices is unlikely while supply woes persist. With global inventories so low, the price reaction to any fresh supply disruption could also be severe. In the long-term, global inventories are too depleted to accommodate persistent and growing deficits. Therefore output and consumption must ultimately be forced back into balance. This could be via higher tin prices, easing lockdown constraints on output, or unexpected new sources of mine supply. Any future macro-induced economic slowdown could also temper demand, with the prospect of tighter global monetary and fiscal policy likely to weigh in the coming years.